Answered step by step

Verified Expert Solution

Question

1 Approved Answer

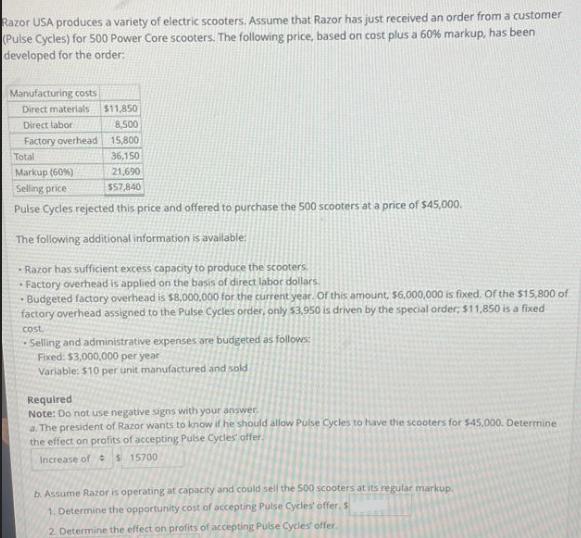

Razor USA produces a variety of electric scooters. Assume that Razor has just received an order from a customer (Pulse Cycles) for 500 Power

Razor USA produces a variety of electric scooters. Assume that Razor has just received an order from a customer (Pulse Cycles) for 500 Power Core scooters. The following price, based on cost plus a 60% markup, has been developed for the order: Manufacturing costs Direct materials $11,850 Direct labor Factory overhead 8,500 15,800 36,150 21,690 $57,840 Total Markup (60%) Selling price Pulse Cycles rejected this price and offered to purchase the 500 scooters at a price of $45,000. The following additional information is available: -Razor has sufficient excess capacity to produce the scooters. Factory overhead is applied on the basis of direct labor dollars. Budgeted factory overhead is $8,000,000 for the current year. Of this amount, $6,000,000 is fixed. Of the $15,800 of factory overhead assigned to the Pulse Cycles order, only $3,950 is driven by the special order; $11,850 is a fixed cost. Selling and administrative expenses are budgeted as follows: Fixed: $3,000,000 per year Variable: $10 per unit manufactured and sold Required Note: Do not use negative signs with your answer. a. The president of Razor wants to know if he should allow Pulse Cycles to have the scooters for $45.000. Determine the effect on profits of accepting Pulse Cycles offer. Increase of $15700 b. Assume Razor is operating at capacity and could sell the 500 scooters at its regular markup. 1. Determine the opportunity cost of accepting Pulse Cycles' offer, s 2. Determine the effect on profits of accepting Pulse Cycles offer.

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started