Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question3 (4+2+4) a. AKIJFOODS growth rate is 14 percent for first 2 years, growth rate assumed 12 percent up to year 5 and after that

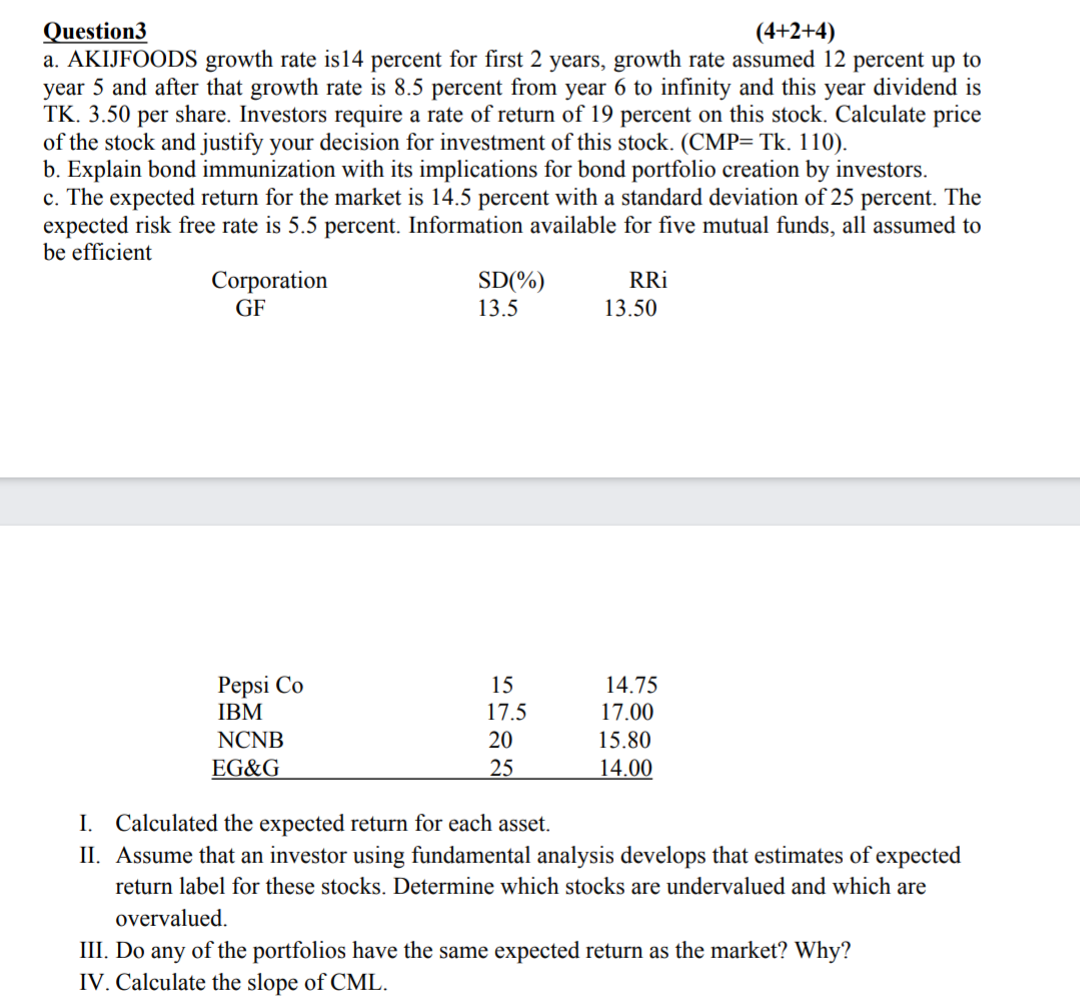

Question3 (4+2+4) a. AKIJFOODS growth rate is 14 percent for first 2 years, growth rate assumed 12 percent up to year 5 and after that growth rate is 8.5 percent from year 6 to infinity and this year dividend is TK. 3.50 per share. Investors require a rate of return of 19 percent on this stock. Calculate price of the stock and justify your decision for investment of this stock. (CMP= Tk. 110). b. Explain bond immunization with its implications for bond portfolio creation by investors. c. The expected return for the market is 14.5 percent with a standard deviation of 25 percent. The expected risk free rate is 5.5 percent. Information available for five mutual funds, all assumed to be efficient Corporation SD(%) RRi GF 13.5 13.50 Pepsi Co IBM NCNB EG&G 15 17.5 20 25 14.75 17.00 15.80 14.00 I. Calculated the expected return for each asset. II. Assume that an investor using fundamental analysis develops that estimates of expected return label for these stocks. Determine which stocks are undervalued and which are overvalued. III. Do any of the portfolios have the same expected return as the market? Why? IV. Calculate the slope of CML. Question3 (4+2+4) a. AKIJFOODS growth rate is 14 percent for first 2 years, growth rate assumed 12 percent up to year 5 and after that growth rate is 8.5 percent from year 6 to infinity and this year dividend is TK. 3.50 per share. Investors require a rate of return of 19 percent on this stock. Calculate price of the stock and justify your decision for investment of this stock. (CMP= Tk. 110). b. Explain bond immunization with its implications for bond portfolio creation by investors. c. The expected return for the market is 14.5 percent with a standard deviation of 25 percent. The expected risk free rate is 5.5 percent. Information available for five mutual funds, all assumed to be efficient Corporation SD(%) RRi GF 13.5 13.50 Pepsi Co IBM NCNB EG&G 15 17.5 20 25 14.75 17.00 15.80 14.00 I. Calculated the expected return for each asset. II. Assume that an investor using fundamental analysis develops that estimates of expected return label for these stocks. Determine which stocks are undervalued and which are overvalued. III. Do any of the portfolios have the same expected return as the market? Why? IV. Calculate the slope of CML

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started