Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question1 The aggregate supply curve is often drawn with three ranges as real gross domestic product (GDP) increases. These are (A) The Keynesian, the Laffer,

Question1 The aggregate supply curve is often drawn with three ranges as real gross domestic product (GDP) increases. These are (A) The Keynesian, the Laffer, and the classical ranges (B) The Keynesian, the Monetarist, and the classical ranges (C) The Keynesian, the intermediate, and the classical ranges (D) The Keynesian, the Randian, and the classical ranges (E) The Friedman, the intermediate, and the Smithian ranges

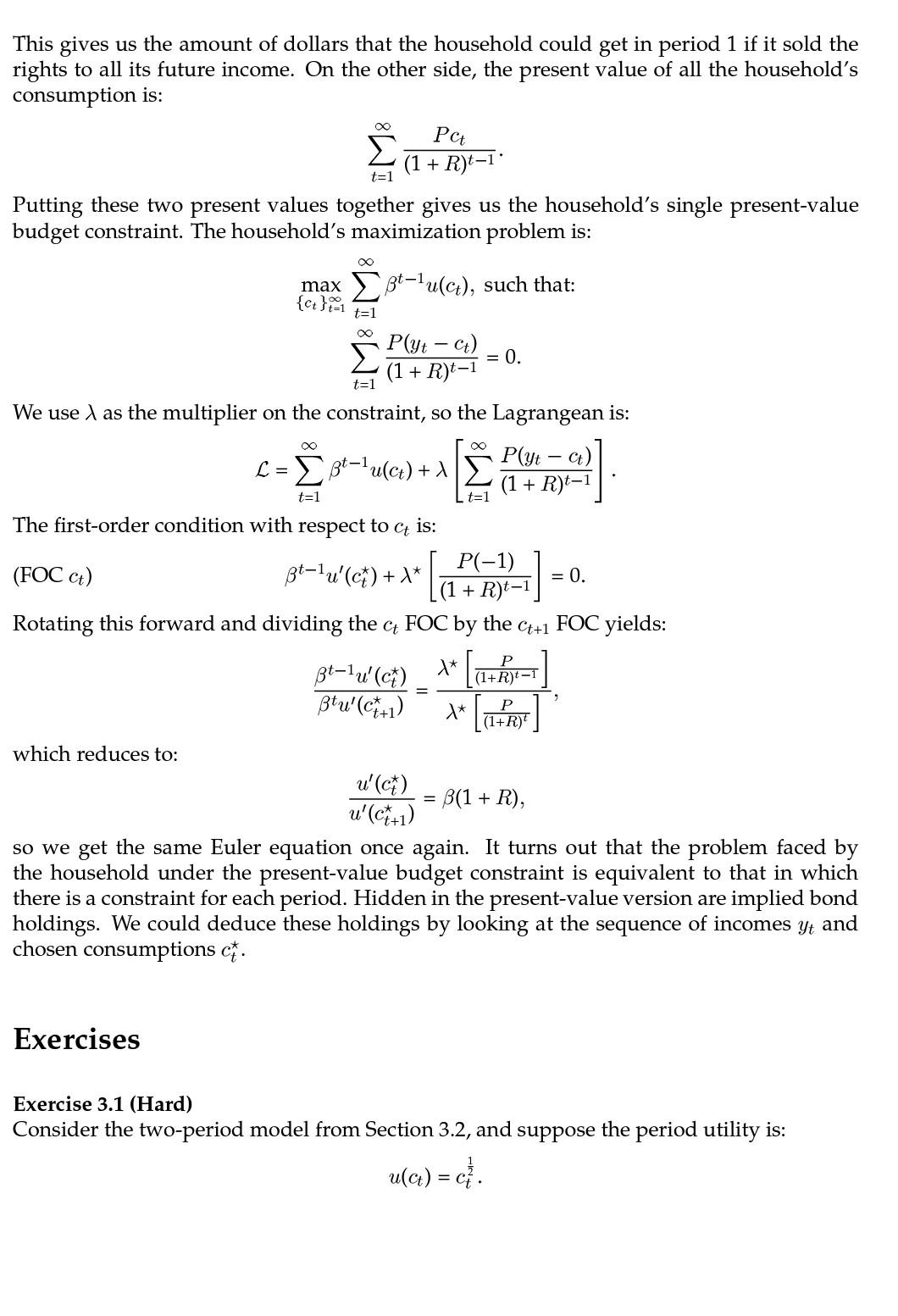

This gives us the amount of dollars that the household could get in period 1 if it sold the rights to all its future income. On the other side, the present value of all the household's consumption is: ct (1 + R)-1 Putting these two present values together gives us the household's single present-value budget constraint. The household's maximization problem is: max {cto 86-1u(c), such that: t=1 P(yt - ct) = 0. (1 + R)-1 t=1 c- ***** + t-1 t=1 t=1 We use , as the multiplier on the constraint, so the Lagrangean is: P(yt ct) ' -'u(ca) + (1 + R)- The first-order condition with respect to ct is: P(-1) (FOC ct) ft-lu' (C7) + 1* = 0. (1 + R)t-1 Rotating this forward and dividing the FOC by the Ct+1 FOC yields: P ft-lu' (07) * (1+R) - Btu'(C++1) 1* (1+R) U (10 ) = 9 which reduces to: u' (c7) = B(1 + R), u' (CT+1) so we get the same Euler equation once again. It turns out that the problem faced by the household under the present-value budget constraint is equivalent to that in which there is a constraint for each period. Hidden in the present-value version are implied bond holdings. We could deduce these holdings by looking at the sequence of incomes yt and chosen consumptions c. Exercises Exercise 3.1 (Hard) Consider the two-period model from Section 3.2, and suppose the period utility is: u(at) = c. = The version of the model in which the representative household lives for an infinite number of periods is similar to the two-period model from the previous section. The utility of the household is now: U(C1,C2, ...) = u(ci) + Bu(c2) + B2u(cz) + .... In each period t, the household faces a budget constraint: Pyt + bt-1(1 + R) = Pc + bt. Since the household lives for all t 1,2, ..., there are infinitely many of these budget constraints. The household chooses ct and bt in each period, so there are infinitely many choice variables and infinitely many first-order conditions. This may seem disconcerting, but don't let it intimidate you. It all works out rather nicely. We write out the maximization problem in condensed form as follows: = t=1 max Bt-lu(ct), such that: {Ct,bt}ia1 Pyt + bt-1(1 + R) = Pc+ bt, Vt e {1,2,...}. The "V" symbol means "for all, so the last part of the constraint line reads as "for all t in the set of positive integers". To make the Lagrangean, we follow the rules outlined on page 15. In each time period t, the household has a budget constraint that gets a Lagrange multiplier it. The only trick is that we use summation notation to handle all the constraints: L= 3t-Tuct) + 4 [Pyt + bt-1(1 + R) PQ by]. = t=1 t=1 Now we are ready to take first-order conditions. Since there are infinitely many of them, we have no hope of writing them all out one by one. Instead, we just write the FOCs for period-t variables. The ct FOC is pretty easy: aL (FOC C) ft-lu' (C1) + [-P] = 0. act Again, we use starred variables in first-order conditions because these equations hold only for the optimal values of these variables. The first-order condition for bt is harder because there are two terms in the summation that have bt in them. Consider b2. It appears in the t = 2 budget constraint as bt, but it also appears in the t = 3 budget constraint as bt-1. This leads to the t + 1 term below: aL (FOC bt) = \ [-1] + 1+1 [(1 + R)] = 0. abt =Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started