Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 (9 marks) Eaker Company uses activity-based costing to apply overhead costs for internal purposes. The company has three activity cost pools and applies

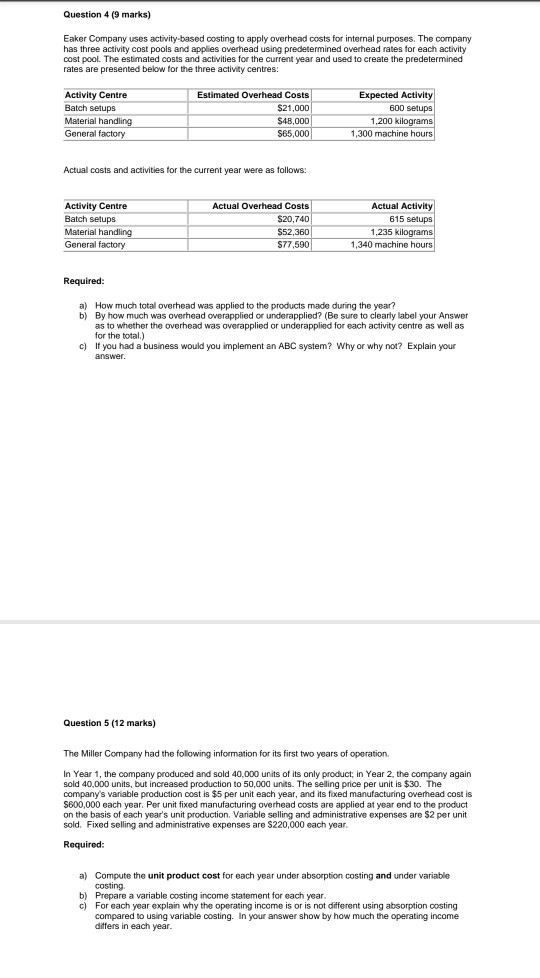

Question 4 (9 marks) Eaker Company uses activity-based costing to apply overhead costs for internal purposes. The company has three activity cost pools and applies overhead using predetermined overhead rates for each activity cast pool. The estimated costs and activities for the current year and used to create the predetermined rates are presented below for the three activity centres: Activity Centre Batch setups Material handling General factory Estimated Overhead Costs $21,000 $48,000 S65,000 Expected Activity 600 setups 1,200 kilograms 1,300 machine hours Actual costs and activities for the current year were as follows: Activity Centre Batch setups Material handling General factory Actual Overhead Costs $20,740 $52,360 $77,590 Actual Activity 615 setups 1,235 kilograms 1,340 machine hours Required: a) How much total overhead was applied to the products made during the year? b) By how much was overhead overapplied or underapplied? (Be sure to clearly label your Answer as to whether the overhead was overapplied or underapplied for each activity centre as well as for the total) c) If you had a business would you implement an ABC system? Why or why not? Explain your answer. Question 5 (12 marks) The Miller Company had the following information for its first two years of operation In Year 1, the company produced and sold 40,000 units of its only product, in Year 2, the company again sold 40,000 units, but increased production to 50,000 units. The selling price per unit is $30. The company's variable production cost is $5 per unit each year, and its foxed manufacturing overhead cost is $600,000 each year. Per unit fixed manufacturing overhead costs are applied at year end to the product on the basis of each year's unit production. Variable selling and administrative expenses are $2 per unit sold. Fixed selling and administrative expenses are $220,000 each year. Required: a) Compute the unit product cost for each year under absorption costing and under variable costing b) Prepare a variable costing income statement for each year. c) For each year explain why the operating income is or is not different using absorption costing compared to using variable costing. In your answer show by how much the operating income differs in each year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started