Answered step by step

Verified Expert Solution

Question

1 Approved Answer

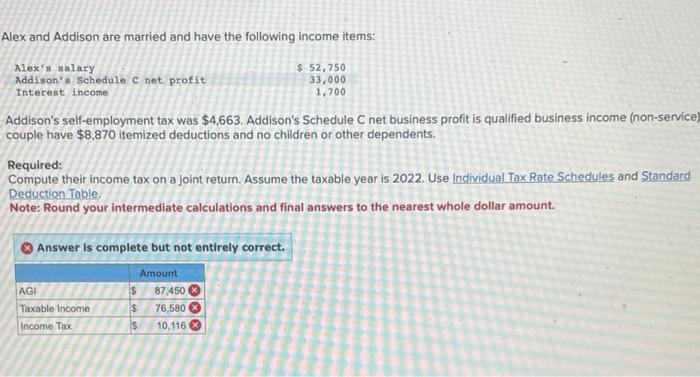

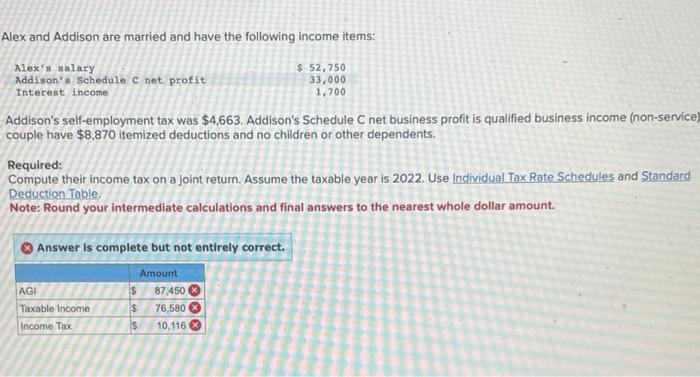

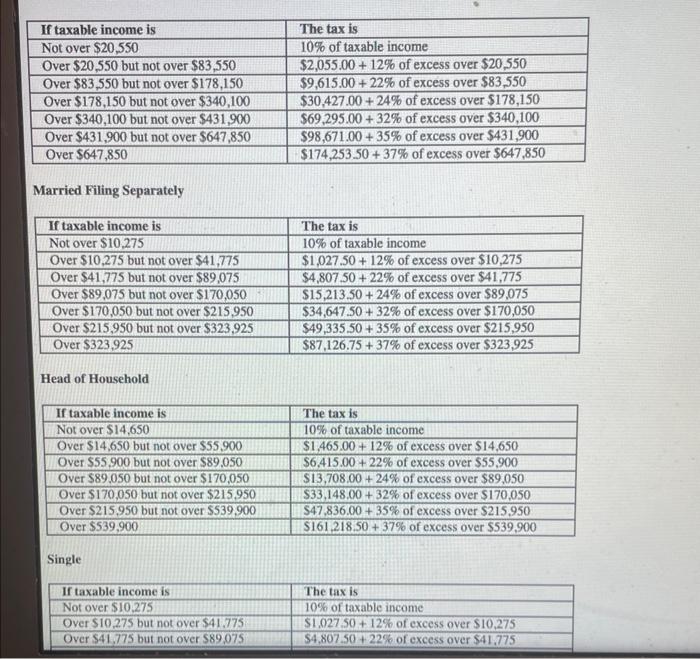

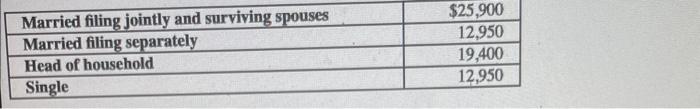

Question: individual tax rate schedules: standard deduction table: Alex and Addison are married and have the following income items: Addison's self-employment tax was $4,663. Addison's

Question:

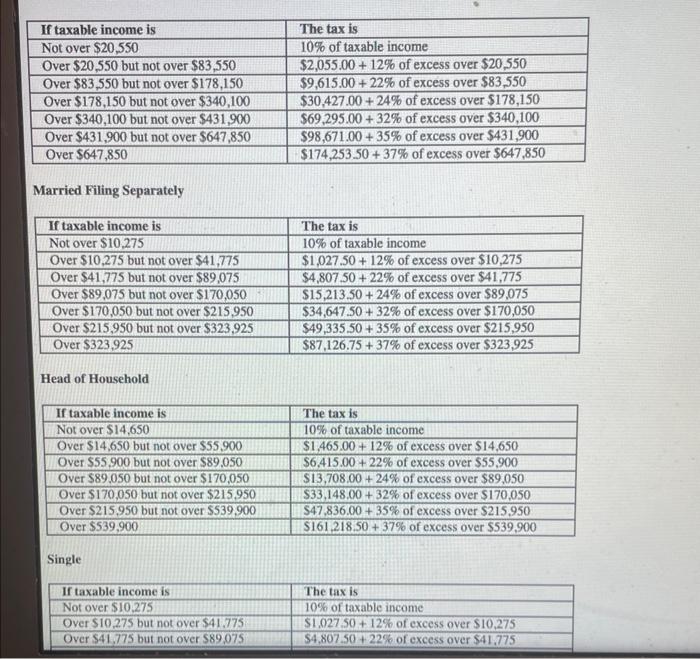

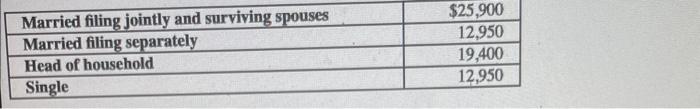

Alex and Addison are married and have the following income items: Addison's self-employment tax was $4,663. Addison's Schedule C net business profit is qualified business income (non-service, couple have $8,870 itemized deductions and no children or other dependents. Required: Compute their income tax on a joint return. Assume the taxable year is 2022. Use Individual Tax Rate Schedules and Standard Deduction Table. Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. Answer is complete but not entirely correct. Married Filing Separately Head of Household Single \begin{tabular}{|l|r|} \hline Married filing jointly and surviving spouses & $25,900 \\ \hline Married filing separately & 12,950 \\ \hline Head of household & 19,400 \\ \hline Single & 12,950 \\ \hline \end{tabular}

individual tax rate schedules:

standard deduction table:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started