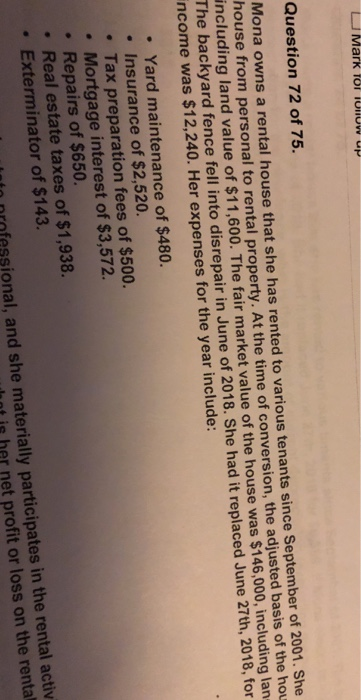

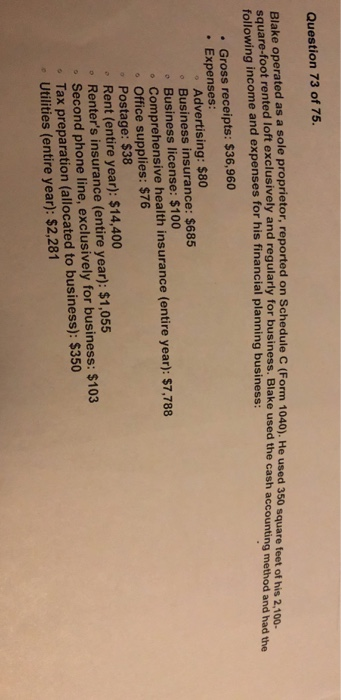

Question 72 of 75 Mona owns a rental house that she has rented to various tenants since September of 2 house from personal to rental property. At the time of con including land value of $11,600. The fair market value of the house was $146,000, including lar The backyard fence fell into disrepair in June of 2018. She had it replaced June 27th, 2018, for ncome was $12,240. Her expenses for the year include: 001. She version, the adjuste . Yard maintenance of $480. . Insurance of $2,520. . Tax preparation fees of $500. Mortgage interest of $3,572. . Repairs of $650. . Real estate taxes of $1,938. . Exterminator of $143 ato nrofessional, and she materially participates in the rental activ hot is her net profit or loss on the rental Question 73 of 75 ke operated as a sole proprietor, reported on Schedule C (Form 1040). He used 350 square feet of his 2.100- square-foot rented lo Blake operaexclusively and regularly for business. Blake used the cash accounting method and had the following income and expenses for his financial planning business: square feet of his 2,100- Gross receipts: $36,960 Expenses: Advertising: $80 o Business insurance: $685 e Business license: $100 e Comprehensive health insurance (entire year): $7,788 Office supplies: $76 Postage: $38 Rent (entire year): $14,400 e Renter's insurance (entire year): $1,055 - Second phone line, exclusively for business: $103 . Tax preparation (allocated to business): $350 e Utilities (entire year): $2,281 Question 72 of 75 Mona owns a rental house that she has rented to various tenants since September of 2 house from personal to rental property. At the time of con including land value of $11,600. The fair market value of the house was $146,000, including lar The backyard fence fell into disrepair in June of 2018. She had it replaced June 27th, 2018, for ncome was $12,240. Her expenses for the year include: 001. She version, the adjuste . Yard maintenance of $480. . Insurance of $2,520. . Tax preparation fees of $500. Mortgage interest of $3,572. . Repairs of $650. . Real estate taxes of $1,938. . Exterminator of $143 ato nrofessional, and she materially participates in the rental activ hot is her net profit or loss on the rental Question 73 of 75 ke operated as a sole proprietor, reported on Schedule C (Form 1040). He used 350 square feet of his 2.100- square-foot rented lo Blake operaexclusively and regularly for business. Blake used the cash accounting method and had the following income and expenses for his financial planning business: square feet of his 2,100- Gross receipts: $36,960 Expenses: Advertising: $80 o Business insurance: $685 e Business license: $100 e Comprehensive health insurance (entire year): $7,788 Office supplies: $76 Postage: $38 Rent (entire year): $14,400 e Renter's insurance (entire year): $1,055 - Second phone line, exclusively for business: $103 . Tax preparation (allocated to business): $350 e Utilities (entire year): $2,281