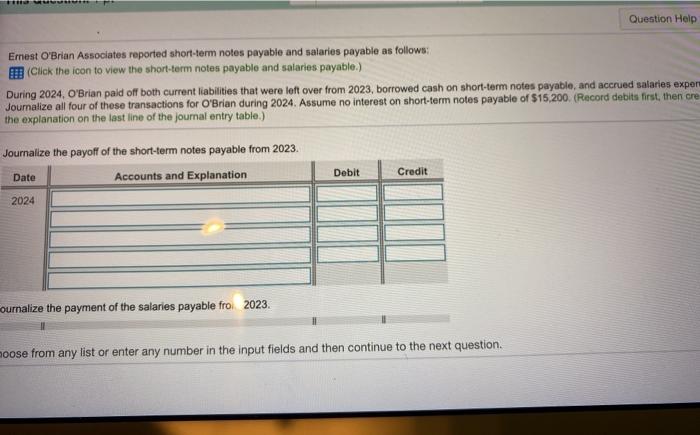

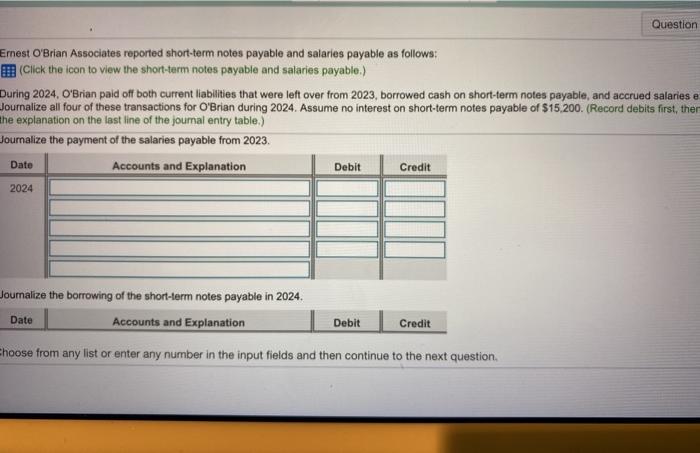

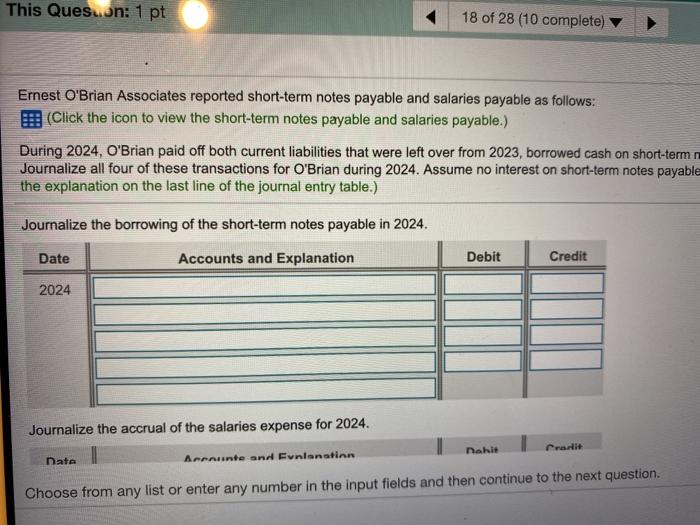

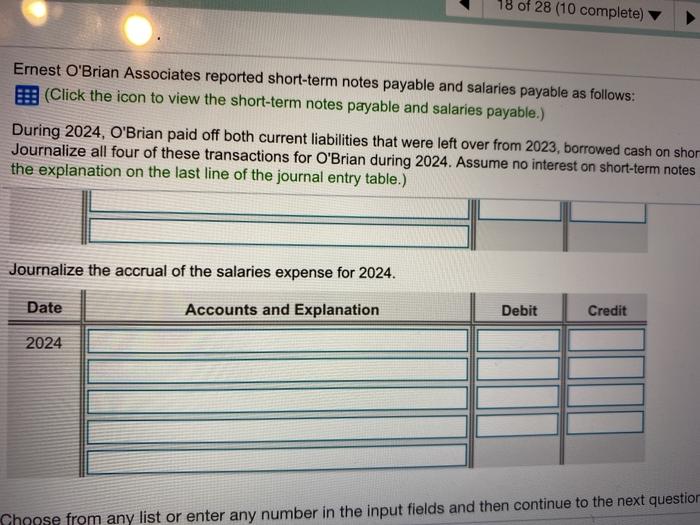

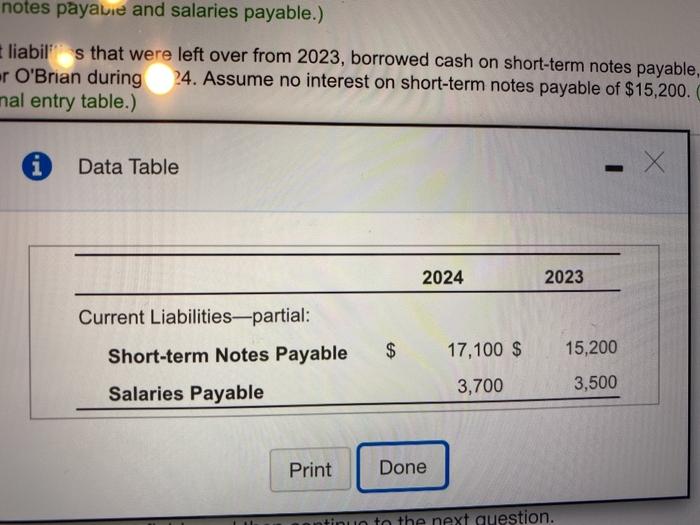

Question Help Emest O'Brian Associates reported short-term notes payable and salaries payable as follows: (Click the icon to view the short-term notes payablo and salarios payable.) During 2024, O'Brian paid off both current liabilities that were left over from 2023, borrowed cash on short-term notes payable, and accrued salaries expert Journalize all four of these transactions for O'Brian during 2024. Assume no interest on short-term notes payable of $15,200 (Record debits first, then cre the explanation on the last line of the journal entry table.) Journalize the payoff of the short-term notes payable from 2023. Date Accounts and Explanation Debit Credit 2024 ournalize the payment of the salaries payable fro 2023. moose from any list or enter any number in the input fields and then continue to the next question. Question Ernest O'Brian Associates reported short-term notes payable and salaries payable as follows: (Click the icon to view the short-term notes payable and salaries payable.) During 2024. O'Brian paid off both current liabilities that were left over from 2023, borrowed cash on short-term notes payable, and accrued salaries e Journalize all four of these transactions for O'Brian during 2024. Assume no interest on short-term notes payable of $15,200. (Record debits first, ther the explanation on the last line of the journal entry table.) Journalize the payment of the salaries payable from 2023. Date Accounts and Explanation Debit Credit 2024 Joumalize the borrowing of the short-term notes payable in 2024. Date Accounts and Explanation Debit Credit Choose from any list or enter any number in the input fields and then continue to the next question This Ques..un: 1 pt 18 of 28 (10 complete) Ernest O'Brian Associates reported short-term notes payable and salaries payable as follows: (Click the icon to view the short-term notes payable and salaries payable.) During 2024, O'Brian paid off both current liabilities that were left over from 2023, borrowed cash on short-term Journalize all four of these transactions for O'Brian during 2024. Assume no interest on short-term notes payable the explanation on the last line of the journal entry table.) Journalize the borrowing of the short-term notes payable in 2024. Date Accounts and Explanation Debit Credit 2024 Journalize the accrual of the salaries expense for 2024. 1 Nate Arcanine and Funlanatinn nahit Cratit Choose from any list or enter any number in the input fields and then continue to the next question. 18 of 28 (10 complete) Ernest O'Brian Associates reported short-term notes payable and salaries payable as follows: (Click the icon to view the short-term notes payable and salaries payable.) During 2024, O'Brian paid off both current liabilities that were left over from 2023, borrowed cash on shor Journalize all four of these transactions for O'Brian during 2024. Assume no interest on short-term notes the explanation on the last line of the journal entry table.) Journalize the accrual of the salaries expense for 2024. Date Accounts and Explanation Debit Credit 2024 Choose from any list or enter any number in the input fields and then continue to the next question notes payabie and salaries payable.) liabil s that were left over from 2023, borrowed cash on short-term notes payable, er O'Brian during 24. Assume no interest on short-term notes payable of $15,200. mal entry table.) i Data Table 2024 2023 Current Liabilitiespartial: Short-term Notes Payable $ 17,100 $ 15,200 Salaries Payable 3,700 3,500 Print Done ontinuo to the next question. Question Help Emest O'Brian Associates reported short-term notes payable and salaries payable as follows: (Click the icon to view the short-term notes payablo and salarios payable.) During 2024, O'Brian paid off both current liabilities that were left over from 2023, borrowed cash on short-term notes payable, and accrued salaries expert Journalize all four of these transactions for O'Brian during 2024. Assume no interest on short-term notes payable of $15,200 (Record debits first, then cre the explanation on the last line of the journal entry table.) Journalize the payoff of the short-term notes payable from 2023. Date Accounts and Explanation Debit Credit 2024 ournalize the payment of the salaries payable fro 2023. moose from any list or enter any number in the input fields and then continue to the next question. Question Ernest O'Brian Associates reported short-term notes payable and salaries payable as follows: (Click the icon to view the short-term notes payable and salaries payable.) During 2024. O'Brian paid off both current liabilities that were left over from 2023, borrowed cash on short-term notes payable, and accrued salaries e Journalize all four of these transactions for O'Brian during 2024. Assume no interest on short-term notes payable of $15,200. (Record debits first, ther the explanation on the last line of the journal entry table.) Journalize the payment of the salaries payable from 2023. Date Accounts and Explanation Debit Credit 2024 Joumalize the borrowing of the short-term notes payable in 2024. Date Accounts and Explanation Debit Credit Choose from any list or enter any number in the input fields and then continue to the next question This Ques..un: 1 pt 18 of 28 (10 complete) Ernest O'Brian Associates reported short-term notes payable and salaries payable as follows: (Click the icon to view the short-term notes payable and salaries payable.) During 2024, O'Brian paid off both current liabilities that were left over from 2023, borrowed cash on short-term Journalize all four of these transactions for O'Brian during 2024. Assume no interest on short-term notes payable the explanation on the last line of the journal entry table.) Journalize the borrowing of the short-term notes payable in 2024. Date Accounts and Explanation Debit Credit 2024 Journalize the accrual of the salaries expense for 2024. 1 Nate Arcanine and Funlanatinn nahit Cratit Choose from any list or enter any number in the input fields and then continue to the next question. 18 of 28 (10 complete) Ernest O'Brian Associates reported short-term notes payable and salaries payable as follows: (Click the icon to view the short-term notes payable and salaries payable.) During 2024, O'Brian paid off both current liabilities that were left over from 2023, borrowed cash on shor Journalize all four of these transactions for O'Brian during 2024. Assume no interest on short-term notes the explanation on the last line of the journal entry table.) Journalize the accrual of the salaries expense for 2024. Date Accounts and Explanation Debit Credit 2024 Choose from any list or enter any number in the input fields and then continue to the next question notes payabie and salaries payable.) liabil s that were left over from 2023, borrowed cash on short-term notes payable, er O'Brian during 24. Assume no interest on short-term notes payable of $15,200. mal entry table.) i Data Table 2024 2023 Current Liabilitiespartial: Short-term Notes Payable $ 17,100 $ 15,200 Salaries Payable 3,700 3,500 Print Done ontinuo to the next