Answered step by step

Verified Expert Solution

Question

1 Approved Answer

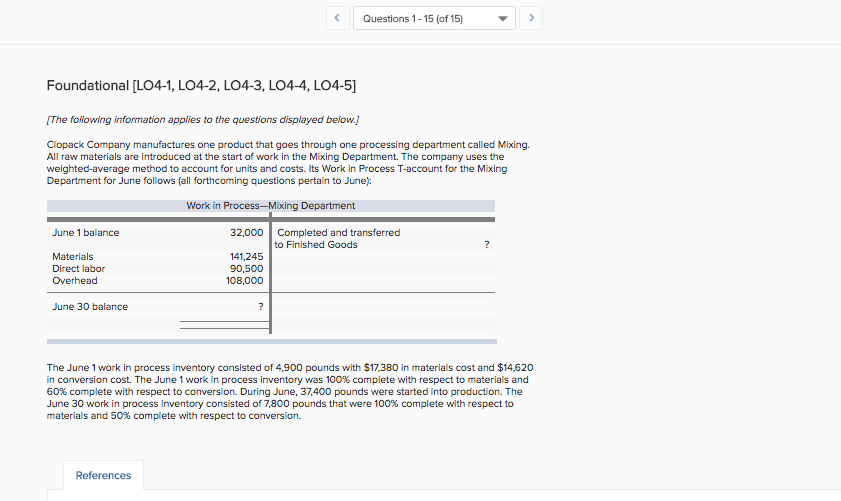

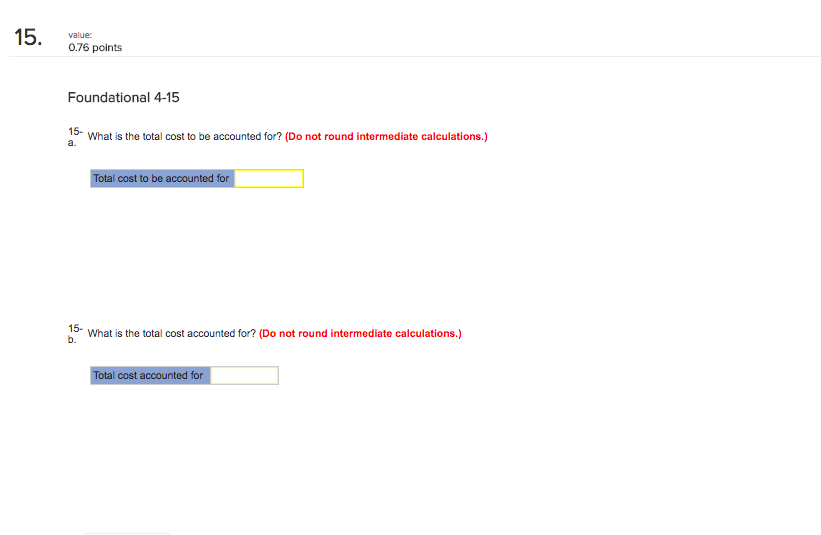

Questions 1-15 (of 150 v Foundational L 4-1, LO4-2, LO4-3, LO4-4, LO4-5] IThe following information applies to the questions displayed below Clopack Company manufactures one

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started