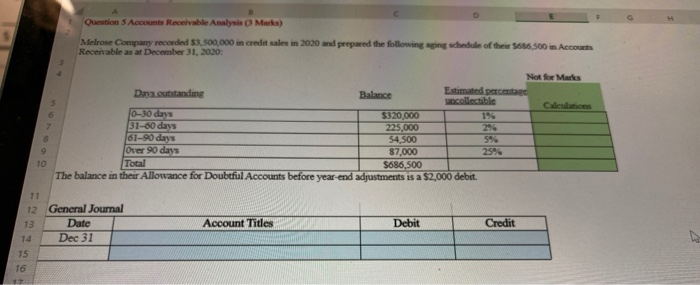

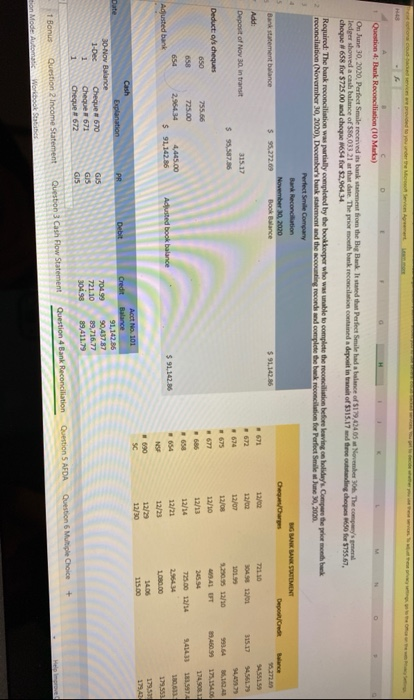

Question 5 Accounts Receivable Analysis (Mark) Melrose Company recorded $3,500,000 in credit sales in 2020 and prepared the following ping schedule of the 5686.500 in Accounts Receivable as at December 31, 2020: Not for Marks Days outstanding Balance Estimated percentage collectible Calculations 0-30 days $320,000 196 31-60 days 225,000 61-90 days 54,500 5% Over 90 days 87,000 25% Total $686,500 The balance in their Allowance for Doubtful Accounts before year-end adjustments is a $2,000 debut. TO Account Titles Debit Credit 11 12 General Journal 13 Date 14 Dec 31 15 16 HAS Question 4: Tank Reconciliation (10 Maria) On June 30, 2020, Perfect Smule received its bank statement from the Big Bank. It stated that Perfect Smile had a balance of $179,424.05 November The company's ledger showed a cash balance of 586,033 21 at that date. The prior mothbank reconciation contained a deposit in trof S315.17 and there in choo for 5755.67 cheque # 658 for $725.00 and cheque 1654 for $2,964.34 Required: The bank reconciliation was partially completed by the bookkeeper who was unable to complete the reconciliation before leaving on holidays. Compare the price meetbank reconcilition (November 30, 2020), December's bank statement and the accounting records and complete the bank reconciation for Perfect Smile June 30, 2000 Perfect Smile Company Bank Reconciliation BIGBANK BANK STATEMENT November 30, 2020 Bank statement balance $ 95,272.09 Chemor Book Balance Deposit $ 91.142.36 Add: 721.30 Deposit of Nov 30. in transit 315.17 12/02 304.98 12/01 315.17 $ 55,587.86 12/02 Deducto/s cheques 675 2015 12/10 LUFT 40 650 755.66 .686 12/13 2454 658 725.00 12/14 725.00 12/14 944 654 2.954.34 4,445.00 $ 91.142.86 Adjusted bank Adjusted book balance $ 91,142.35 654 2434 12/21 1080.00 an 173.154.00 174 SOLE 179,553 090 SC 12/30 115.00 PR Debe Credit Date Cash Explanation 30-Nov Balance 1-Dec Cheque # 670 Cheque # 671 Cheque # 672 Acc No. 101 Balance 91.142.16 90,43787 39.716.77 89,411.79 70499 721.10 304.38 GIS GUS 1 1 Question 5 AFDA Question 6 Multiple Choice Question 4 Bank Reconciliation Question 3 Cash Flow Statement 1 Bonus Question 2 Income Statement non Mode: Automatic Workbook States