Answered step by step

Verified Expert Solution

Question

1 Approved Answer

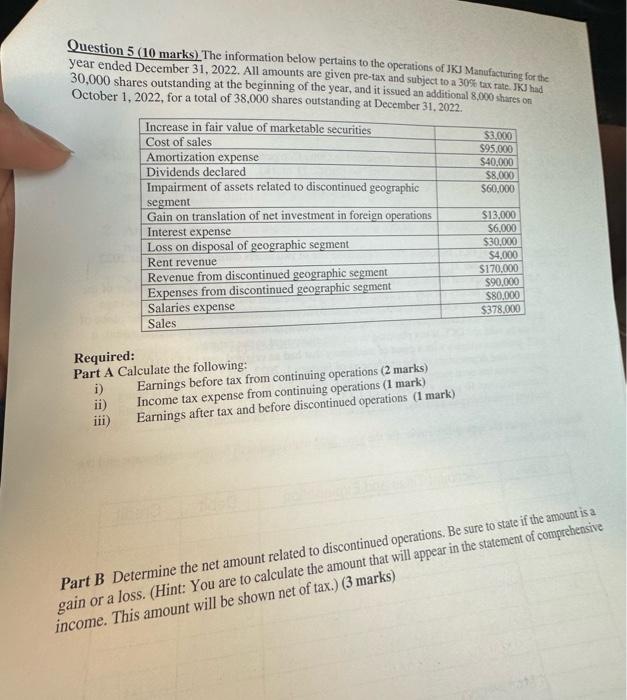

Question 5 (10 marks) The information below pertains to the operations of JKJ Manufacturing for the year ended December 31, 2022. All amounts are

Question 5 (10 marks) The information below pertains to the operations of JKJ Manufacturing for the year ended December 31, 2022. All amounts are given pre-tax and subject to a 30% tax rate. JKJ had 30,000 shares outstanding at the beginning of the year, and it issued an additional 8,000 shares on October 1, 2022, for a total of 38,000 shares outstanding at December 31, 2022. Increase in fair value of marketable securities Cost of sales Amortization expense Dividends declared Impairment of assets related to discontinued geographic i) ii) iii) segment Gain on translation of net investment in foreign operations Interest expense Loss on disposal of geographic segment Rent revenue Revenue from discontinued geographic segment Expenses from discontinued geographic segment Salaries expense Sales Required: Part A Calculate the following: Earnings before tax from continuing operations (2 marks) Income tax expense from continuing operations (1 mark) Earnings after tax and before discontinued operations (1 mark) $3,000 $95.000 $40,000 $8,000 $60,000 $13,000 $6,000 $30,000 $4,000 $170,000 $90,000 $80,000 $378,000 Part B Determine the net amount related to discontinued operations. Be sure to state if the amount is a gain or a loss. (Hint: You are to calculate the amount that will appear in the statement of comprehensive income. This amount will be shown net of tax.) (3 marks)

Step by Step Solution

★★★★★

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Part A I Earnings before tax from continuing operations Revenue from conti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started