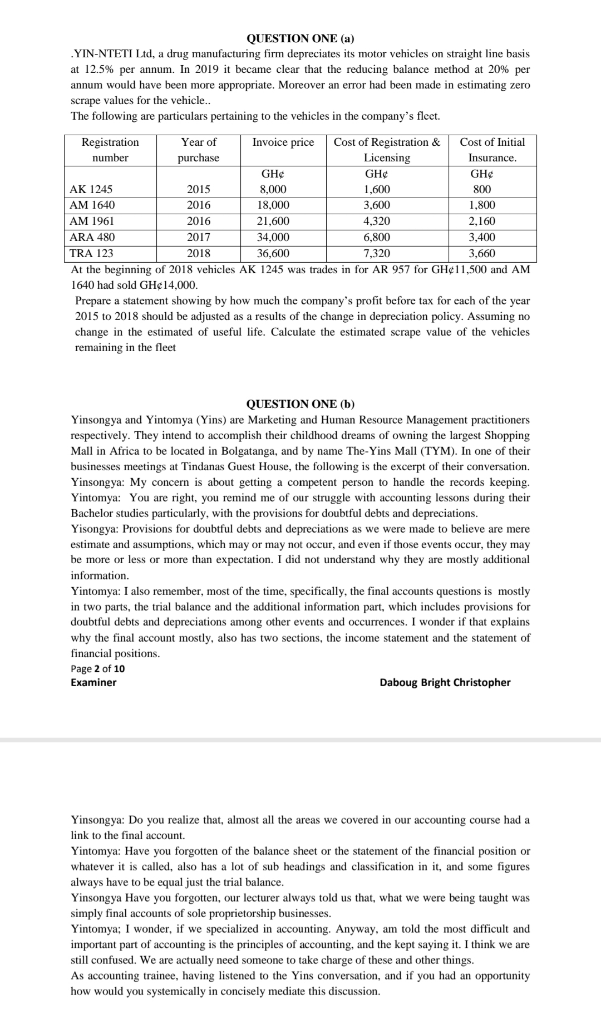

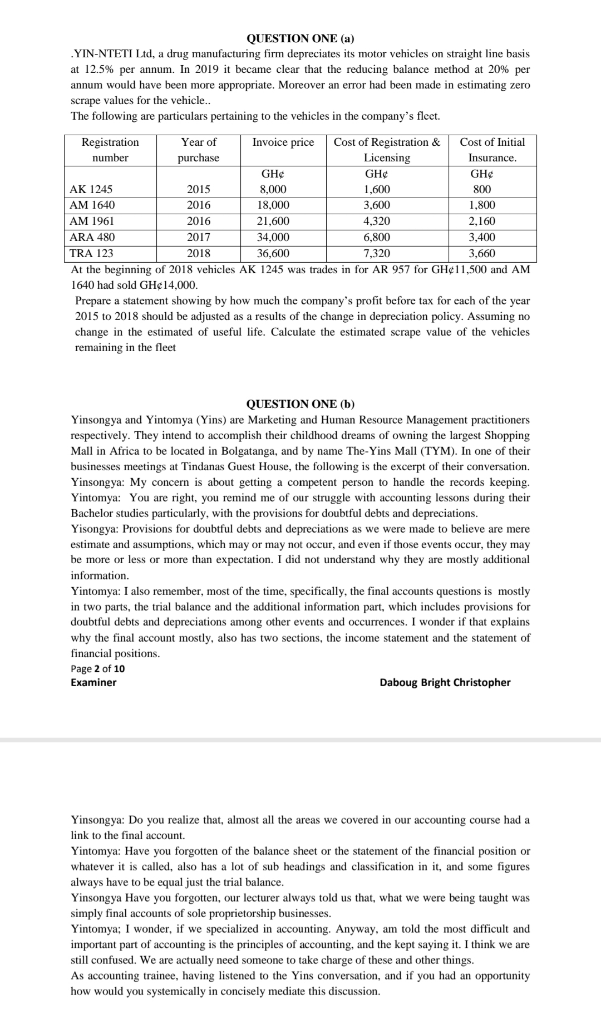

QUESTION ONE (a) .YIN-NTETI Ltd, a drug manufacturing firm depreciates its motor vehicles on straight line basis at 12.5% per annum. In 2019 it became clear that the reducing balance method at 20% per annum would have been more appropriate. Moreover an error had been made in estimating zero scrape values for the vehicle.. The following are particulars pertaining to the vehicles in the company's flect. Registration Year of Invoice price Cost of Registration & Cost of Initial number purchase Licensing Insurance. GHS GH GH AK 1245 2015 8,000 1,600 800 AM 1640 2016 18.000 3,600 1,800 AM 1961 2016 21.600 4,320 2,160 ARA 480 2017 34.000 6.800 3,400 TRA 123 2018 36,600 7,320 3,660 At the beginning of 2018 vehicles AK 1245 was trades in for AR 957 for GH11,500 and AM 1640 had sold GH14,000. Prepare a statement showing by how much the company's profit before tax for each of the year 2015 to 2018 should be adjusted as a results of the change in depreciation policy. Assuming no change in the estimated of useful life. Calculate the estimated scrape value of the vehicles remaining in the fleet QUESTION ONE (b) Yinsongya and Yintomya (Yins) are Marketing and Human Resource Management practitioners respectively. They intend to accomplish their childhood dreams owning the largest Shopping Mall in Africa to be located in Bolgatanga, and by name The-Yins Mall (TYM). In one of their businesses meetings at Tindanas Guest House, the following is the excerpt of their conversation. Yinsongya: My concern is about getting a competent person to handle the records keeping. Yintomya: You are right you remind me of our struggle with accounting lessons during their Bachelor studies particularly, with the provisions for doubtful debts and depreciations. Yisongya: Provisions for doubtful debts and depreciations as we were made to believe are mere estimate and assumptions, which may may not occur, and even if those events occur, they may be more or less or more than expectation. I did not understand why they are mostly additional information Yintomya: I also remember, most of the time, specifically, the final accounts questions is mostly in two parts, the trial balance and the additional information part, which includes provisions for doubtful debts and depreciations among other events and occurrences. I wonder if that explains why the final account mostly, also has two sections, the income statement and the statement of financial positions. Page 2 of 10 Examiner Daboug Bright Christopher Yinsongya: Do you realize that, almost all the areas we covered in our accounting course had a link to the final account. Yintomya: Have you forgotten of the balance sheet or the statement of the financial position or whatever it is called, also has a lot of sub headings and classification in it, and some figures always have to be equal just the trial balance. Yinsongya Have you forgotten, our lecturer always told us that, what we were being taught was simply final accounts of sole proprietorship businesses. Yintomya; I wonder, if we specialized in accounting. Anyway, am told the most difficult and important part of accounting is the principles of accounting, and the kept saying it. I think we are still confused. We are actually need someone to take charge of these and other things. As accounting trainee, having listened to the Yins conversation, and if you had an opportunity how would you systemically in concisely mediate this discussion. QUESTION ONE (a) .YIN-NTETI Ltd, a drug manufacturing firm depreciates its motor vehicles on straight line basis at 12.5% per annum. In 2019 it became clear that the reducing balance method at 20% per annum would have been more appropriate. Moreover an error had been made in estimating zero scrape values for the vehicle.. The following are particulars pertaining to the vehicles in the company's flect. Registration Year of Invoice price Cost of Registration & Cost of Initial number purchase Licensing Insurance. GHS GH GH AK 1245 2015 8,000 1,600 800 AM 1640 2016 18.000 3,600 1,800 AM 1961 2016 21.600 4,320 2,160 ARA 480 2017 34.000 6.800 3,400 TRA 123 2018 36,600 7,320 3,660 At the beginning of 2018 vehicles AK 1245 was trades in for AR 957 for GH11,500 and AM 1640 had sold GH14,000. Prepare a statement showing by how much the company's profit before tax for each of the year 2015 to 2018 should be adjusted as a results of the change in depreciation policy. Assuming no change in the estimated of useful life. Calculate the estimated scrape value of the vehicles remaining in the fleet QUESTION ONE (b) Yinsongya and Yintomya (Yins) are Marketing and Human Resource Management practitioners respectively. They intend to accomplish their childhood dreams owning the largest Shopping Mall in Africa to be located in Bolgatanga, and by name The-Yins Mall (TYM). In one of their businesses meetings at Tindanas Guest House, the following is the excerpt of their conversation. Yinsongya: My concern is about getting a competent person to handle the records keeping. Yintomya: You are right you remind me of our struggle with accounting lessons during their Bachelor studies particularly, with the provisions for doubtful debts and depreciations. Yisongya: Provisions for doubtful debts and depreciations as we were made to believe are mere estimate and assumptions, which may may not occur, and even if those events occur, they may be more or less or more than expectation. I did not understand why they are mostly additional information Yintomya: I also remember, most of the time, specifically, the final accounts questions is mostly in two parts, the trial balance and the additional information part, which includes provisions for doubtful debts and depreciations among other events and occurrences. I wonder if that explains why the final account mostly, also has two sections, the income statement and the statement of financial positions. Page 2 of 10 Examiner Daboug Bright Christopher Yinsongya: Do you realize that, almost all the areas we covered in our accounting course had a link to the final account. Yintomya: Have you forgotten of the balance sheet or the statement of the financial position or whatever it is called, also has a lot of sub headings and classification in it, and some figures always have to be equal just the trial balance. Yinsongya Have you forgotten, our lecturer always told us that, what we were being taught was simply final accounts of sole proprietorship businesses. Yintomya; I wonder, if we specialized in accounting. Anyway, am told the most difficult and important part of accounting is the principles of accounting, and the kept saying it. I think we are still confused. We are actually need someone to take charge of these and other things. As accounting trainee, having listened to the Yins conversation, and if you had an opportunity how would you systemically in concisely mediate this discussion