Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Highway Driving School charges $800 per student to prepare and administer written and driving tests. Variable costs of $240 per student include trainers' wages,

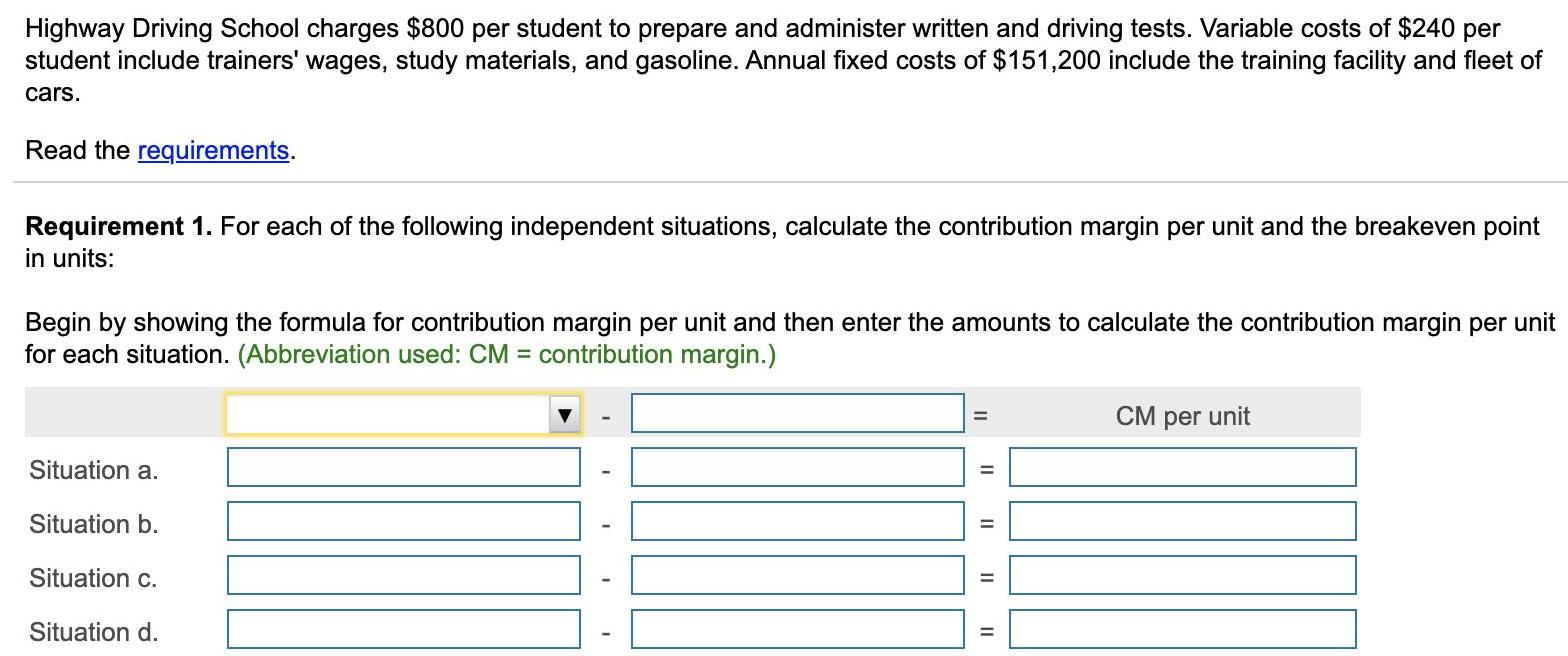

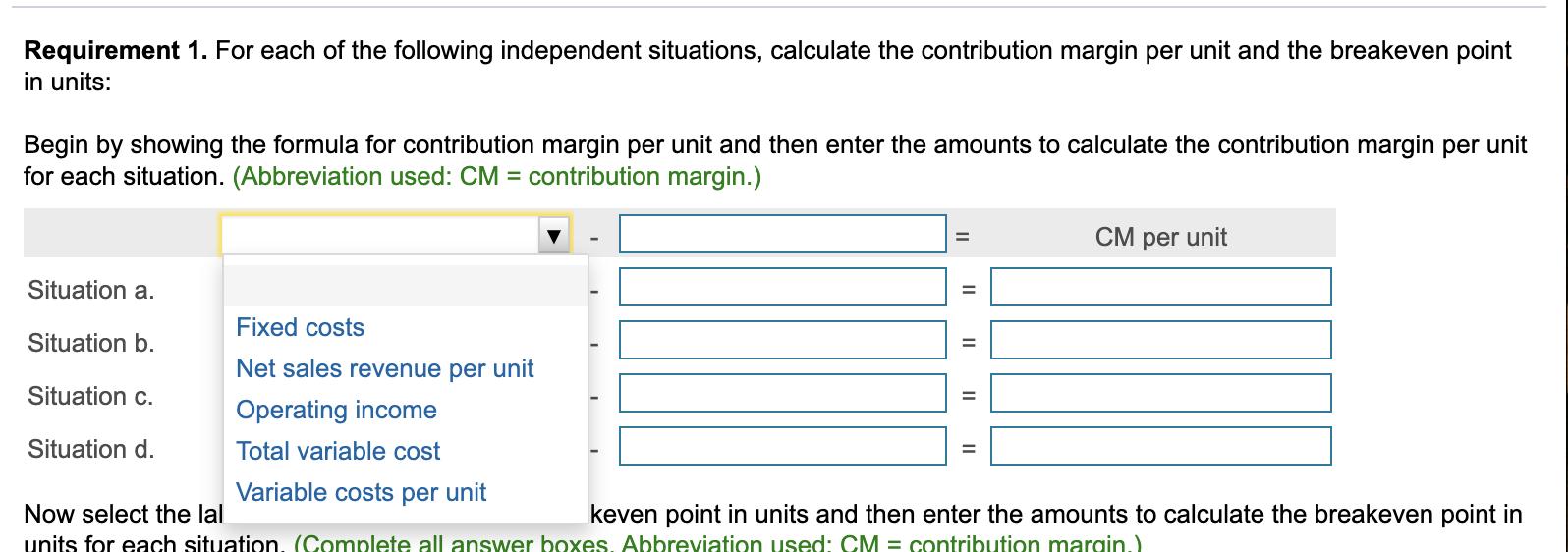

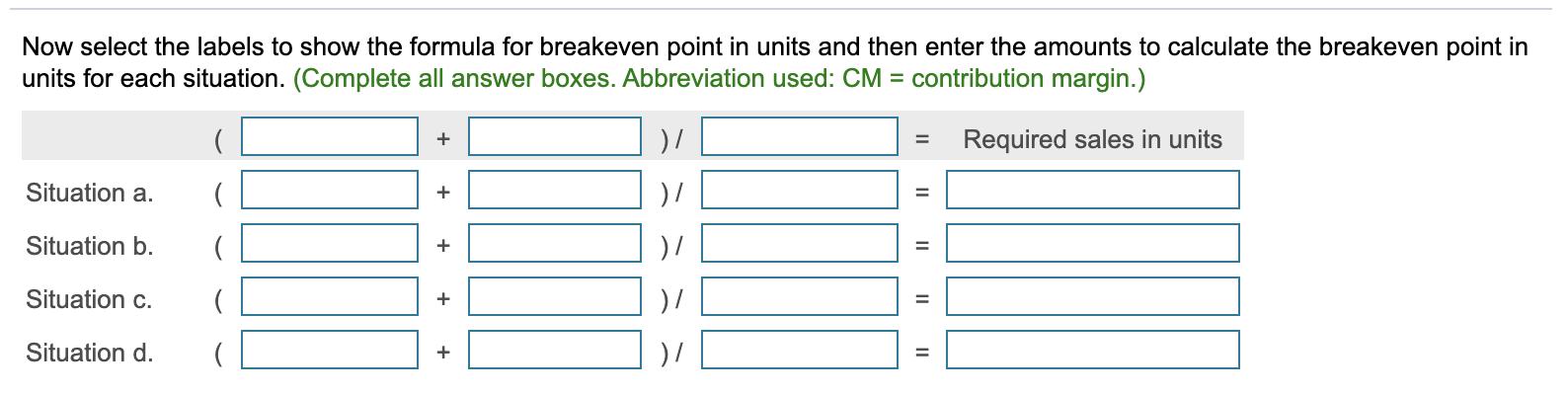

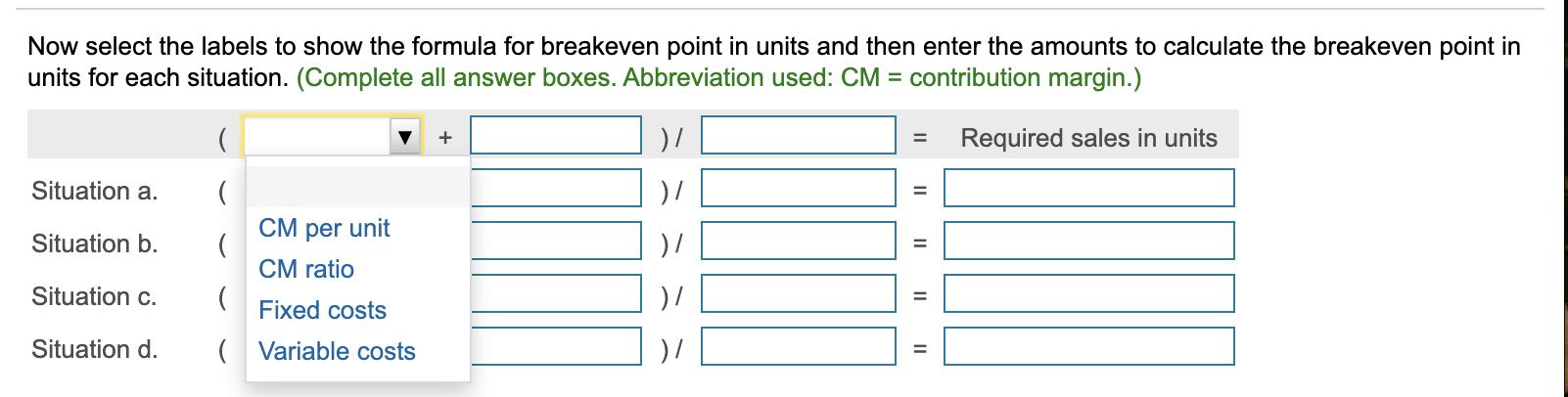

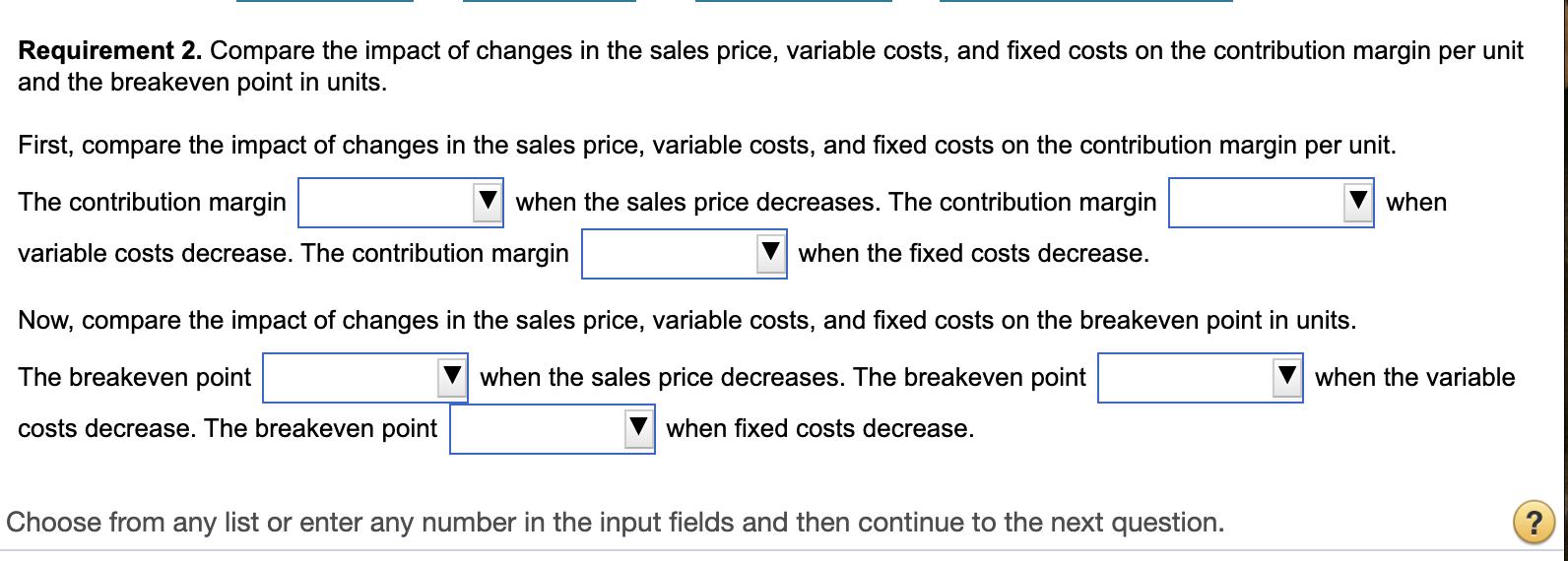

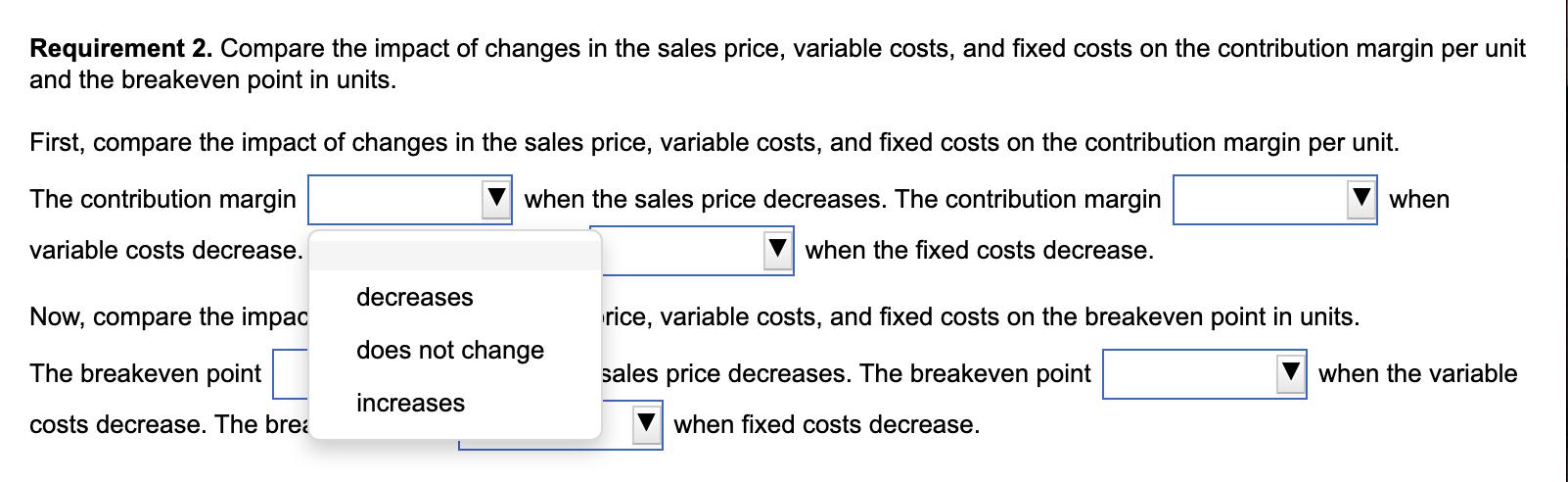

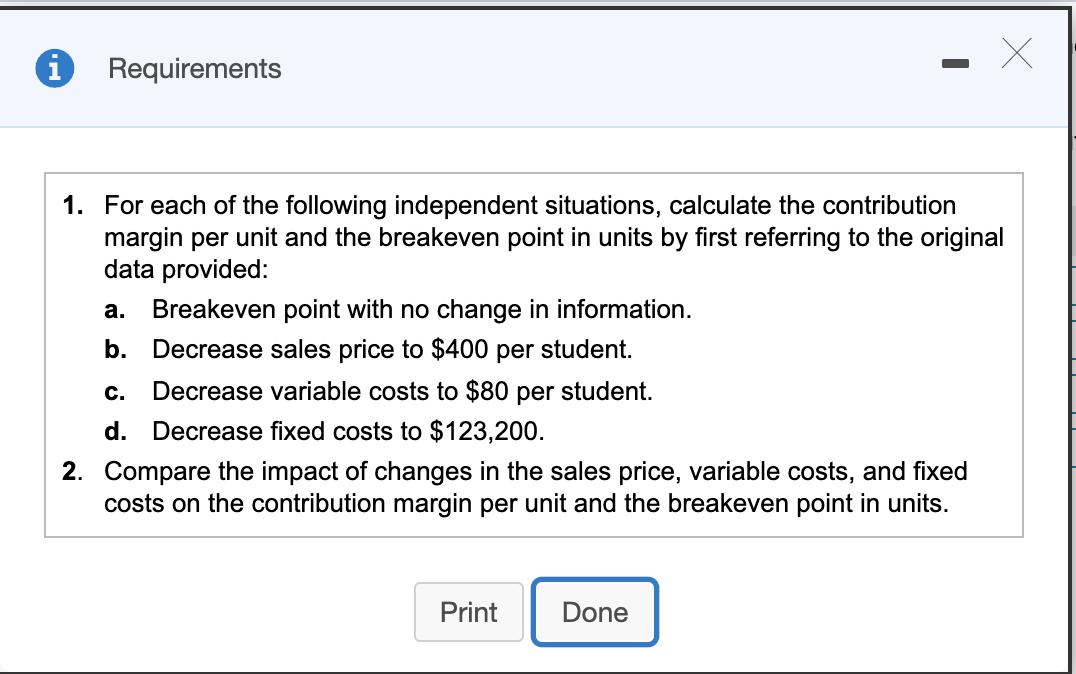

Highway Driving School charges $800 per student to prepare and administer written and driving tests. Variable costs of $240 per student include trainers' wages, study materials, and gasoline. Annual fixed costs of $151,200 include the training facility and fleet of cars. Read the requirements. Requirement 1. For each of the following independent situations, calculate the contribution margin per unit and the breakeven point in units: Begin by showing the formula for contribution margin per unit and then enter the amounts to calculate the contribution margin per unit for each situation. (Abbreviation used: CM = contribution margin.) CM per unit %3D Situation a. Situation b. Situation c. Situation d. II || I| II Requirement 1. For each of the following independent situations, calculate the contribution margin per unit and the breakeven point in units: Begin by showing the formula for contribution margin per unit and then enter the amounts to calculate the contribution margin per unit for each situation. (Abbreviation used: CM = contribution margin.) CM per unit Situation a. Fixed costs Situation b. Net sales revenue per unit Situation c. Operating income Situation d. Total variable cost Variable costs per unit Now select the lal keven point in units and then enter the amounts to calculate the breakeven point in units for each situation, (Complete all answer boxes, Abbreviation used: CM = contribution margin.) II II I| II Now select the labels to show the formula for breakeven point in units and then enter the amounts to calculate the breakeven point in units for each situation. (Complete all answer boxes. Abbreviation used: CM = contribution margin.) + Required sales in units %3D Situation a. + %3D Situation b. + Situation c. Situation d. + II II || + Now select the labels to show the formula for breakeven point in units and then enter the amounts to calculate the breakeven point in units for each situation. (Complete all answer boxes. Abbreviation used: CM = contribution margin.) Required sales in units %3D Situation a. %3D CM per unit ( CM ratio ( Situation b. Situation c. Fixed costs Situation d. ( Variable costs Requirement 2. Compare the impact of changes in the sales price, variable costs, and fixed costs on the contribution margin per unit and the breakeven point in units. First, compare the impact of changes in the sales price, variable costs, and fixed costs on the contribution margin per unit. The contribution margin when the sales price decreases. The contribution margin when variable costs decrease. The contribution margin when the fixed costs decrease. Now, compare the impact of changes in the sales price, variable costs, and fixed costs on the breakeven point in units. The breakeven point when the sales price decreases. The breakeven point when the variable costs decrease. The breakeven point when fixed costs decrease. Choose from any list or enter any number in the input fields and then continue to the next question. Requirement 2. Compare the impact of changes in the sales price, variable costs, and fixed costs on the contribution margin per unit and the breakeven point in units. First, compare the impact of changes in the sales price, variable costs, and fixed costs on the contribution margin per unit. The contribution margin when the sales price decreases. The contribution margin when variable costs decrease. when the fixed costs decrease. decreases Now, compare the impac rice, variable costs, and fixed costs on the breakeven point in units. does not change The breakeven point sales price decreases. The breakeven point when the variable increases costs decrease. The brea when fixed costs decrease. i Requirements 1. For each of the following independent situations, calculate the contribution margin per unit and the breakeven point in units by first referring to the original data provided: . Breakeven point with no change in information. b. Decrease sales price to $400 per student. . Decrease variable costs to $80 per student. d. Decrease fixed costs to $123,200. 2. Compare the impact of changes in the sales price, variable costs, and fixed costs on the contribution margin per unit and the breakeven point in units. Print Done Highway Driving School charges $800 per student to prepare and administer written and driving tests. Variable costs of $240 per student include trainers' wages, study materials, and gasoline. Annual fixed costs of $151,200 include the training facility and fleet of cars. Read the requirements. Requirement 1. For each of the following independent situations, calculate the contribution margin per unit and the breakeven point in units: Begin by showing the formula for contribution margin per unit and then enter the amounts to calculate the contribution margin per unit for each situation. (Abbreviation used: CM = contribution margin.) CM per unit %3D Situation a. Situation b. Situation c. Situation d. II || I| II Requirement 1. For each of the following independent situations, calculate the contribution margin per unit and the breakeven point in units: Begin by showing the formula for contribution margin per unit and then enter the amounts to calculate the contribution margin per unit for each situation. (Abbreviation used: CM = contribution margin.) CM per unit Situation a. Fixed costs Situation b. Net sales revenue per unit Situation c. Operating income Situation d. Total variable cost Variable costs per unit Now select the lal keven point in units and then enter the amounts to calculate the breakeven point in units for each situation, (Complete all answer boxes, Abbreviation used: CM = contribution margin.) II II I| II Now select the labels to show the formula for breakeven point in units and then enter the amounts to calculate the breakeven point in units for each situation. (Complete all answer boxes. Abbreviation used: CM = contribution margin.) + Required sales in units %3D Situation a. + %3D Situation b. + Situation c. Situation d. + II II || + Now select the labels to show the formula for breakeven point in units and then enter the amounts to calculate the breakeven point in units for each situation. (Complete all answer boxes. Abbreviation used: CM = contribution margin.) Required sales in units %3D Situation a. %3D CM per unit ( CM ratio ( Situation b. Situation c. Fixed costs Situation d. ( Variable costs Requirement 2. Compare the impact of changes in the sales price, variable costs, and fixed costs on the contribution margin per unit and the breakeven point in units. First, compare the impact of changes in the sales price, variable costs, and fixed costs on the contribution margin per unit. The contribution margin when the sales price decreases. The contribution margin when variable costs decrease. The contribution margin when the fixed costs decrease. Now, compare the impact of changes in the sales price, variable costs, and fixed costs on the breakeven point in units. The breakeven point when the sales price decreases. The breakeven point when the variable costs decrease. The breakeven point when fixed costs decrease. Choose from any list or enter any number in the input fields and then continue to the next question. Requirement 2. Compare the impact of changes in the sales price, variable costs, and fixed costs on the contribution margin per unit and the breakeven point in units. First, compare the impact of changes in the sales price, variable costs, and fixed costs on the contribution margin per unit. The contribution margin when the sales price decreases. The contribution margin when variable costs decrease. when the fixed costs decrease. decreases Now, compare the impac rice, variable costs, and fixed costs on the breakeven point in units. does not change The breakeven point sales price decreases. The breakeven point when the variable increases costs decrease. The brea when fixed costs decrease. i Requirements 1. For each of the following independent situations, calculate the contribution margin per unit and the breakeven point in units by first referring to the original data provided: . Breakeven point with no change in information. b. Decrease sales price to $400 per student. . Decrease variable costs to $80 per student. d. Decrease fixed costs to $123,200. 2. Compare the impact of changes in the sales price, variable costs, and fixed costs on the contribution margin per unit and the breakeven point in units. Print Done Highway Driving School charges $800 per student to prepare and administer written and driving tests. Variable costs of $240 per student include trainers' wages, study materials, and gasoline. Annual fixed costs of $151,200 include the training facility and fleet of cars. Read the requirements. Requirement 1. For each of the following independent situations, calculate the contribution margin per unit and the breakeven point in units: Begin by showing the formula for contribution margin per unit and then enter the amounts to calculate the contribution margin per unit for each situation. (Abbreviation used: CM = contribution margin.) CM per unit %3D Situation a. Situation b. Situation c. Situation d. II || I| II Requirement 1. For each of the following independent situations, calculate the contribution margin per unit and the breakeven point in units: Begin by showing the formula for contribution margin per unit and then enter the amounts to calculate the contribution margin per unit for each situation. (Abbreviation used: CM = contribution margin.) CM per unit Situation a. Fixed costs Situation b. Net sales revenue per unit Situation c. Operating income Situation d. Total variable cost Variable costs per unit Now select the lal keven point in units and then enter the amounts to calculate the breakeven point in units for each situation, (Complete all answer boxes, Abbreviation used: CM = contribution margin.) II II I| II Now select the labels to show the formula for breakeven point in units and then enter the amounts to calculate the breakeven point in units for each situation. (Complete all answer boxes. Abbreviation used: CM = contribution margin.) + Required sales in units %3D Situation a. + %3D Situation b. + Situation c. Situation d. + II II || + Now select the labels to show the formula for breakeven point in units and then enter the amounts to calculate the breakeven point in units for each situation. (Complete all answer boxes. Abbreviation used: CM = contribution margin.) Required sales in units %3D Situation a. %3D CM per unit ( CM ratio ( Situation b. Situation c. Fixed costs Situation d. ( Variable costs Requirement 2. Compare the impact of changes in the sales price, variable costs, and fixed costs on the contribution margin per unit and the breakeven point in units. First, compare the impact of changes in the sales price, variable costs, and fixed costs on the contribution margin per unit. The contribution margin when the sales price decreases. The contribution margin when variable costs decrease. The contribution margin when the fixed costs decrease. Now, compare the impact of changes in the sales price, variable costs, and fixed costs on the breakeven point in units. The breakeven point when the sales price decreases. The breakeven point when the variable costs decrease. The breakeven point when fixed costs decrease. Choose from any list or enter any number in the input fields and then continue to the next question. Requirement 2. Compare the impact of changes in the sales price, variable costs, and fixed costs on the contribution margin per unit and the breakeven point in units. First, compare the impact of changes in the sales price, variable costs, and fixed costs on the contribution margin per unit. The contribution margin when the sales price decreases. The contribution margin when variable costs decrease. when the fixed costs decrease. decreases Now, compare the impac rice, variable costs, and fixed costs on the breakeven point in units. does not change The breakeven point sales price decreases. The breakeven point when the variable increases costs decrease. The brea when fixed costs decrease. i Requirements 1. For each of the following independent situations, calculate the contribution margin per unit and the breakeven point in units by first referring to the original data provided: . Breakeven point with no change in information. b. Decrease sales price to $400 per student. . Decrease variable costs to $80 per student. d. Decrease fixed costs to $123,200. 2. Compare the impact of changes in the sales price, variable costs, and fixed costs on the contribution margin per unit and the breakeven point in units. Print Done Highway Driving School charges $800 per student to prepare and administer written and driving tests. Variable costs of $240 per student include trainers' wages, study materials, and gasoline. Annual fixed costs of $151,200 include the training facility and fleet of cars. Read the requirements. Requirement 1. For each of the following independent situations, calculate the contribution margin per unit and the breakeven point in units: Begin by showing the formula for contribution margin per unit and then enter the amounts to calculate the contribution margin per unit for each situation. (Abbreviation used: CM = contribution margin.) CM per unit %3D Situation a. Situation b. Situation c. Situation d. II || I| II Requirement 1. For each of the following independent situations, calculate the contribution margin per unit and the breakeven point in units: Begin by showing the formula for contribution margin per unit and then enter the amounts to calculate the contribution margin per unit for each situation. (Abbreviation used: CM = contribution margin.) CM per unit Situation a. Fixed costs Situation b. Net sales revenue per unit Situation c. Operating income Situation d. Total variable cost Variable costs per unit Now select the lal keven point in units and then enter the amounts to calculate the breakeven point in units for each situation, (Complete all answer boxes, Abbreviation used: CM = contribution margin.) II II I| II Now select the labels to show the formula for breakeven point in units and then enter the amounts to calculate the breakeven point in units for each situation. (Complete all answer boxes. Abbreviation used: CM = contribution margin.) + Required sales in units %3D Situation a. + %3D Situation b. + Situation c. Situation d. + II II || + Now select the labels to show the formula for breakeven point in units and then enter the amounts to calculate the breakeven point in units for each situation. (Complete all answer boxes. Abbreviation used: CM = contribution margin.) Required sales in units %3D Situation a. %3D CM per unit ( CM ratio ( Situation b. Situation c. Fixed costs Situation d. ( Variable costs Requirement 2. Compare the impact of changes in the sales price, variable costs, and fixed costs on the contribution margin per unit and the breakeven point in units. First, compare the impact of changes in the sales price, variable costs, and fixed costs on the contribution margin per unit. The contribution margin when the sales price decreases. The contribution margin when variable costs decrease. The contribution margin when the fixed costs decrease. Now, compare the impact of changes in the sales price, variable costs, and fixed costs on the breakeven point in units. The breakeven point when the sales price decreases. The breakeven point when the variable costs decrease. The breakeven point when fixed costs decrease. Choose from any list or enter any number in the input fields and then continue to the next question. Requirement 2. Compare the impact of changes in the sales price, variable costs, and fixed costs on the contribution margin per unit and the breakeven point in units. First, compare the impact of changes in the sales price, variable costs, and fixed costs on the contribution margin per unit. The contribution margin when the sales price decreases. The contribution margin when variable costs decrease. when the fixed costs decrease. decreases Now, compare the impac rice, variable costs, and fixed costs on the breakeven point in units. does not change The breakeven point sales price decreases. The breakeven point when the variable increases costs decrease. The brea when fixed costs decrease. i Requirements 1. For each of the following independent situations, calculate the contribution margin per unit and the breakeven point in units by first referring to the original data provided: . Breakeven point with no change in information. b. Decrease sales price to $400 per student. . Decrease variable costs to $80 per student. d. Decrease fixed costs to $123,200. 2. Compare the impact of changes in the sales price, variable costs, and fixed costs on the contribution margin per unit and the breakeven point in units. Print Done

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Net Sales Revenue per unit Variable ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started