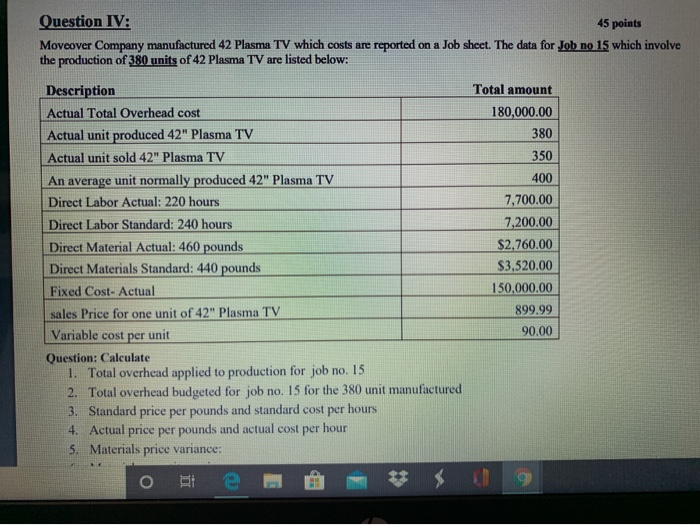

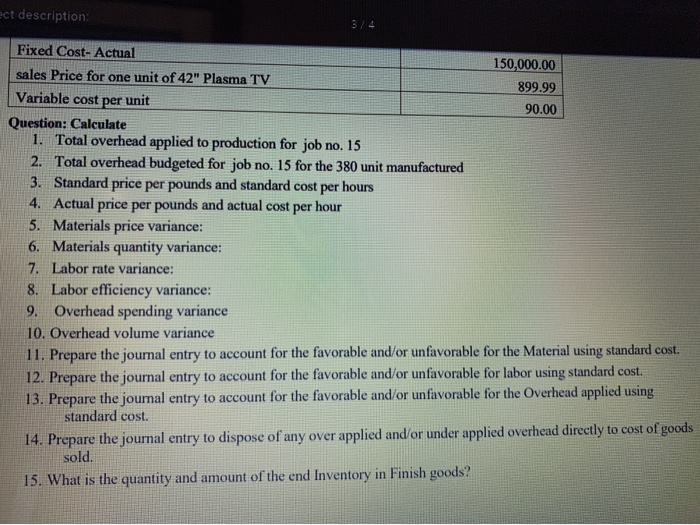

Question IV: 45 points Moveover Company manufactured 42 Plasma TV which costs are reported on a Job sheet. The data for Job no 15 which involve the production of 380 units of 42 Plasma TV are listed below: Description Total amount Actual Total Overhead cost 180,000.00 Actual unit produced 42" Plasma TV 380 Actual unit sold 42" Plasma TV 350 An average unit normally produced 42" Plasma TV 400 Direct Labor Actual: 220 hours 7,700.00 Direct Labor Standard: 240 hours 7,200.00 Direct Material Actual: 460 pounds $2,760.00 Direct Materials Standard: 440 pounds $3,520.00 Fixed Cost- Actual 150,000.00 sales Price for one unit of 42" Plasma TV 899.99 Variable cost per unit 90.00 Question: Calculate 1. Total overhead applied to production for job no. 15 2. Total overhead budgeted for job no. 15 for the 380 unit manufactured 3. Standard price per pounds and standard cost per hours 4. Actual price per pounds and actual cost per hour 5. Materials price variance: OBI ect description: 3/4 Fixed Cost- Actual 150,000.00 sales Price for one unit of 42" Plasma TV 899.99 Variable cost per unit 90.00 Question: Calculate 1. Total overhead applied to production for job no. 15 2. Total overhead budgeted for job no. 15 for the 380 unit manufactured 3. Standard price per pounds and standard cost per hours 4. Actual price per pounds and actual cost per hour 5. Materials price variance: 6. Materials quantity variance: 7. Labor rate variance: 8. Labor efficiency variance: 9. Overhead spending variance 10. Overhead volume variance 11. Prepare the journal entry to account for the favorable and/or unfavorable for the Material using standard cost. 12. Prepare the journal entry to account for the favorable and/or unfavorable for labor using standard cost. 13. Prepare the journal entry to account for the favorable and/or unfavorable for the Overhead applied using standard cost. 14. Prepare the journal entry to dispose of any over applied and/or under applied overhead directly to cost of goods sold. 15. What is the quantity and amount of the end Inventory in Finish goods