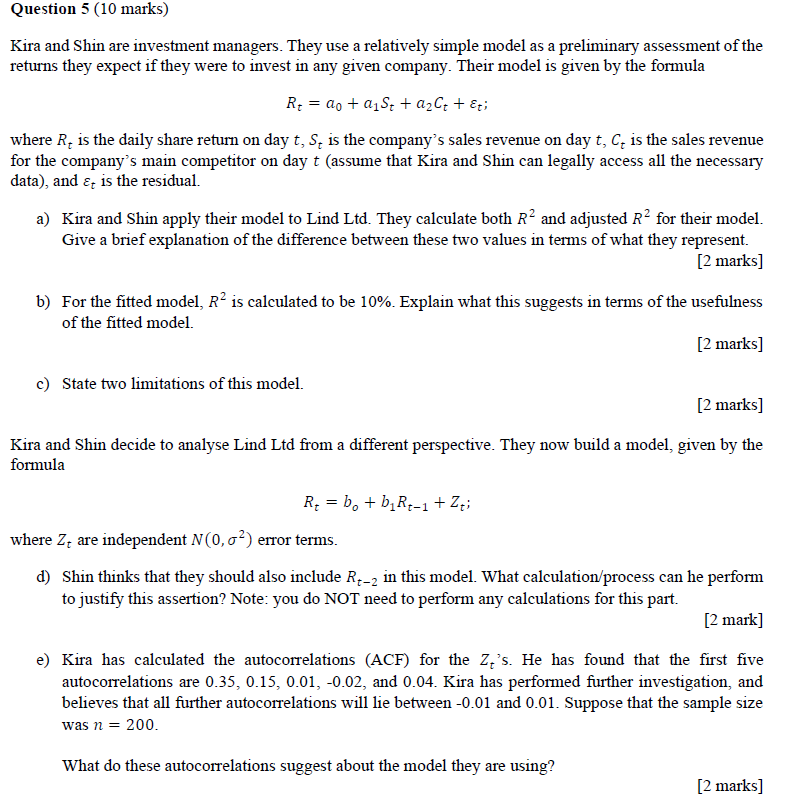

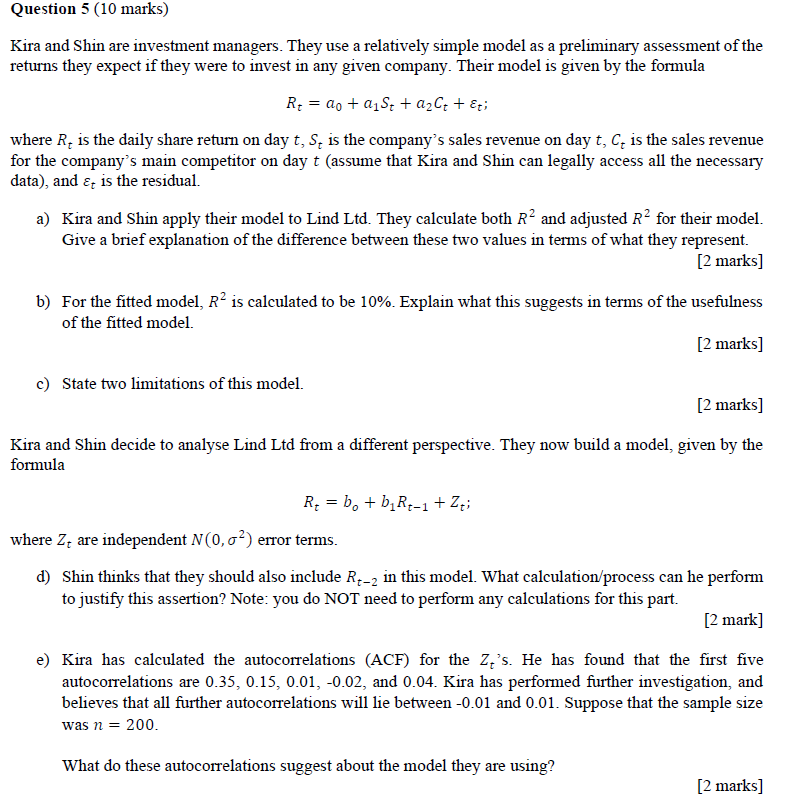

Question 5 (10 marks) Kira and Shin are investment managers. They use a relatively simple model as a preliminary assessment of the returns they expect if they were to invest in any given company. Their model is given by the formula Re = do + 01St + a2C+ + Et; where R, is the daily share return on day t, s, is the company's sales revenue on day t, C, is the sales revenue for the company's main competitor on day t (assume that Kira and Shin can legally access all the necessary data), and Er is the residual. a) Kira and Shin apply their model to Lind Ltd. They calculate both R and adjusted R2 for their model. Give a brief explanation of the difference between these two values in terms of what they represent. [2 marks] b) For the fitted model, R2 is calculated to be 10%. Explain what this suggests in terms of the usefulness of the fitted model. [2 marks] c) State two limitations of this model. [2 marks] Kira and Shin decide to analyse Lind Ltd from a different perspective. They now build a model, given by the formula R = b. + biR-1 + 24; where Z are independent N(0,0%) error terms. d) Shin thinks that they should also include Rt-2 in this model. What calculation process can he perform to justify this assertion? Note: you do NOT need to perform any calculations for this part. [2 mark] e) Kira has calculated the autocorrelations (ACF) for the Z.'s. He has found that the first five autocorrelations are 0.35, 0.15, 0.01, -0.02, and 0.04. Kira has performed further investigation, and believes that all further autocorrelations will lie between -0.01 and 0.01. Suppose that the sample size was n = 200. What do these autocorrelations suggest about the model they are using? [2 marks] Question 5 (10 marks) Kira and Shin are investment managers. They use a relatively simple model as a preliminary assessment of the returns they expect if they were to invest in any given company. Their model is given by the formula Re = do + 01St + a2C+ + Et; where R, is the daily share return on day t, s, is the company's sales revenue on day t, C, is the sales revenue for the company's main competitor on day t (assume that Kira and Shin can legally access all the necessary data), and Er is the residual. a) Kira and Shin apply their model to Lind Ltd. They calculate both R and adjusted R2 for their model. Give a brief explanation of the difference between these two values in terms of what they represent. [2 marks] b) For the fitted model, R2 is calculated to be 10%. Explain what this suggests in terms of the usefulness of the fitted model. [2 marks] c) State two limitations of this model. [2 marks] Kira and Shin decide to analyse Lind Ltd from a different perspective. They now build a model, given by the formula R = b. + biR-1 + 24; where Z are independent N(0,0%) error terms. d) Shin thinks that they should also include Rt-2 in this model. What calculation process can he perform to justify this assertion? Note: you do NOT need to perform any calculations for this part. [2 mark] e) Kira has calculated the autocorrelations (ACF) for the Z.'s. He has found that the first five autocorrelations are 0.35, 0.15, 0.01, -0.02, and 0.04. Kira has performed further investigation, and believes that all further autocorrelations will lie between -0.01 and 0.01. Suppose that the sample size was n = 200. What do these autocorrelations suggest about the model they are using? [2 marks]