Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 4 Larry purchased an annuity from an insurance company that promises to pay him $1,500 per month for the rest of his life. Larry

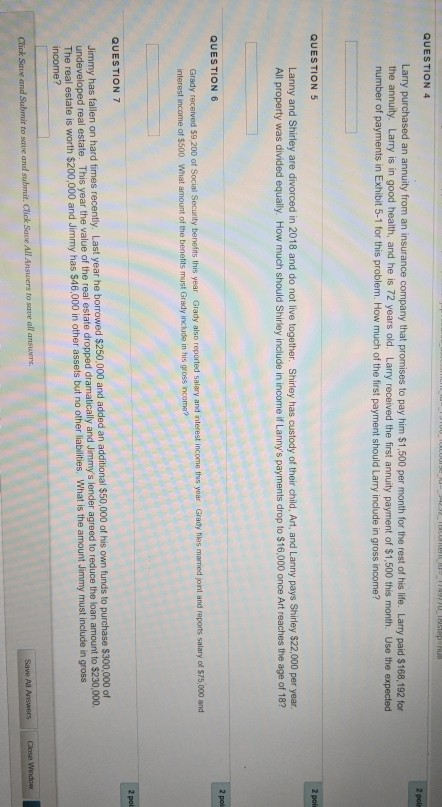

QUESTION 4 Larry purchased an annuity from an insurance company that promises to pay him $1,500 per month for the rest of his life. Larry paid $168,192 for the annuity. Larry is in good health, and he is 72 years old. Larry received the first annuity payment of $1,500 this month. Use the expected number of payments in Exhibit 5-1 for this problem. How much of the first payment should Larry include in gross income? QUESTION 5 Lanny and Shirley are divorced in 2018 and do not live together. Shirley has custody of their child, Art, and Lanny pays Shirley $22,000 per year All property was divided equally. How much should Shirley include in income if Lanny's payments drop to $16,000 once Art reaches the age of 18? QUESTION 6 Grady received $9 200 of Social Security benefts this year Grady also reported salary and nterest income thes year Grady ties married joint and reports salary of $75,000 and interest income of $500 What amount of the benetits must Grady include in his gross ncoma? QUESTION 7 Jimmy has fallen on hard times recently. Last year he borrowed S250.000 and added an additional undeveloped real estate. This year the value of the real estate dropped dramatically and Jimmy's lender agreed to reduce the The real estate is worth $200,000 and Jimmy has $46,000 in other assets but no other liabilities. What is the amount $50,000 of his own funds to purchase $300,000 of loan amount to $230,000. i Jimmy must include in gross Click Save and Submir to save and submit. Click Save All Answers to save all ansuers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started