Answered step by step

Verified Expert Solution

Question

1 Approved Answer

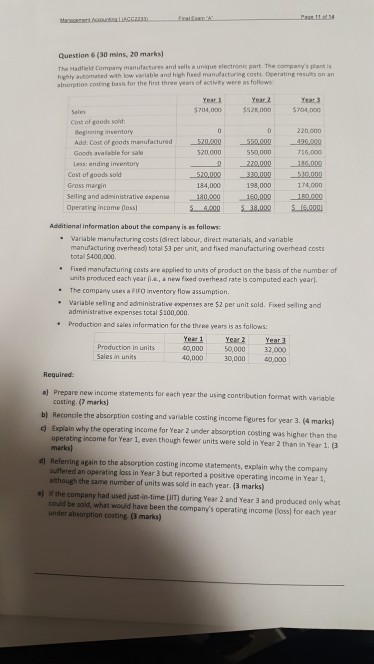

Question 6 (30 mins, 20 marks) The Hadfield Company rnanufactre, and seli unque electronic part. The company plant is highly automated with low variable and

Question 6 (30 mins, 20 marks) The Hadfield Company rnanufactre, and seli unque electronic part. The company plant is highly automated with low variable and high fised manulacturine costs Operating results on an morption costing basts for the first three years of actvy were as follows Year 2 Year3 704,000528,000 $04,000 Cost of goods sold Beginning intventory Add Cost of poods manufactured Goods avalable for sake Less: ending invemory 5200000220000 50,000 0000495.00 520.00 520,000 Cost of goodk sold Gross margin 522,002 33000310.002 198,000 174000 80000 184,000 Selling and administrative expese1800 160,00 Operating income (loss) Additional information about the company is as follows: Variable manufacturing costs (direct labour, direct materials, and varable manufacturing overhead) total $3 per unit, and fixed manufacturing overhead costs total 5400,000 " Fised manufacturing costs are applied to units of product on the basis of the number of units produced each year fie, a new fooed overhead rate is computed each yearl. The company uses a FiFO Inventory flow assumption . Variable seling and administrative expenses are $2 per unit sald. Fixed selling and . Production and sales information for the three years is as follows: administrative expenses total $100,000 Production in units Sales in units 40,000 40,00050,00032,000 40,000 30,000 40,000 Required. e) Prepare new income bl Reconcile the abscrption costing and variable costing income feures for year 3. (4 marks) me statements for each year the using contribution formst with variable costing. (7 marks) Explain why the operating income for Year 2 under absorption costing was higher than the marks suffered an operating loss in Year 3 but reported a positihe operating income in Year , income for Year 1, even though fewer units were sold in Year 2 than in Year 1. (3 d) Referring again to the abscrption costing income stetements, explain why the company athough the same number of units was sold in each year.(3 marks) el it the company had used just-in-time (UIT) during Year 2 and Year 3 and produced only what couid be sold, what wouid have been the company's operating income (loss) for each year under absorption costing (3 marks) Question 6 (30 mins, 20 marks) The Hadfield Company rnanufactre, and seli unque electronic part. The company plant is highly automated with low variable and high fised manulacturine costs Operating results on an morption costing basts for the first three years of actvy were as follows Year 2 Year3 704,000528,000 $04,000 Cost of goods sold Beginning intventory Add Cost of poods manufactured Goods avalable for sake Less: ending invemory 5200000220000 50,000 0000495.00 520.00 520,000 Cost of goodk sold Gross margin 522,002 33000310.002 198,000 174000 80000 184,000 Selling and administrative expese1800 160,00 Operating income (loss) Additional information about the company is as follows: Variable manufacturing costs (direct labour, direct materials, and varable manufacturing overhead) total $3 per unit, and fixed manufacturing overhead costs total 5400,000 " Fised manufacturing costs are applied to units of product on the basis of the number of units produced each year fie, a new fooed overhead rate is computed each yearl. The company uses a FiFO Inventory flow assumption . Variable seling and administrative expenses are $2 per unit sald. Fixed selling and . Production and sales information for the three years is as follows: administrative expenses total $100,000 Production in units Sales in units 40,000 40,00050,00032,000 40,000 30,000 40,000 Required. e) Prepare new income bl Reconcile the abscrption costing and variable costing income feures for year 3. (4 marks) me statements for each year the using contribution formst with variable costing. (7 marks) Explain why the operating income for Year 2 under absorption costing was higher than the marks suffered an operating loss in Year 3 but reported a positihe operating income in Year , income for Year 1, even though fewer units were sold in Year 2 than in Year 1. (3 d) Referring again to the abscrption costing income stetements, explain why the company athough the same number of units was sold in each year.(3 marks) el it the company had used just-in-time (UIT) during Year 2 and Year 3 and produced only what couid be sold, what wouid have been the company's operating income (loss) for each year under absorption costing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started