Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question: CALCULATE THE TOTAL GOODWILL INITIALLY ARISING FROM ACQUISITION, USING THE IFRS ALTERNATIVE METHOD OF VALUATION. Required Prepare, in good form, the consolidated statement of

Question: CALCULATE THE TOTAL GOODWILL INITIALLY ARISING FROM ACQUISITION, USING THE IFRS ALTERNATIVE METHOD OF VALUATION.

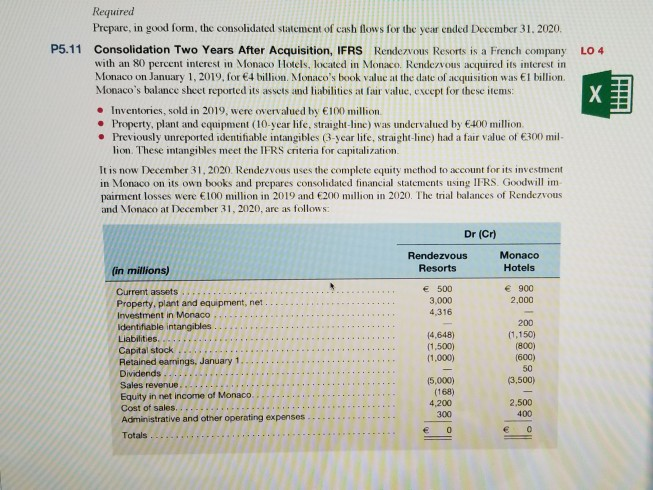

Required Prepare, in good form, the consolidated statement of cash flows for the year ended December 31. 2020 Consolidation Two Years After Acquisition, IFRS Rendezvous Resorts is a French company with an 80 percent interest in Monaco Hotels, located in Monaco. Rendezvous acquired its intcrest in Monaco on January 1, 2019, for 4 billion. Monaco's book value at the date of acquisition was E1 billion. Monaco's balance sheet reported its assets and liabilities at fair value, except for these items: P5.11 LO4 Inventories, sold in 2019, were overvalued by 100 million. * Property, plant and equipment (10-year life, straight-line) was undervalued by 400 million Previously unreported identifiable intangibles (3-year life, straight-line) had a fair value ot 300 mil- lion. These intangibles meet the IFRS criteria for capitalization It is now Decemher 31,2020. Rendezvous uses the complete equity method to account for its investment in Monaco on its own books and prepares consolidated financial statements using IFRS. Goodwill im pairment losses were E100 million in 2019 and 200 million in 2020. The trial balances of Rendezvous and Monaco at December 31, 2020, are as follows: Dr (Cr) Rendezvous Resorts Monaco Hotels in millions) Current assets Property, plant and equipment, net Investment in Monaco . .. 500 3,000 4,316 900 2,000 4,648) (1,500) (1,000) 200 (1,150) (800) Liabilities. .. Capital stock .. 50 5,000) (168) 4,200 300 (3,500) Sales revenue. Equity in net income of Monaco.. Cost of sales Administrative and other operating expenses Totals 2,500 400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started