Answered step by step

Verified Expert Solution

Question

1 Approved Answer

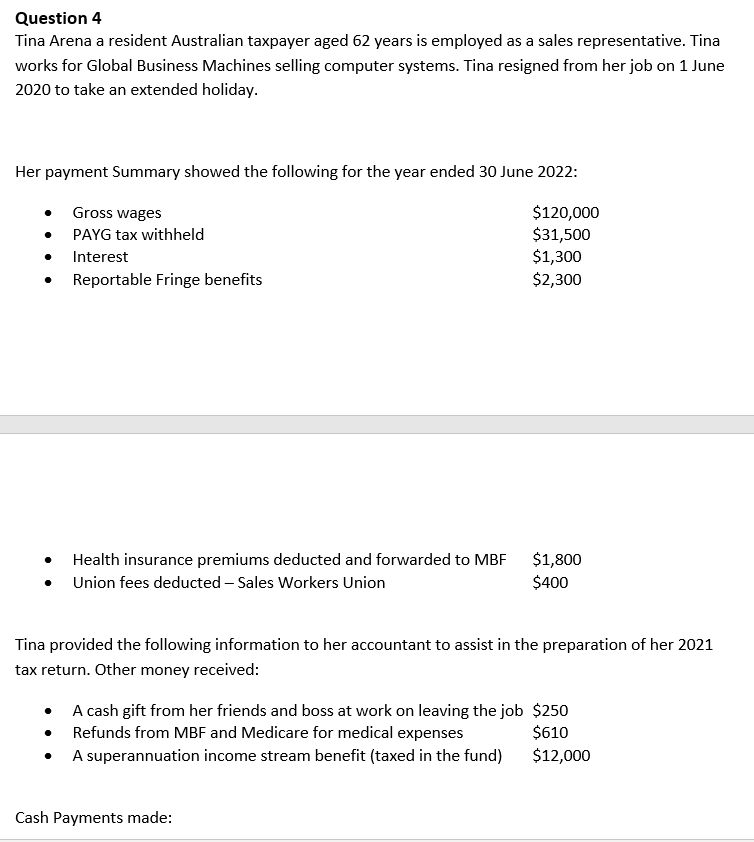

Question 4 Tina Arena a resident Australian taxpayer aged 62 years is employed as a sales representative. Tina works for Global Business Machines selling

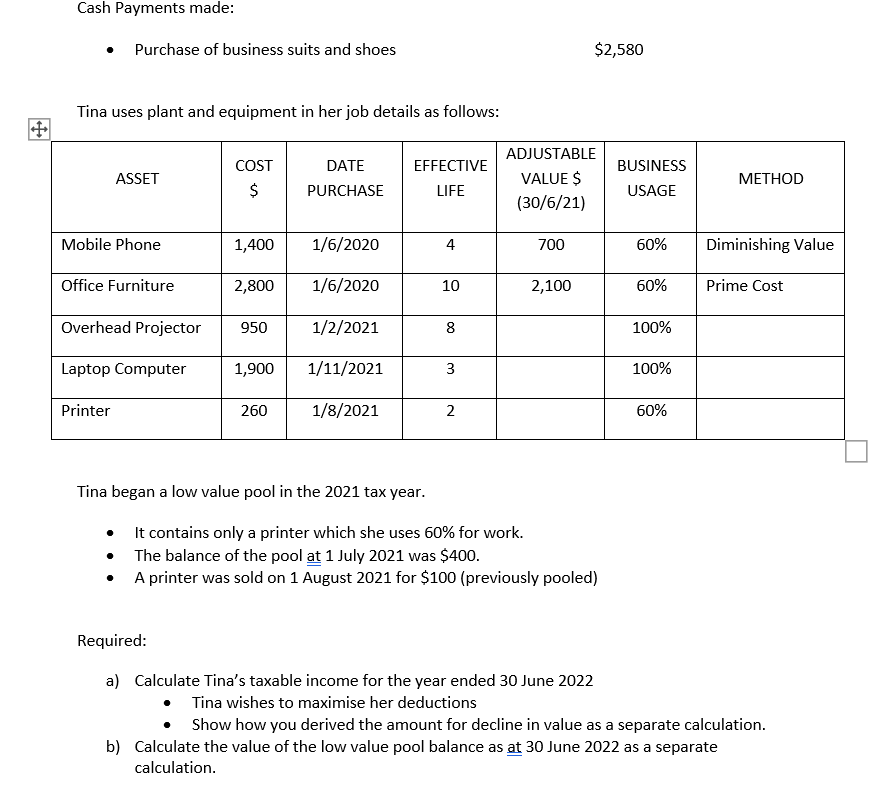

Question 4 Tina Arena a resident Australian taxpayer aged 62 years is employed as a sales representative. Tina works for Global Business Machines selling computer systems. Tina resigned from her job on 1 June 2020 to take an extended holiday. Her payment Summary showed the following for the year ended 30 June 2022: $120,000 $31,500 $1,300 $2,300 Gross wages PAYG tax withheld Interest Reportable Fringe benefits Health insurance premiums deducted and forwarded to MBF Union fees deducted - Sales Workers Union $1,800 $400 Tina provided the following information to her accountant to assist in the preparation of her 2021 tax return. Other money received: A cash gift from her friends and boss at work on leaving the job $250 Refunds from MBF and Medicare for medical expenses $610 A superannuation income stream benefit (taxed in the fund) $12,000 Cash Payments made: Cash Payments made: Purchase of business suits and shoes Tina uses plant and equipment in her job details as follows: ASSET Mobile Phone Office Furniture Printer COST $ 1,400 Overhead Projector 950 Laptop Computer 2,800 1/6/2020 1,900 DATE PURCHASE 260 1/6/2020 1/2/2021 1/11/2021 1/8/2021 EFFECTIVE LIFE Tina began a low value pool in the 2021 tax year. 4 10 8 3 2 ADJUSTABLE VALUE $ (30/6/21) 700 2,100 $2,580 It contains only a printer which she uses 60% for work. The balance of the pool at 1 July 2021 was $400. A printer was sold on 1 August 2021 for $100 (previously pooled) Required: a) Calculate Tina's taxable income for the year ended 30 June 2022 Tina wishes to maximise her deductions BUSINESS USAGE 60% Diminishing Value 60% 100% 100% METHOD 60% Prime Cost Show how you derived the amount for decline in value as a separate calculation. b) Calculate the value of the low value pool balance as at 30 June 2022 as a separate calculation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate Tinas taxable income for the year ended 30 June 2022 we need to consider her i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started