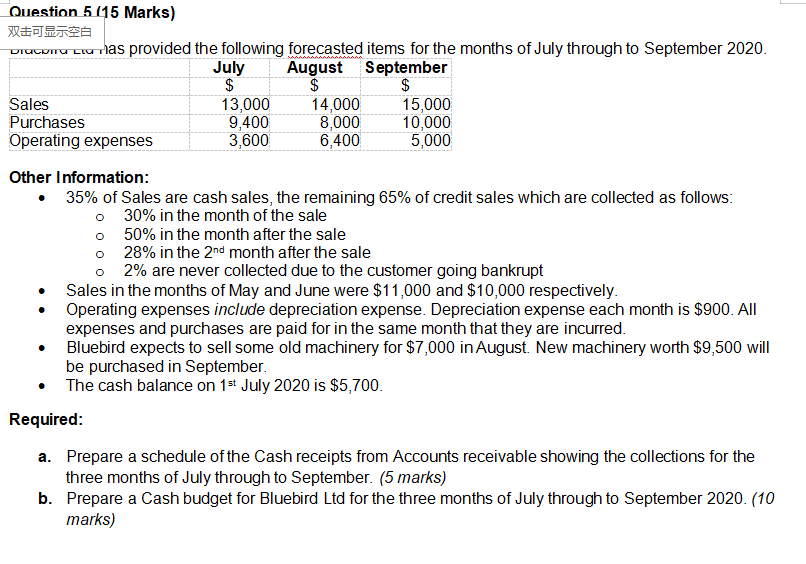

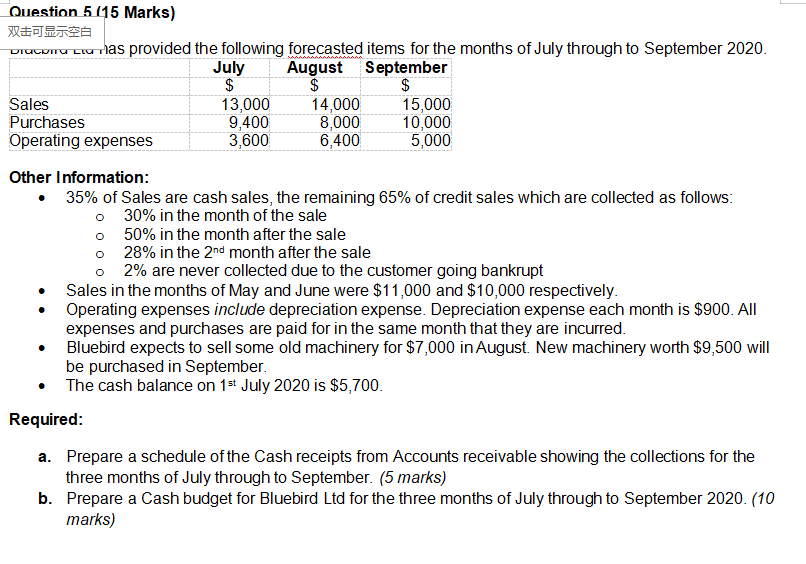

Question 5 (15 Marks) DIAWnu teu las provided the following forecasted items for the months of July through to September 2020. July August September $ $ $ Sales 13,000 14,000 15,000 Purchases 9,400 8,000 10,000 Operating expenses 3,600 6,400 5,000 Other Information: 35% of Sales are cash sales, the remaining 65% of credit sales which are collected as follows: o 30% in the month of the sale 50% in the month after the sale 28% in the 2nd month after the sale 2% are never collected due to the customer going bankrupt Sales in the months of May and June were $11,000 and $10,000 respectively. Operating expenses include depreciation expense. Depreciation expense each month is $900. All expenses and purchases are paid for in the same month that they are incurred. Bluebird expects to sell some old machinery for $7,000 in August. New machinery worth $9,500 will be purchased in September. The cash balance on 1st July 2020 is $5,700. Required: a. Prepare a schedule of the Cash receipts from Accounts receivable showing the collections for the three months of July through to September. (5 marks) b. Prepare a Cash budget for Bluebird Ltd for the three months of July through to September 2020. (10 marks) Question 5 (15 Marks) DIAWnu teu las provided the following forecasted items for the months of July through to September 2020. July August September $ $ $ Sales 13,000 14,000 15,000 Purchases 9,400 8,000 10,000 Operating expenses 3,600 6,400 5,000 Other Information: 35% of Sales are cash sales, the remaining 65% of credit sales which are collected as follows: o 30% in the month of the sale 50% in the month after the sale 28% in the 2nd month after the sale 2% are never collected due to the customer going bankrupt Sales in the months of May and June were $11,000 and $10,000 respectively. Operating expenses include depreciation expense. Depreciation expense each month is $900. All expenses and purchases are paid for in the same month that they are incurred. Bluebird expects to sell some old machinery for $7,000 in August. New machinery worth $9,500 will be purchased in September. The cash balance on 1st July 2020 is $5,700. Required: a. Prepare a schedule of the Cash receipts from Accounts receivable showing the collections for the three months of July through to September. (5 marks) b. Prepare a Cash budget for Bluebird Ltd for the three months of July through to September 2020. (10 marks)