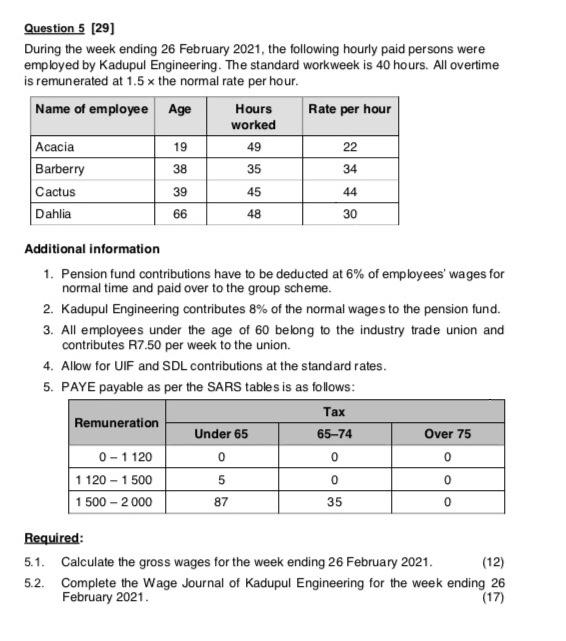

Question 5 (29) During the week ending 26 February 2021, the following hourly paid persons were employed by Kadupul Engineering. The standard workweek is 40 hours. All overtime is remunerated at 1.5x the normal rate per hour. Name of employee Age Hours Rate per hour worked Acacia 19 22 Barberry 38 35 34 Cactus Dahlia 66 49 39 45 44 48 30 Additional information 1. Pension fund contributions have to be deducted at 6% of employees' wages for normal time and paid over to the group scheme. 2. Kadupul Engineering contributes 8% of the normal wages to the pension fund. 3. All employees under the age of 60 belong to the industry trade union and contributes R7.50 per week to the union. 4. Allow for UIF and SDL contributions at the standard rates. 5. PAYE payable as per the SARS tables is as follows: Tax Remuneration Under 65 65-74 Over 75 0 - 1 120 0 0 1 120 - 1 500 5 1 500 - 2000 87 35 0 0 0 0 Required: 5.1. Calculate the gross wages for the week ending 26 February 2021. (12) 5.2. Complete the Wage Journal of Kadupul Engineering for the week ending 26 February 2021. (17) Question 5 (29) During the week ending 26 February 2021, the following hourly paid persons were employed by Kadupul Engineering. The standard workweek is 40 hours. All overtime is remunerated at 1.5x the normal rate per hour. Name of employee Age Hours Rate per hour worked Acacia 19 22 Barberry 38 35 34 Cactus Dahlia 66 49 39 45 44 48 30 Additional information 1. Pension fund contributions have to be deducted at 6% of employees' wages for normal time and paid over to the group scheme. 2. Kadupul Engineering contributes 8% of the normal wages to the pension fund. 3. All employees under the age of 60 belong to the industry trade union and contributes R7.50 per week to the union. 4. Allow for UIF and SDL contributions at the standard rates. 5. PAYE payable as per the SARS tables is as follows: Tax Remuneration Under 65 65-74 Over 75 0 - 1 120 0 0 1 120 - 1 500 5 1 500 - 2000 87 35 0 0 0 0 Required: 5.1. Calculate the gross wages for the week ending 26 February 2021. (12) 5.2. Complete the Wage Journal of Kadupul Engineering for the week ending 26 February 2021. (17)