Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Four a) The Intemational Accounting standards Board (IASB)'s IFRS 15) ( Revenue from Contracts with Customers) guides on how on return basis should be

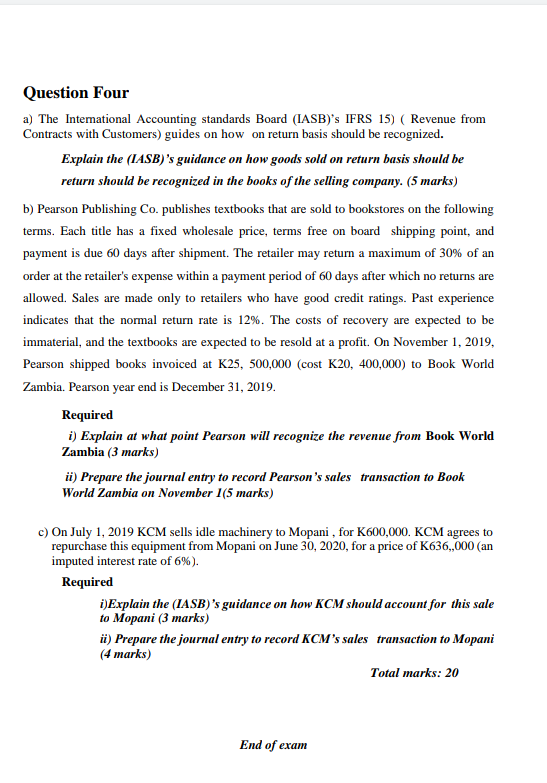

Question Four a) The Intemational Accounting standards Board (IASB)'s IFRS 15) ( Revenue from Contracts with Customers) guides on how on return basis should be recognized. Explain the (IASB)'s guidance on how goods sold on return basis should be return should be recognized in the books of the selling company. (5 marks) b) Pearson Publishing Co. publishes textbooks that are sold to bookstores on the following terms. Each title has a fixed wholesale price, terms free on board shipping point, and payment is due 60 days after shipment. The retailer may return a maximum of 30% of an order at the retailer's expense within a payment period of 60 days after which no returns are allowed. Sales are made only to retailers who have good credit ratings. Past experience indicates that the normal return rate is 12%. The costs of recovery are expected to be immaterial, and the textbooks are expected to be resold at a profit. On November 1, 2019, Pearson shipped books invoiced at K25, 500,000 (cost K20, 400,000) to Book World Zambia. Pearson year end is December 31, 2019. Required i) Explain at what point Pearson will recognize the revenue from Book World Zambia (3 marks) ii) Prepare the journal entry to record Pearson's sales transaction to Book World Zambia on November I (5 marks) c) On July 1, 2019KCM sells idle machinery to Mopani , for K600,000. KCM agrees to repurchase this equipment from Mopani on June 30,2020 , for a price of K636,000 (an imputed interest rate of 6%). Required i) Explain the (IASB)'s guidance on how KCM should account for this sale to Mopani (3 marks) ii) Prepare the journal entry to record KCM 's sales transaction to Mopani (4 marks) Total marks: 20 Question Four a) The Intemational Accounting standards Board (IASB)'s IFRS 15) ( Revenue from Contracts with Customers) guides on how on return basis should be recognized. Explain the (IASB)'s guidance on how goods sold on return basis should be return should be recognized in the books of the selling company. (5 marks) b) Pearson Publishing Co. publishes textbooks that are sold to bookstores on the following terms. Each title has a fixed wholesale price, terms free on board shipping point, and payment is due 60 days after shipment. The retailer may return a maximum of 30% of an order at the retailer's expense within a payment period of 60 days after which no returns are allowed. Sales are made only to retailers who have good credit ratings. Past experience indicates that the normal return rate is 12%. The costs of recovery are expected to be immaterial, and the textbooks are expected to be resold at a profit. On November 1, 2019, Pearson shipped books invoiced at K25, 500,000 (cost K20, 400,000) to Book World Zambia. Pearson year end is December 31, 2019. Required i) Explain at what point Pearson will recognize the revenue from Book World Zambia (3 marks) ii) Prepare the journal entry to record Pearson's sales transaction to Book World Zambia on November I (5 marks) c) On July 1, 2019KCM sells idle machinery to Mopani , for K600,000. KCM agrees to repurchase this equipment from Mopani on June 30,2020 , for a price of K636,000 (an imputed interest rate of 6%). Required i) Explain the (IASB)'s guidance on how KCM should account for this sale to Mopani (3 marks) ii) Prepare the journal entry to record KCM 's sales transaction to Mopani (4 marks) Total marks: 20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started