Answered step by step

Verified Expert Solution

Question

1 Approved Answer

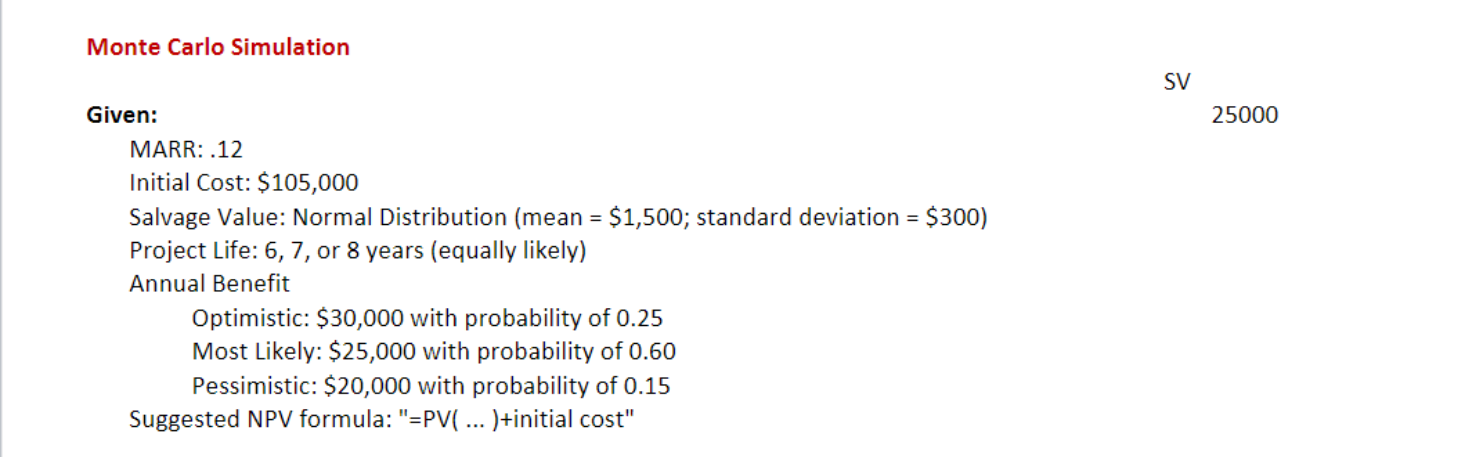

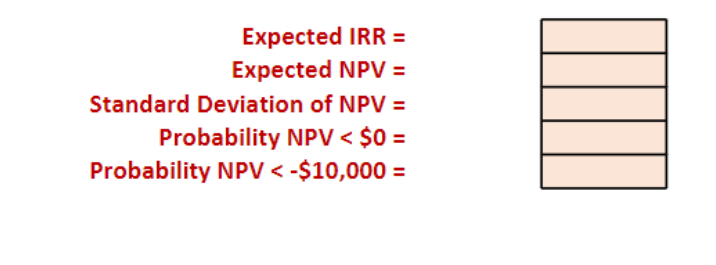

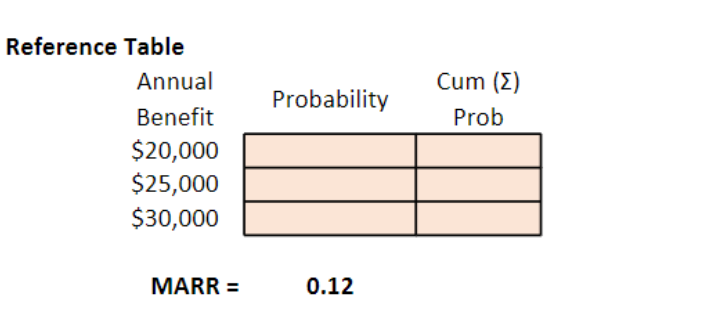

Question: Calculate Expected NPV, Standard Deviation for expected NPV, Expected IRR, and estimate of Probability that NPV PLease complete all tables below and show all

Question: Calculate Expected NPV, Standard Deviation for expected NPV, Expected IRR, and estimate of Probability that NPV

PLease complete all tables below and show all formulas used. thanks

Monte Carlo Simulation SV 25000 = Given: MARR: 12 Initial Cost: $105,000 Salvage Value: Normal Distribution (mean = $1,500; standard deviation = $300) Project Life: 6,7, or 8 years (equally likely) Annual Benefit Optimistic: $30,000 with probability of 0.25 Most Likely: $25,000 with probability of 0.60 Pessimistic: $20,000 with probability of 0.15 Suggested NPV formula: "=PV( ... )+initial cost" Expected IRR = Expected NPV = Standard Deviation of NPV = Probability NPV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started