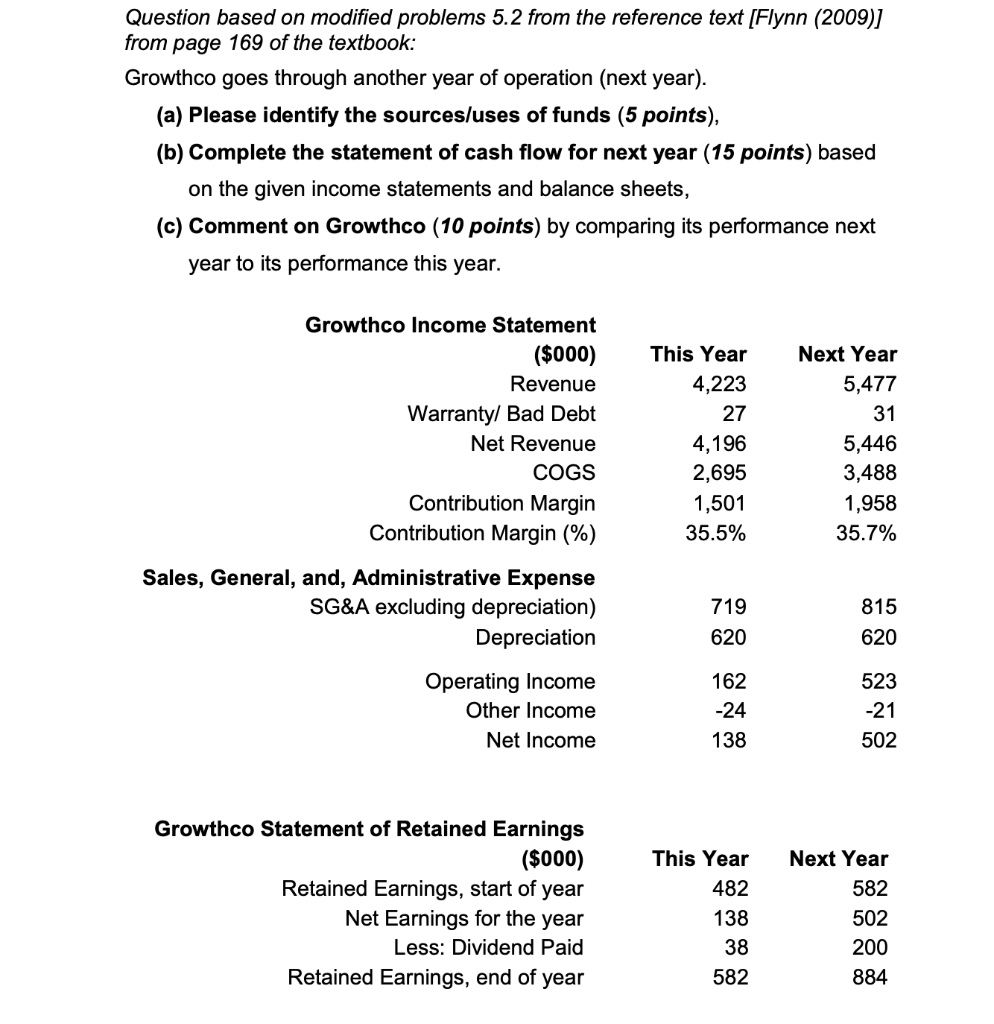

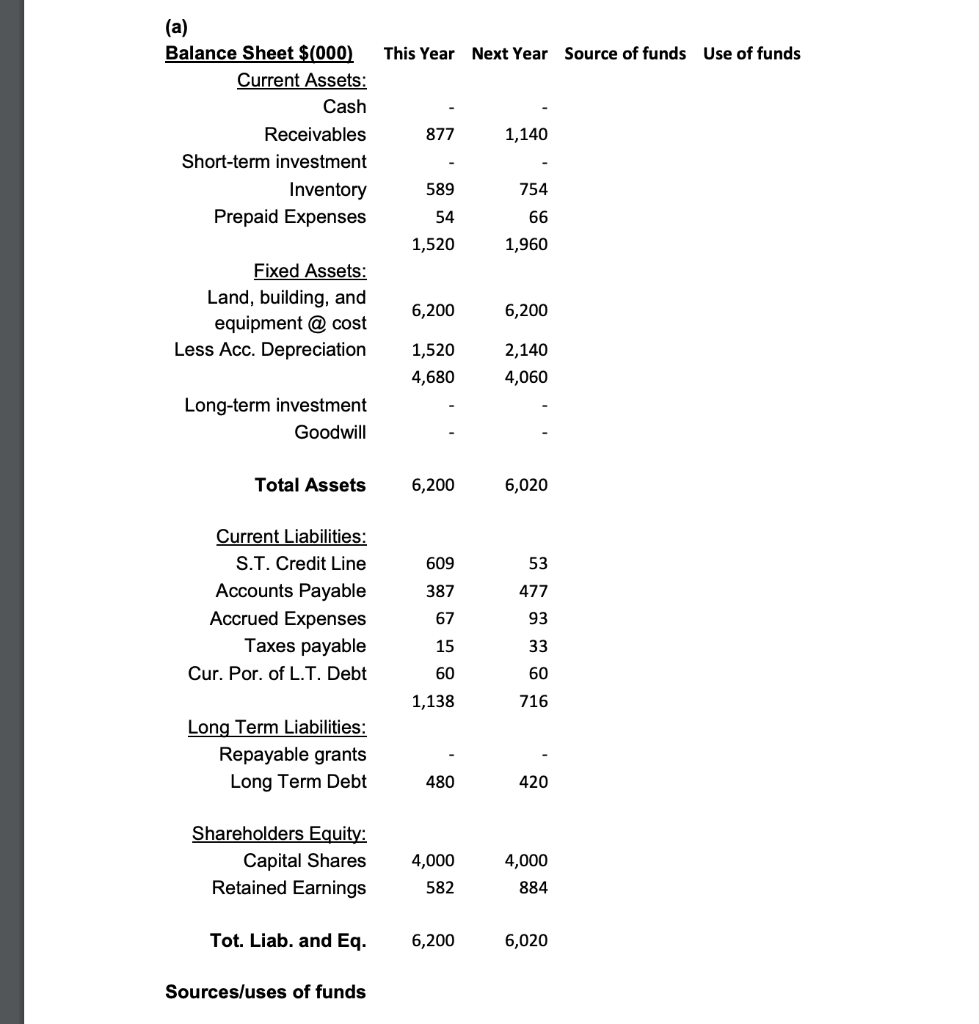

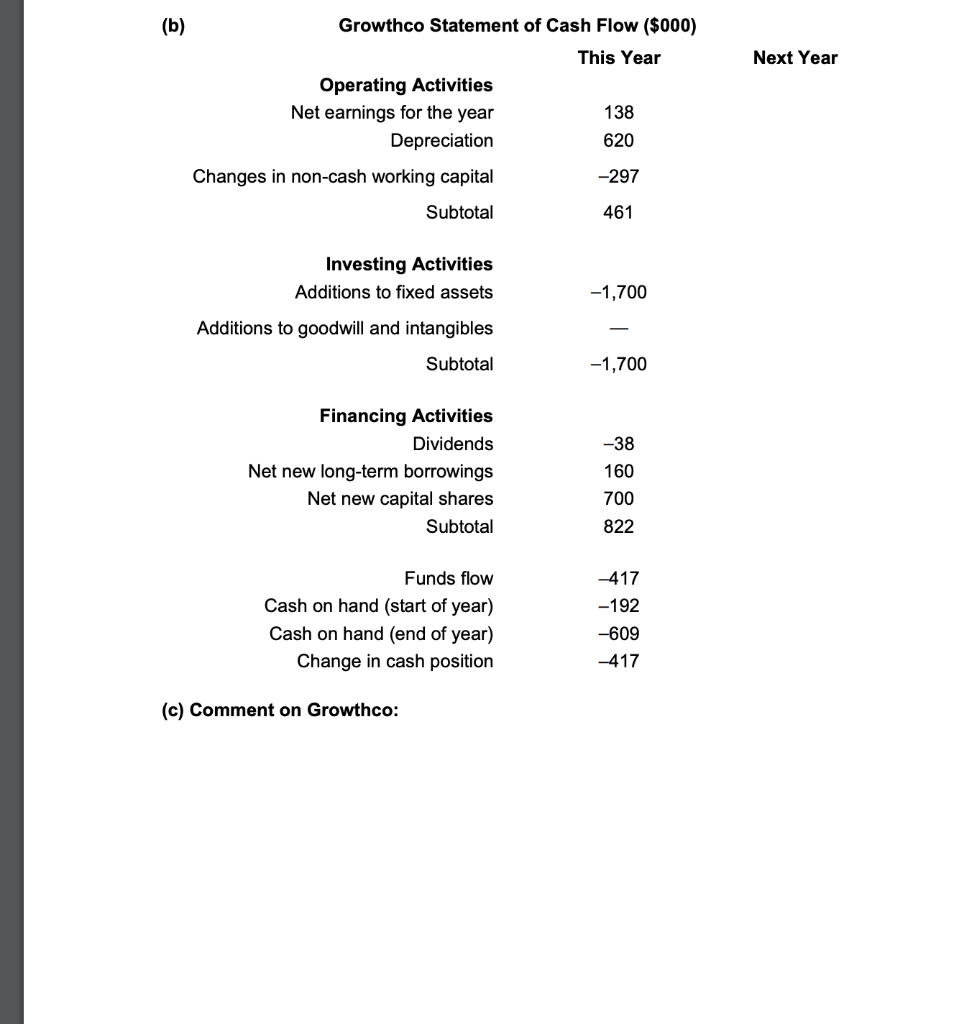

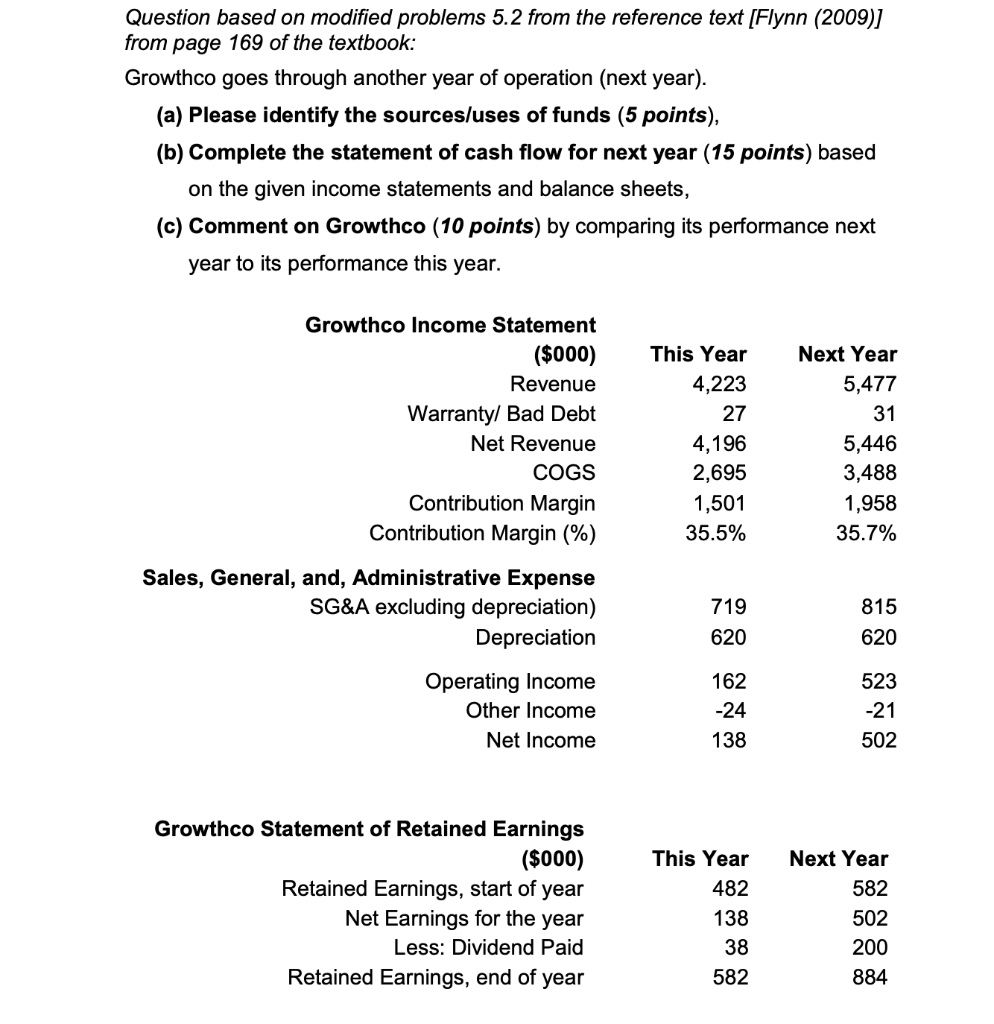

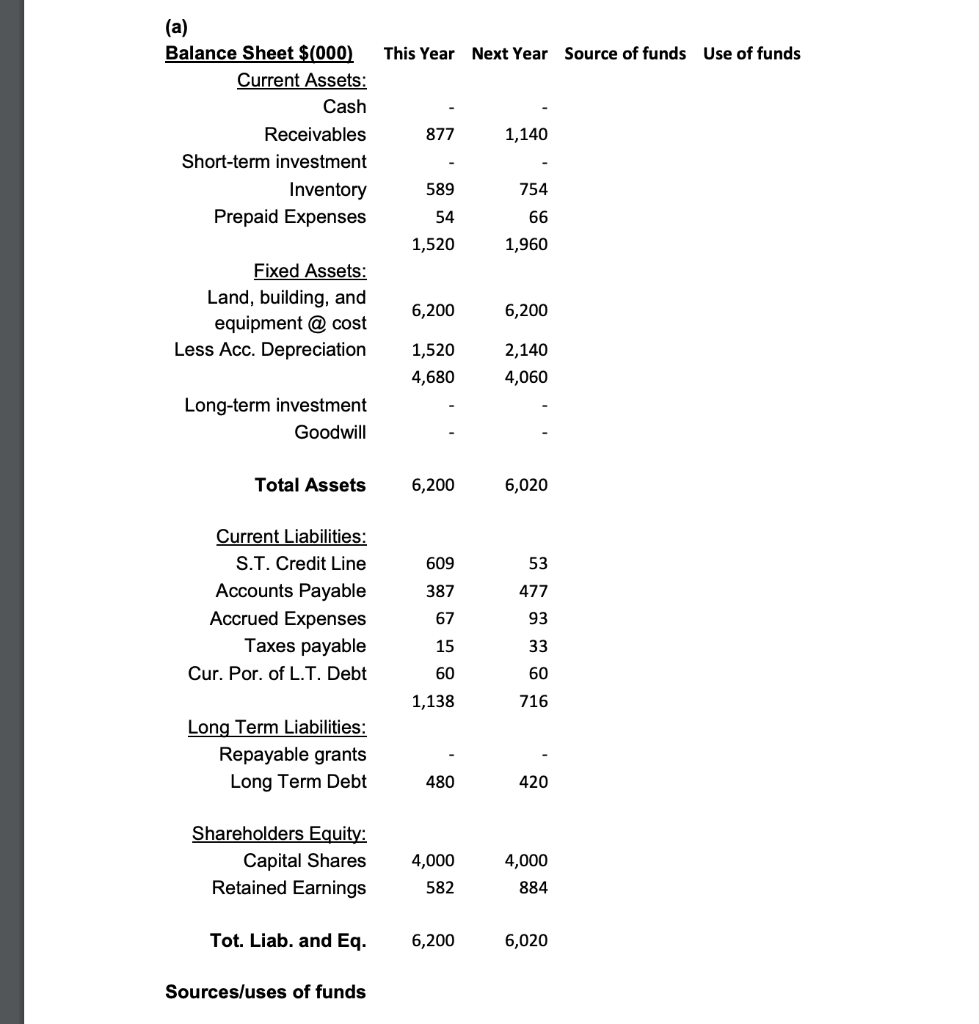

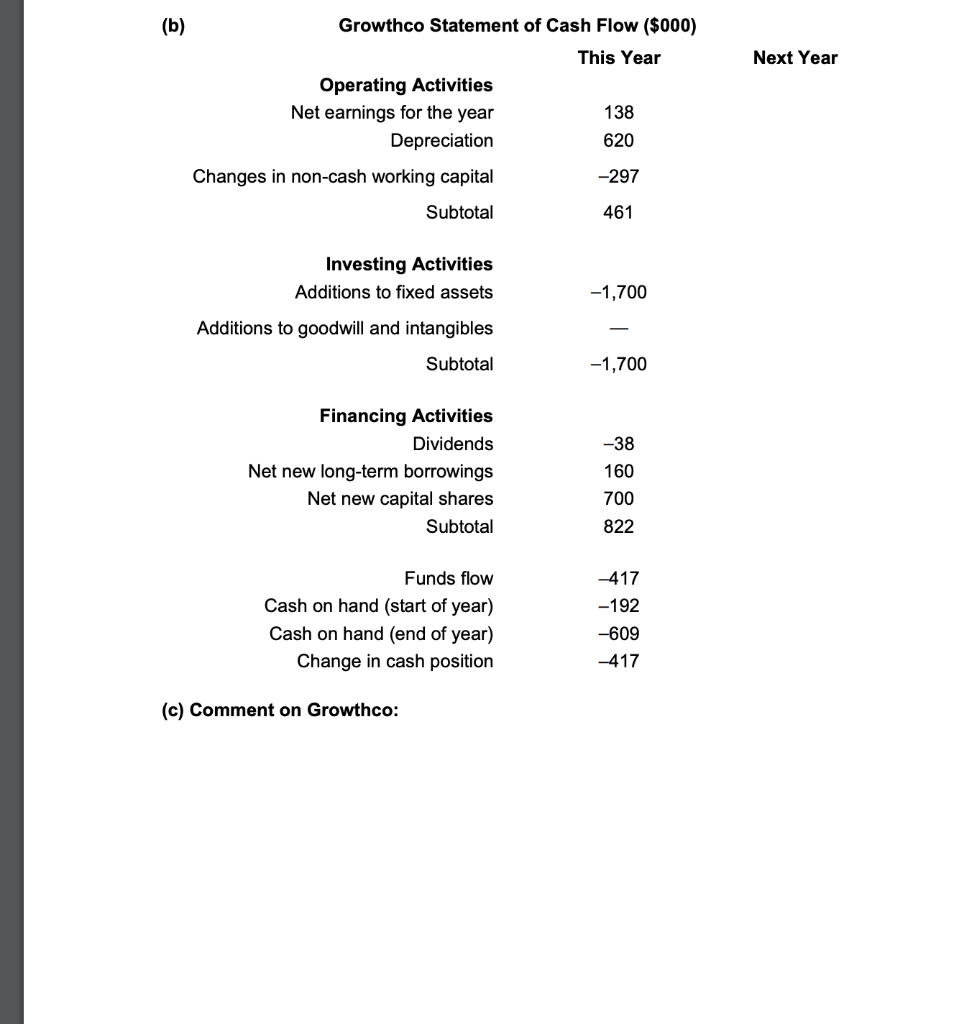

Question based on modified problems 5.2 from the reference text [Flynn (2009)] from page 169 of the textbook: Growthco goes through another year of operation (next year) (a) Please identify the sources/uses of funds (5 points), (b) Complete the statement of cash flow for next year (15 points) based on the given income statements and balance sheets, (c) Comment on Growthco (10 points) by comparing its performance next year to its performance this year. Growthco Income Statement ($000) This Year Next Year 5,477 Revenue 4,223 Warranty/ Bad Debt 27 31 Net Revenue 4,196 5,446 COGS 2,695 3,488 Contribution Margin Contribution Margin (%) 1,501 1,958 35.5% 35.7% Sales, General, and, Administrative Expense SG&A excluding depreciation) 719 815 620 Depreciation 620 523 Operating Income 162 -24 Other Income -21 Net Income 138 502 Growthco Statement of Retained Earnings ($000) Retained Earnings, start of year Net Earnings for the year This Year Next Year 582 482 138 502 Less: Dividend Paid 38 200 Retained Earnings, end of year 582 884 (a) Balance Sheet $(000) This Year Source of funds Use of funds Next Year Current Assets: Cash Receivables 877 1,140 Short-term investment Inventory Prepaid Expenses 589 754 54 66 1,960 1,520 Fixed Assets: Land, building, and equipment @ cost 6,200 6,200 Less Acc. Depreciation 1,520 2,140 4,680 4,060 Long-term investment Goodwill Total Assets 6,200 6,020 Current Liabilities: S.T. Credit Line 609 53 Accounts Payable 477 387 Accrued Expenses 67 93 Taxes payable 15 33 Cur. Por. of L.T. Debt 60 60 716 1,138 Long Term Liabilities: Repayable grants Long Term Debt 480 420 Shareholders Equity: Capital Shares 4,000 4,000 Retained Earnings 582 884 Tot. Liab. and Eq. 6,200 6,020 Sources/uses of funds Growthco Statement of Cash Flow ($000) (b) This Year Next Year Operating Activities Net earnings for the year 138 Depreciation 620 Changes in non-cash working capital -297 461 Subtotal Investing Activities Additions to fixed assets -1,700 Additions to goodwill and intangibles Subtotal -1,700 Financing Activities Dividends -38 Net new long-term borrowings 160 Net new capital shares 700 Subtotal 822 Funds flow -417 Cash on hand (start of year) -192 Cash on hand (end of year) -609 -417 Change in cash position (c) Comment on Growthco