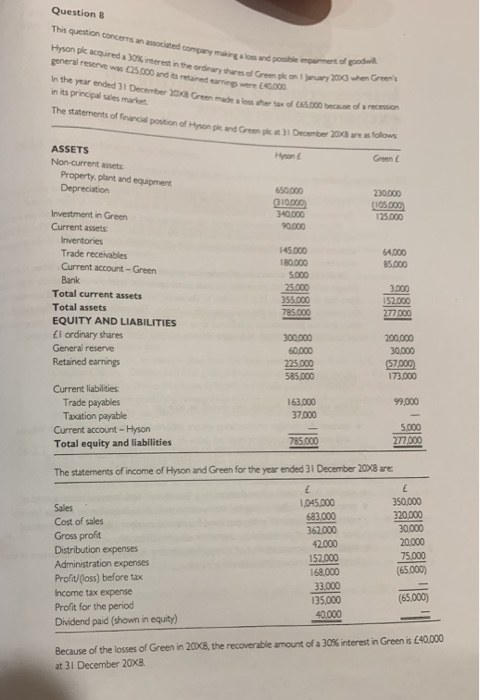

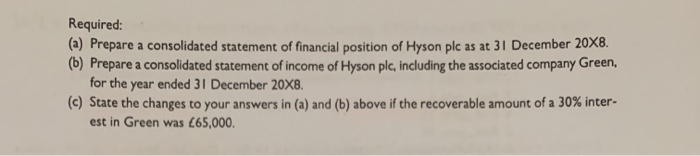

Question 8 This question concerns and concay Hyson picured a 30% general reserve was 500 and o ond posible moment of goodwill res of Greek on ary200 when Green's earn In the year ended 31 December 2008 Gr in its principal sales market ( 600 tax dl 5.000 because of a recension .500 The statements of racial position of Honk and Grow December 2005 s foliows Hront Green ASSETS Non-current sets Property, plant and equipment Depreciation 650.000 310000 340.000 90.000 230.000 (105.000 125.000 64.000 85.000 Investment in Green Current assets Inventories Trade receivables Current account -Green Bank Total current assets Total assets EQUITY AND LIABILITIES l ordinary shares General reserve Retained earnings 145.000 180.000 5.000 25.000 355.000 785.000 3.000 152.000 277000 300.000 60,000 225.000 585.000 200.000 30,000 (57000 173.000 Current liabilities Trade payables Taxation payable Current account - Hyson Total equity and liabilities 163.000 37.000 99,000 785.000 5,000 277.000 The statements of income of Hyson and Green for the year ended 31 December 20X8 are Sales Cost of sales Gross profit Distribution expenses Administration expenses Profit(loss) before tax Income tax expense Profit for the period Dividend paid (shown in equity) 1.045.000 683.000 362.000 42000 152,000 168,000 33.000 135.000 40.000 350.000 320.000 30.000 20.000 75.000 (65.000) (65.000) Because of the losses of Green in 20x8, the recoverable amount of a 30% interest in Green is 40.000 at 31 December 20X8 Required: (a) Prepare a consolidated statement of financial position of Hyson plc as at 31 December 20X8. (6) Prepare a consolidated statement of income of Hyson plc, including the associated company Green, for the year ended 31 December 20X8. (C) State the changes to your answers in (a) and (b) above if the recoverable amount of a 30% inter- est in Green was 65,000. Question 8 This question concerns and concay Hyson picured a 30% general reserve was 500 and o ond posible moment of goodwill res of Greek on ary200 when Green's earn In the year ended 31 December 2008 Gr in its principal sales market ( 600 tax dl 5.000 because of a recension .500 The statements of racial position of Honk and Grow December 2005 s foliows Hront Green ASSETS Non-current sets Property, plant and equipment Depreciation 650.000 310000 340.000 90.000 230.000 (105.000 125.000 64.000 85.000 Investment in Green Current assets Inventories Trade receivables Current account -Green Bank Total current assets Total assets EQUITY AND LIABILITIES l ordinary shares General reserve Retained earnings 145.000 180.000 5.000 25.000 355.000 785.000 3.000 152.000 277000 300.000 60,000 225.000 585.000 200.000 30,000 (57000 173.000 Current liabilities Trade payables Taxation payable Current account - Hyson Total equity and liabilities 163.000 37.000 99,000 785.000 5,000 277.000 The statements of income of Hyson and Green for the year ended 31 December 20X8 are Sales Cost of sales Gross profit Distribution expenses Administration expenses Profit(loss) before tax Income tax expense Profit for the period Dividend paid (shown in equity) 1.045.000 683.000 362.000 42000 152,000 168,000 33.000 135.000 40.000 350.000 320.000 30.000 20.000 75.000 (65.000) (65.000) Because of the losses of Green in 20x8, the recoverable amount of a 30% interest in Green is 40.000 at 31 December 20X8 Required: (a) Prepare a consolidated statement of financial position of Hyson plc as at 31 December 20X8. (6) Prepare a consolidated statement of income of Hyson plc, including the associated company Green, for the year ended 31 December 20X8. (C) State the changes to your answers in (a) and (b) above if the recoverable amount of a 30% inter- est in Green was 65,000