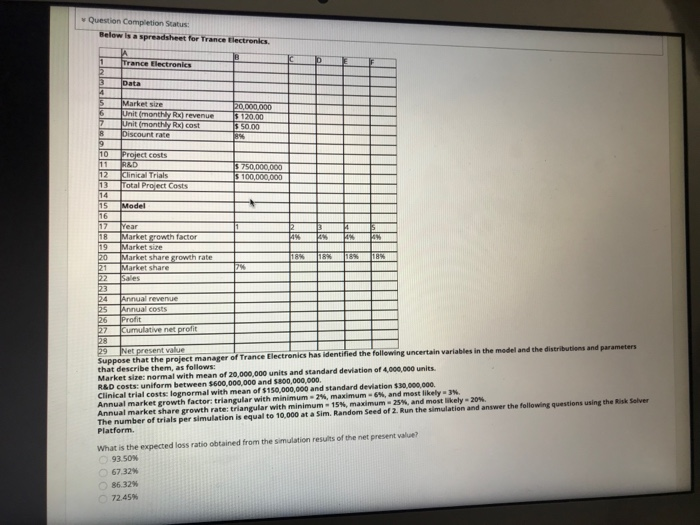

Question Completion Status: low is a spreadsheet for Trance flest Trance Electronics Unit (monthly Rx revenue Unit (monthly Rx) cost 220.000.000 $ 120,00 $ 50.00 10 11 Project costs RED $ 750,000.000 13 Total Project Costs 15 Model 18 Market growth factor Market share growth rate Market share Annual revenue Annual costs 05 27 Cumulative net profit 39 Net present value Suppose that the project manager of Trance Electronics has identified the following uncertain variables in the model and the distributions and parameters that describe them, as follows: Market size: normal with mean of 20,000,000 units and standard deviation of 4,000,000 units. R&D costs: uniform between $600,000,000 and 5800,000,000 Clinical trial costs lognormal with mean of $150,000,000 and standard deviation $30,000,000 Annual market growth factor: triangular with minimum - 2%, maximum -6%, and most likely J. Annual market share growth rate: triangular with minimum 15N, maximum 25%, and most likely -20%. The number of trials per simulation is equal to 10 000 at a Sim. Random Seed of 2. Run the simulation and answer the following questions using the Risk Selver Platform What is the expected loss ratio obtained from the simulation results of the net present value? 93. SON 67.32% 86.32% 72.45% Question Completion Status: low is a spreadsheet for Trance flest Trance Electronics Unit (monthly Rx revenue Unit (monthly Rx) cost 220.000.000 $ 120,00 $ 50.00 10 11 Project costs RED $ 750,000.000 13 Total Project Costs 15 Model 18 Market growth factor Market share growth rate Market share Annual revenue Annual costs 05 27 Cumulative net profit 39 Net present value Suppose that the project manager of Trance Electronics has identified the following uncertain variables in the model and the distributions and parameters that describe them, as follows: Market size: normal with mean of 20,000,000 units and standard deviation of 4,000,000 units. R&D costs: uniform between $600,000,000 and 5800,000,000 Clinical trial costs lognormal with mean of $150,000,000 and standard deviation $30,000,000 Annual market growth factor: triangular with minimum - 2%, maximum -6%, and most likely J. Annual market share growth rate: triangular with minimum 15N, maximum 25%, and most likely -20%. The number of trials per simulation is equal to 10 000 at a Sim. Random Seed of 2. Run the simulation and answer the following questions using the Risk Selver Platform What is the expected loss ratio obtained from the simulation results of the net present value? 93. SON 67.32% 86.32% 72.45%