Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions: Just A, B, and C Case 2 Pleasant Pasta Overview Pleasant Pasta (the Company) was the largest dry pasta producer in North America. As

Questions: Just A, B, and C

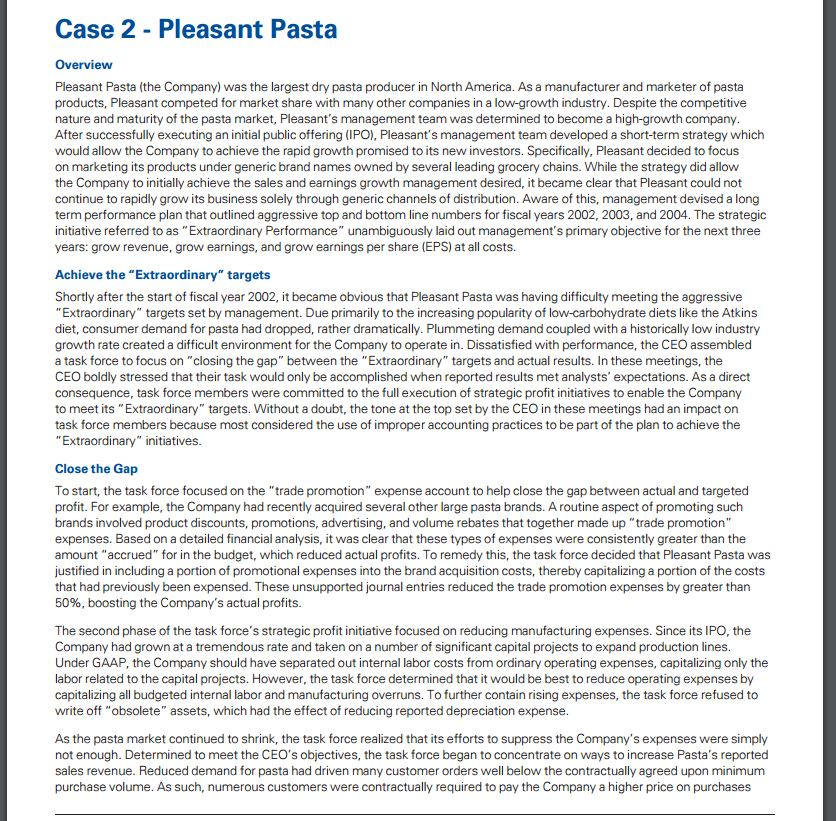

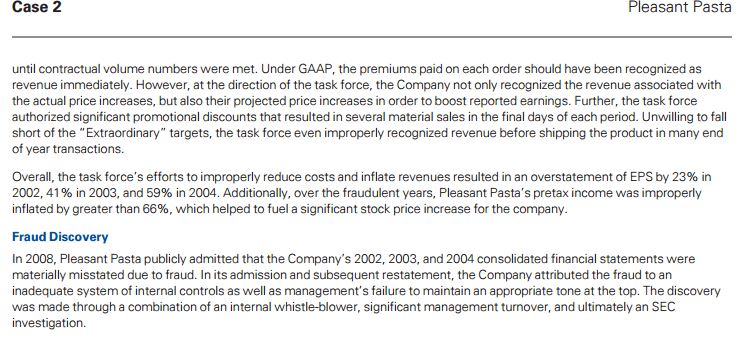

Case 2 Pleasant Pasta Overview Pleasant Pasta (the Company) was the largest dry pasta producer in North America. As a manufacturer and marketer of pasta Pleasant competed for market share with many other companies in a low-growth industry. Despite the competitive products, nature and maturi of the pasta market, Pleasant's management team was determined to become a high-growth company. After successfully executing an initial public offering (IPO), Pleasant's management team developed a short-term strategy which would allow the Company to achieve the rapid growth promised to its new investors. Specifically, Pleasant decided to focus on marketing its products under generic brand names owned by several leading grocery chains. While the strategy did allow the Company to initially achieve the sales and earnings growth management desired, itbecame clear that Pleasant could not continue to rapidly grow its business solely through generic channels of distribution. Aware of this, management devised a long term performance plan that outlined aggressive top and bottom line numbers for fiscal years 2002, 2003, and 2004. The strategic initiative referred to as "Extraordinary Performance" unambiguously laid out management's primary objective for the next three years: grow revenue, grow earnings, and grow earnings per share (EPS) at all costs Achieve the "Extraordinary" targets Shortly after the startof fiscal year 2002, it became obvious that Pleasant Pasta was having difficulty meeting the aggressive Extraordinary" targets set by management. Due primarily to the increasing popularity of low-carbohydrate diets like the Atkins diet, consumer demand for pasta had dropped, rather dramatically. Plummeting demand coupled with a historically low industry growth rate created a difficult environment for the Company to operate in. Dissatisfied with performance, the CEO assembled a task force to focus on closing the gap" between the "Extraordinary" targets and actual results. In these meetings, the CEO boldly stressed that their task would only be accomplished when reported results met analysts' expectations As a direct sequence, task force members were committed t the full execution of strategic profitinitiatives to enable the Company xtraordinary" targets. Without a doubt, the tone at the top set by the CEO in these meetings had an impact on to meet its task force members because most considered the use of improper accounting practices to be part of the plan to achieve the Extraordinary" initiatives Close the Gap To start, the task force focused on the "trade promotion" expense account to help close the gap between actual and targeted profit. For example, the Company had recently acquired several other large pasta brands. Aroutine aspect of promoting such brands involved product discounts, promotions, advertising, and volume rebates that together made u "trade promotion expenses. Based on a detailed financial analysis, it was clear that these types of expenses were consistently greater than the amount "accrued" for in the budget, which reduced actual profits. To remedy this, the task force decided that Pleasant Pasta was justified in including a portion of promotional expenses into the brandacquisition costs, thereby capitalizing a portion of the costs that had previously been expensed. These unsupported journal entries reduced the trade promotion expenses by greater than 50%, boosting the Company's actual profits The second phase of the task force's strategic profit initiative focused on reducing manufacturing expenses. Since its lPO, the Company had grown at a tremendous rate and taken on a number of significant capital projects to expand production lines Under GAAP, the Company should have separated out internal labor costs from ordinary operating expenses, capitalizing only the abor related to the capital projects. However, the task force determined that it would be best to reduce operating expenses by capitalizing all budgeted internal labor and manufacturing overruns. To further contain rising expenses, the task force refused to write off "obsolete" assets, which had the effect of reducing reported depreciation expense As the pasta market continued to shrink, the task force realized that its efforts to suppress the Company's expenses were simply not enough. Determined to meet the CEO's objectives, the task force began to concentrate on ways to increase Pasta's reported sales revenue. Reduced demand for pasta had driven many customer orders well below the contractually agreed upon minimum purchase volume. As such, numerous customers were contractually required to pay the Company a higher price on purchasesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started