Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question: Construct pro forma income statements for 1993 for the two financing alternatives. Precision Tool Company Special Topics Directed In late 1992, two executives of

Question:

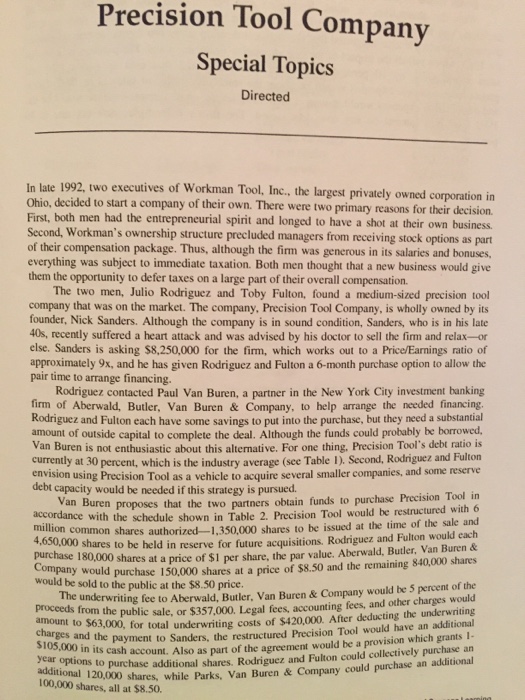

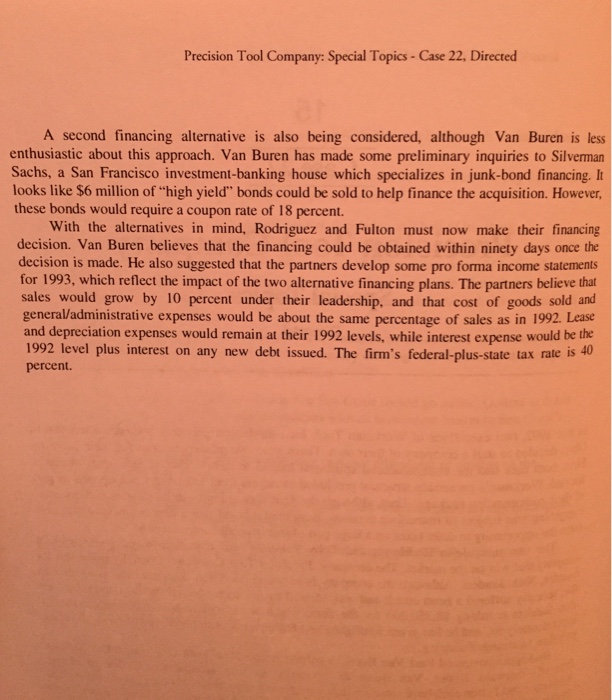

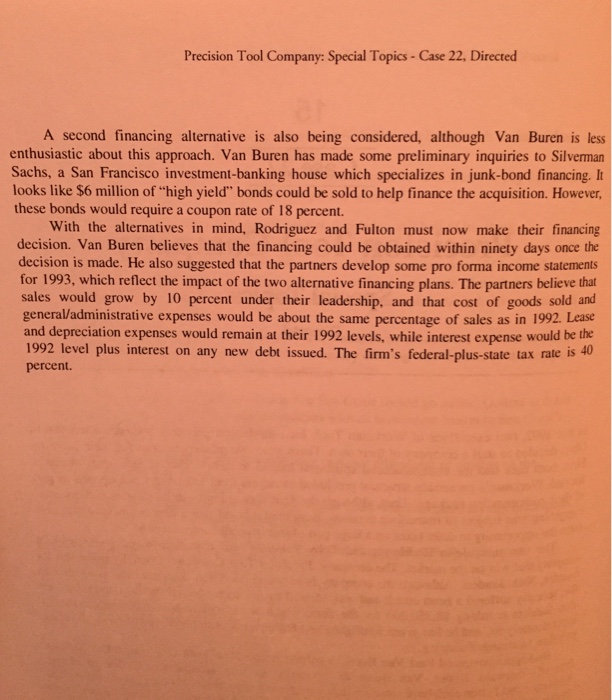

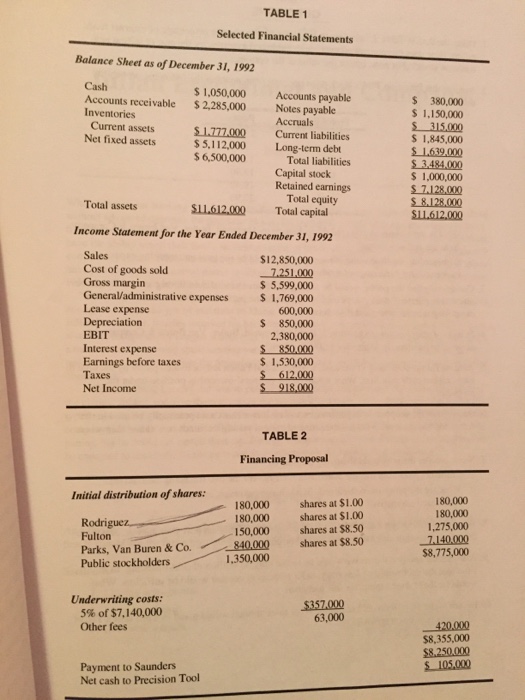

Precision Tool Company Special Topics Directed In late 1992, two executives of Workman Tool, Inc., the largest privately owned corporation irn Ohio, decided to start a company of their own. There were two primary reasons for their decision. First, both men had the entrepreneurial spirit and longed to have a shot at their own business Second, Workman's ownership structure precluded managers from receiving stock options as part of their compensation package. Thus, although the firm was generous in its salaries and bonuses everything was subject to immediate taxation. Both men thought that a new business would give them the opportunity to defer taxes on a large part of their overall compensation. The two men, Julio Rodriguez and Toby Fulton, found a medium-sized precision tool company that was on the market. The company, Precision Tool Company, is wholly owned by its founder, Nick Sanders. Although the company is in sound condition, Sanders, who is in his late 40s, recently suffered a heart attack and was advised by his doctor to sell the firm and relax-or else. Sanders is asking $8,250,000 for the firm, which works out to a Price/Earnings ratio of approximately 9x, and he has given Rodriguez and Fulton a 6-month purchase option to allow the pair time to arrange financing. Rodriguez contacted Paul Van Buren, a partner in the New York City investment banking firm of Aberwald, Butler, Van Buren & Company, to help arrange the needed financing. Rodriguez and Fulton each have some savings to put into the purchase, but they need a substantial amount of outside capital to complete the deal. Although the funds could probably be borrowed. Van Buren is not enthusiastic about this alternative. For one thing, Precision Tool's debt ratio is currently at 30 percent, which is the industry average (see Table 1). Second, Rodriguez and Fulton envision using Precision Tool as a vehicle to acquire several smaller companies, and some reserve debt capacity would be needed if this strategy is pursued proposes that the two partners obtain funds to purchase Precision Tool in schedule shown in Table 2. Precision Tool would be restructured with 6 authorized-1,350,000 shares to be issued at the time of the sale and reserve for future acquisitions. Rodriguez and Fulton would each at a price of $1 per share, the par value. Aberwald, Butler, Van Buren & purchase 150,000 shares at a price of $8.50 and the remaining 840,000 shares Van Buren accordance with the million common shares 4,650,000 s purchase 18 Company would would be sold to the public at the $8.50 price. shares to be held in The nderwriting fee to Aberwald, Butler, Van Buren & Company would be 5 percent of the proceeds from the amount to $63,000, for t o$63,000, for total underwriting costs of $420,000. After deducting the underwriting the payment to Sanders, the restructured Precision Tool would have an additional account. Also as part of the agreement would be a provision which grants I on the public sale, or $357,000. Legal fees, accounting fees, and other charges would Legal fe 5 $105,000 in its cash account additional 12puchase additional shares. Rodriguez and Fulton could collectively purchase an 100.000 20,000 shares, while Parks, Van Buren & Company could purchase an additional 100,000 shares, all at $8.50 Construct pro forma income statements for 1993 for the two financing alternatives.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started