Questions 64 & 65. Thank you!

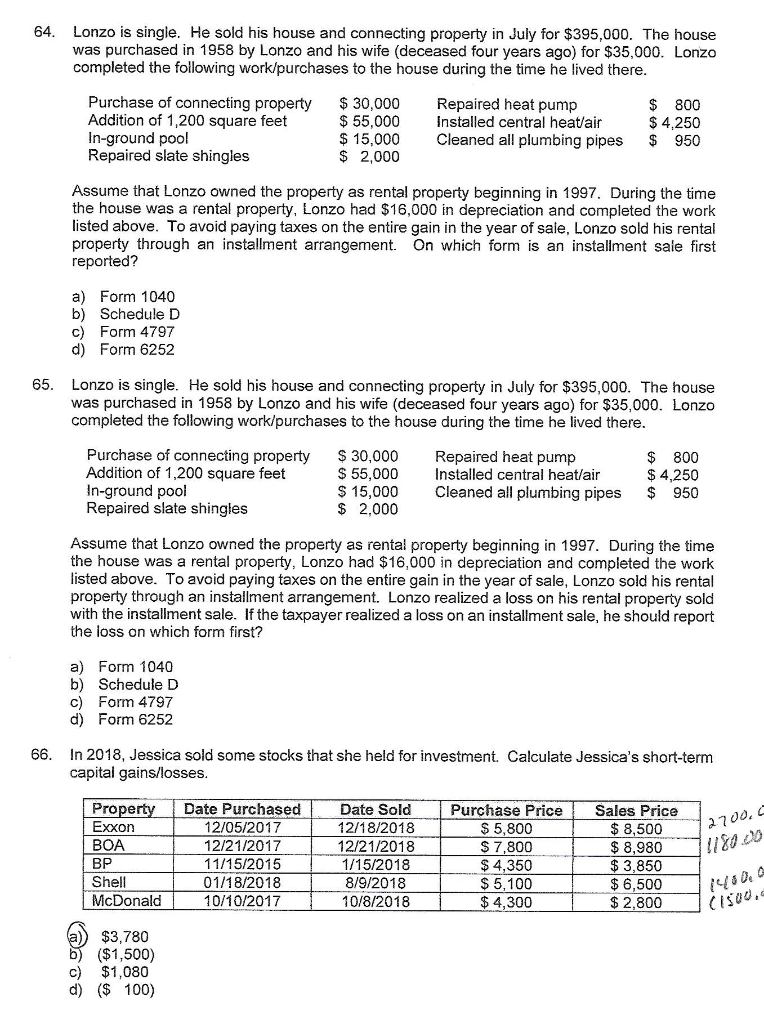

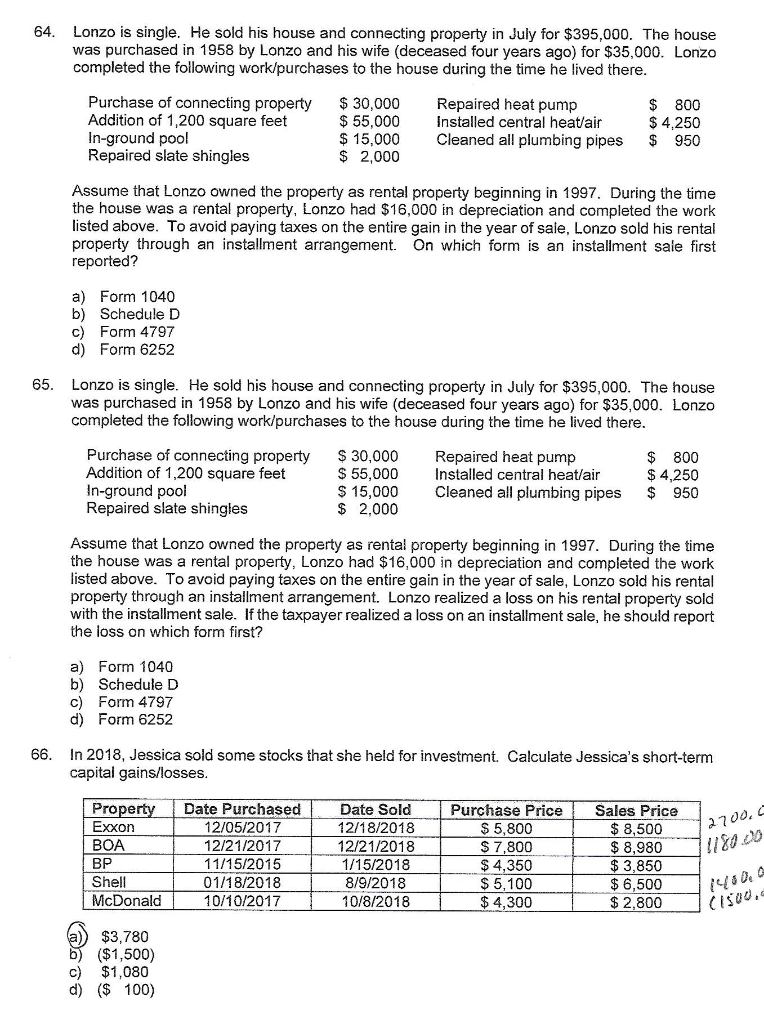

64. Lonzo is single. He sold his house and connecting property in July for $395,000. The house was purchased in 1958 by Lonzo and his wife (deceased four years ago) for $35,000. Lonzo completed the following work/purchases to the house during the time he lived there. Purchase of connecting property Addition of 1,200 square feet In-ground pool Repaired slate shingles $ 30,000 $ 55,000 $ 15,000 $ 2,000 Repaired heat pump Installed central heat/air Cleaned all plumbing pipes $ 800 $4,250 $ 950 Assume that Lonzo owned the property as rental property beginning in 1997. During the time the house was a rental property, Lonzo had $16,000 in depreciation and completed the work listed above. To avoid paying taxes on the entire gain in the year of sale, Lonzo sold his rental property through an installment arrangement. On which form is an installment sale first reported? a) Form 1040 b) Schedule D c) Form 4797 d) Form 6252 65. Lonzo is single. He sold his house and connecting property in July for $395,000. The house was purchased in 1958 by Lonzo and his wife (deceased four years ago) for $35,000. Lonzo completed the following work/purchases to the house during the time he lived there. Purchase of connecting property Addition of 1,200 square feet In-ground pool Repaired slate shingles $ 30,000 $ 55,000 $ 15,000 $ 2,000 Repaired heat pump Installed central heat/air Cleaned all plumbing pipes $ 800 $ 4,250 $ 950 Assume that Lonzo owned the property as rental property beginning in 1997. During the time the house was a rental property, Lonzo had $16,000 in depreciation and completed the work listed above. To avoid paying taxes on the entire gain in the year of sale, Lonzo sold his rental property through an installment arrangement. Lonzo realized a loss on his rental property sold with the installment sale. If the taxpayer realized a loss on an installment sale, he should report the loss on which form first? a) Form 1040 b) Schedule D c) Form 4797 d) Form 6252 66. In 2018, Jessica sold some stocks that she held for investment Calculate Jessica's short-term capital gains/losses. 200. Property Exxon BOA BP Shell McDonald Date Purchased 12/05/2017 12/21/2017 11/15/2015 01/18/2018 10/10/2017 Date Sold 12/18/2018 12/21/2018 1/15/2018 8/9/2018 10/8/2018 Purchase Price $ 5,800 $ 7,800 $ 4,350 $ 5,100 $ 4,300 Sales Price $ 8,500 $ 8,980 $ 3,850 $ 6,500 $ 2,800 1180.00 1 500. a) $3,780 b) ($1,500) c) $1,080 d) ($ 100)