Answered step by step

Verified Expert Solution

Question

1 Approved Answer

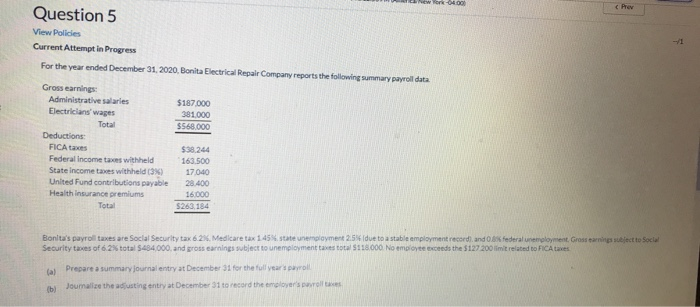

Question 5 View Policies Current Attempt in Progress For the year ended December 31, 2020, Bonita Electrical Repair Company reports the following summary payroll

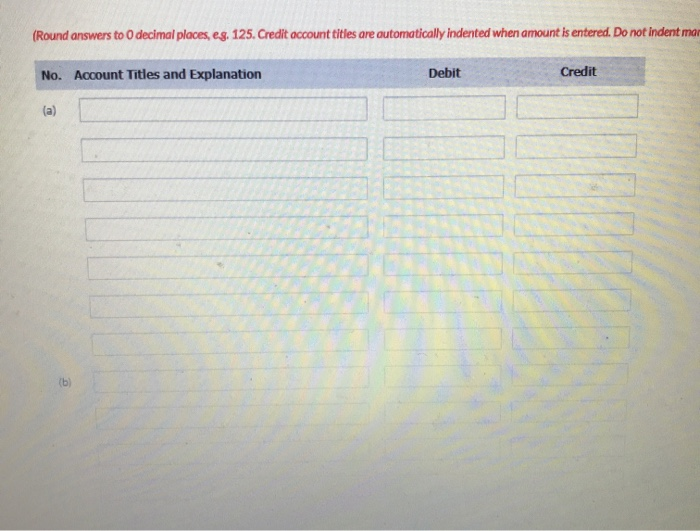

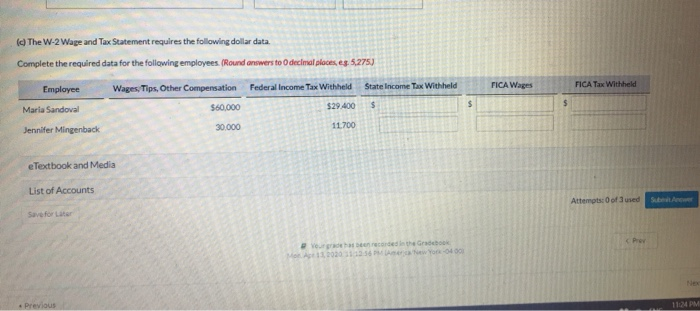

Question 5 View Policies Current Attempt in Progress For the year ended December 31, 2020, Bonita Electrical Repair Company reports the following summary payroll data Gross earnings: Administrative salaries Electricians' wages Deductions Total FICA taxes Federal Income taxes withheld State income taxes withheld (3%) United Fund contributions payable Health insurance premiums Total $187,000 381,000 $568,000 $38.244 163,500 17,040 28.400 16.000 $263,184 York-04:00 < Prev Bonita's payroll taxes are Social Security tax 6.2% Medicare tax 1.45% state unemployment 2.5% (due to a stable employment record), and 0.8% federal unemployment. Gross earnings subject to Social Security taxes of 6.2% total $484,000, and gross earnings subject to unemployment taxes total $118,000 No employee exceeds the $127.200 limit related to FICA taxes (a) Prepare a summary journal entry at December 31 for the full year's payroll (b) Journalize the adjusting entry at December 31 to record the employer's payroll taxes /1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started