Answered step by step

Verified Expert Solution

Question

1 Approved Answer

questions 17-20 please 17. If your broker buys a stock for you on the NASDAQ, you are trading on the A. Primary market B. Secondary

questions 17-20 please

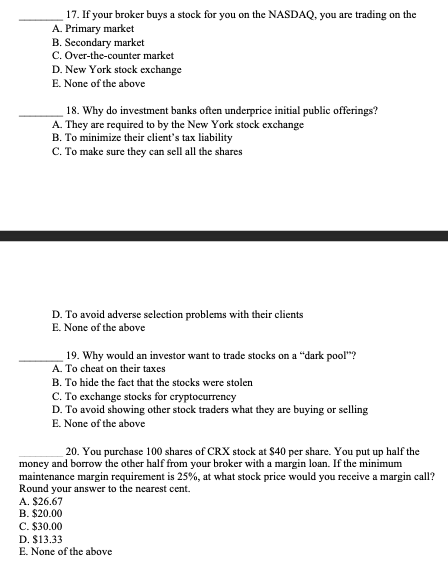

17. If your broker buys a stock for you on the NASDAQ, you are trading on the A. Primary market B. Secondary market C. Over-the-counter market D. New York stock exchange E. None of the above 18. Why do investment banks often underprice initial public offerings? A. They are required to by the New York stock exchange B. To minimize their client's tax liability C. To make sure they can sell all the shares D. To avoid adverse selection problems with their clients E. None of the above 19. Why would an investor want to trade stocks on a dark pool? A. To cheat on their taxes B. To hide the fact that the stocks were stolen C. To exchange stocks for cryptocurrency D. To avoid showing other stock traders what they are buying or selling E. None of the above 20. You purchase 100 shares of CRX stock at $40 per share. You put up half the money and borrow the other half from your broker with a margin loan. If the minimum maintenance margin requirement is 25%, at what stock price would you receive a margin call? Round your answer to the nearest cent. A. $26.67 B. $20.00 C. $30.00 D. $13.33 E. None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started