Read the attached three pagesthat provide the case study of Mr.Smith and his candy company as well as information from the AMA and FTC regarding ethical business practices.

This is not about writing a lot, or writing some idea over and over -- write, edit and read carefully

Here are the questions. Be sure to answer all the questions and explain, fully supporting the answers. There are no right or wrong

1) Is Mr. Smith's marketing strategy an ethical issue or not? Why or why not? (10 points)

2) From an ethical point of view: (a) Are there any positive or negative effects to the company with his strategy? (5 points) and (b) Are there any positive or negative effects to consumers/customers given his strategy? (5 points)

3) If we were responsible for Mr. Smith's budget problems, how would we handle the situation? (10 points)

4) Considering companies and their ethics, how will the American Marketing Association and/or the Federal Trade Commission address decisions taken by Mr. Smith? Is there anything else that Mr. Smith can do to improve ethical decision making and avoid unethical behavior in the future? (10 points).

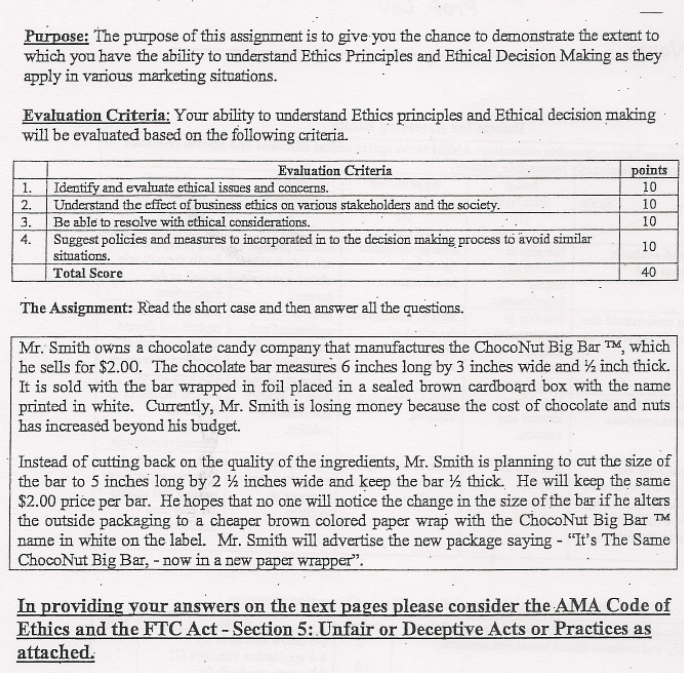

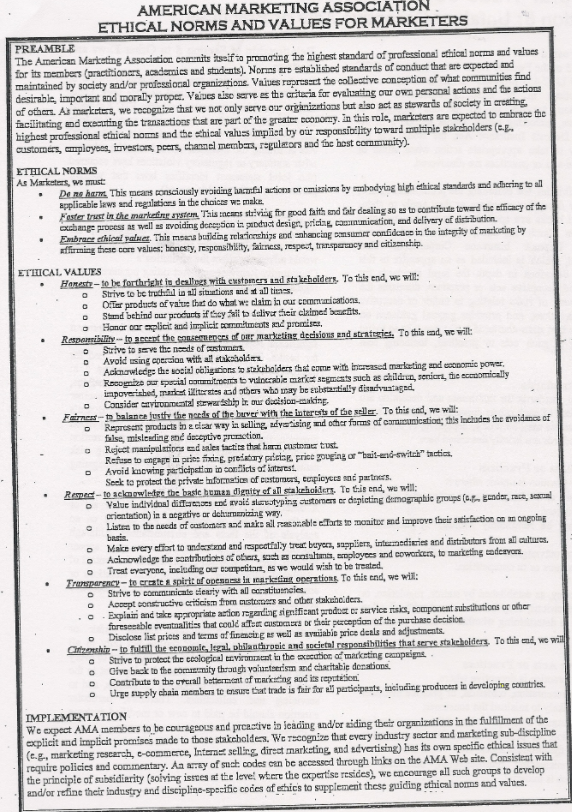

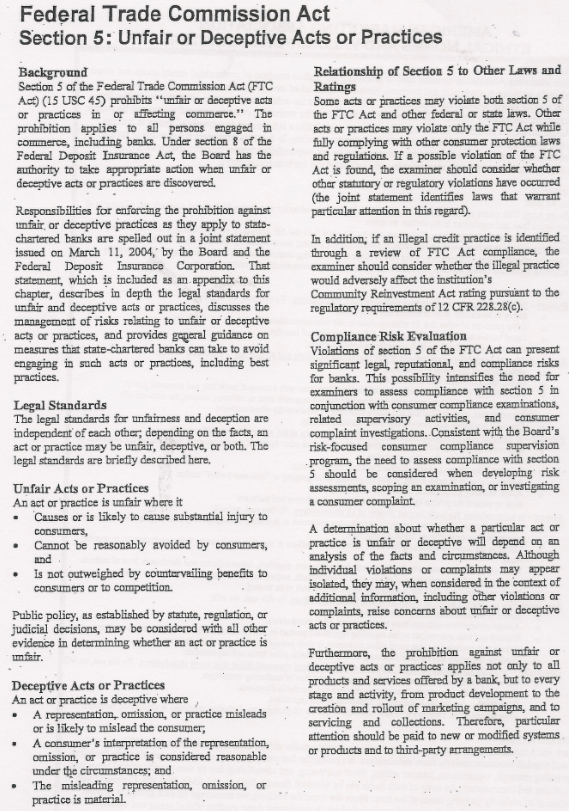

Purpose: The purpose of this assignment is to give you the chance to demonstrate the extent to which you have the ability to understand Ethics Principles and Ethical Decision Making as they apply in various marketing situations. Evaluation Criteria: Your ability to understand Ethics principles and Ethical decision making will be evaluated based on the following criteria. Evaluation Criteria points 1. Identify and evaluate ethical issues and concerns. 10 2. Understand the effect of business ethics on various stakeholders and the society. 10 3. Be able to resolve with ethical considerations. 10 4. Suggest policies and measures to incorporated in to the decision making process to avoid similar situations. 10 Total Score 40 The Assignment: Read the short case and then answer all the questions. Mr. Smith owns a chocolate candy company that manufactures the ChocoNut Big Bar TM, which he sells for $2.00. The chocolate bar measures 6 inches long by 3 inches wide and 12 inch thick. It is sold with the bar wrapped in foil placed in a sealed brown cardboard box with the name printed in white. Currently, Mr. Smith is losing money because the cost of chocolate and nuts has increased beyond his budget. Instead of cutting back on the quality of the ingredients, Mr. Smith is planning to cut the size of the bar to 5 inches long by 2 1/2 inches wide and keep the bar 12 thick. He will keep the same $2.00 price per bar. He hopes that no one will notice the change in the size of the bar if he alters the outside packaging to a cheaper brown colored paper wrap with the ChocoNut Big Bar TM name in white on the label. Mr. Smith will advertise the new package saying - "It's The Same ChocoNut Big Bar, - now in a new paper wrapper". In providing your answers on the next pages please consider the AMA Code of Ethics and the FTC Act - Section 5: Unfair or Deceptive Acts or Practices as attached.AMERICAN MARKETING ASSOCIATION . ETHICAL NORMS AND VALUES FOR MARKETERS PREAMBLE The American Marketing Association commits hasif to promoting the highest standard of professional ethical norms and values for its members (practitioners, academics and students). Norms are established standards of conduct that are expected and maintained by society and/or professional organizations. Valves represent the collective conception of what communities find desirable, important and morally proper. Valves also serve as the criteria for evaluating our own personal actions and fos actions of others. As marketers, we recognize that we not only serve our organizations but also act as stewards of society in creating facilitating and executing the transactions that are part of the greater economy. In this role, marketers are expected to anbrace the highest professional ethical noms and the chical values implied by our responsibility to ward multiple stakeholders (e.E.. customers, employees, investors, peers, channel members, regulators and for best community). ETHICAL NORMS As Marketers, we must Do me home This means consciously avoiding harmful actions or emissions by ambodying high ethical standards and adhering to all applicable laws and regulations in the choices we make. Foster Trust in the marketing system, This means striving for good faith and fair dealing so as to contribute toward the affiency of the exchange process as well as avoiding deception in pobduct design, pricing communication, and delivery of distribution. Embrace ethical polver. This mazu building relationships and sabancing consumer confidence in the integrity of marketing by affirming there core values: honesty, responsibility, fairness, respect, transparency and citizenship. ETHICAL VALUES Faxeste- to be forthright in deallogs with customers and stakeholders. To this end, we will: Strive to be truchAid in all situations and at all times. Offer products of value that do what we claim in our communications, Stand behind our products if they fail to deliver their claimed beachits, Honor oor explicit and implicit commitments and promises, Responsibility -- to accept the con serenees of off marketing decisions and strategies, To this and, we will: Strive to serve the needs of antomas. Avoid using coercion with all mukeholdma Acknowledg: the social obligations to stakeholders that come with Increased marketing and economic power, Recognize pur special commitorion's to vinceable market segments such as children, senior, the somomically impoverished, market illiterates and others who may be substantially disadvantaged, Consider savionmental sewardtly to our decision-cuking. Former - to balance lustre the needs of the buver with the interoits of the seller. To this end, we will: Represent products in a clear way in selling, advertising and other forms of communication; this Inchides the avoidance of false, misleading and deceptive promotion. Reject manipulations end sales tactics that han customer trust Refuse to mipage in price fixing predatory polciap. price gouging or "bait-and switch" faction, Avoid knowing participation in conflicts of interest Seek to protect the private information of customers, corpicyces and partners. Respect - to acknowledge the basic human dignity of all stakeholders. To this end, we will; Value individual differences and avoid slavestyping customers or depicting demographic groups (o.p., gender, macs, sexual crientation) in a negative or dehurnenizing way, Listen to the needs of customers and make all reasonable e Tarts to monitor and improve their satisfaction on an ongoing basis. Make every effort to understand and respectfully treat buyer, suppliers, inframediaries and distributors from all cultures. Acknowledge the contributions of others, such as comislamas, employers and coworkers, to marketing cadeavon. Treat everyone, including our competitors, as we would wish to be treated. Fromparency - to create a spirit of openness in marketing operations To this end, we will Strive to coccotinicale tiearly with all constituencies. Accept constructive criticism from mistrene's and other stakeholder. Explain and take appropriate addon regarding significant product of service makes, component substitutions or officer foreseeable eventualities that could a Tent customers of their perception of the purchase decision Disclose list prices and teams of financing er well as wvaniabis price deals and adjustments. hootchie - to fulfill the ecnooule, legal, philanthropic and societal responsibilities that serve stakeholders. To this end, we will Strive to protect the ecological trevicomment in the execution of marketing campaigns. Oi've back to the community through volunteerism and charitable donations. Contribute to the overall betterment of marketing and its reputation Urge supply chain members to ensure that trade is fair for all participants, meluding producers in developing countries. IMPLEMENTATION We expect AMA members to be courageous and proactive is leading and/or siding their organizations in the fulfillment of the explicit and implicit promises made to those stakeholders. We recognize that every industry sector and marketing sub-discipline (c.g., marketing research, e-commerce, Internet selling, direct marketing, and advertising) has its own specific ethical issues that require policies and commentary. An amay of suck codes can be accessed through links on the AMA Web site. Consistent with the principle of subsidierity (solving issues at the level where the expertise resides), we encourage all such groups to develop and/or refine their industry and discipline-specific codes of ethics to supplement these guiding ethical nouns and values.Federal Trade Commission Act Section 5: Unfair or Deceptive Acts or Practices Background Section 5 of the Federal Trade Commission Act (FTC Relationship of Section 5 to Other Laws and Act) (15 USC 45) prohibits "unfair or deceptive acts Ratings or practices in or affecting commerce." The Some acts or practices may violate both section 5 of the FTC Act and other federal or state laws. Other prohibition applies to all persons engaged in commerce, including banks. Under section 8 of the acts or practices may violate only the FTC Act while Federal Deposit Insurance Act, the Board has the fully complying with other consumer protection laws and regulations. If a possible violation of the FTC authority to take appropriate action when unfair or deceptive acts or practices are discovered. Act is found, the examiner should consider whether other statutory or regulatory violations have occurred Responsibilities for enforcing the prohibition against (the joint statement identifies laws that warrant unfair, or deceptive practices as they apply to state- particular attention in this regard). chartered banks are spelled out in a joint statement issued on March 11, 2004, by the Board and the In addition; if an illegal credit practice is identified Federal Deposit Insurance Corporation. That through a review of FTC Act compliance, the statement, which is included as an-appendix to this examiner should consider whether the illegal practice chapter, describes in depth the legal standards for would adversely affect the institution's infair and deceptive acts or practices, discusses the Community Reinvestment Act rating pursuant to the management of risks relating to unfair or deceptive regulatory requirements of 12 CFR 228.28(c). acts or practices, and provides general guidance on measures that state-chartered banks can take to avoid Compliance Risk Evaluation engaging in such acts or practices, including best Violations of section 5 of the FTC Act can present practices. significant legal, reputational, and compliance risks for banks. This possibility intensifies the need for Legal Standards examiners to assess compliance with section 5 in The legal standards for unfairness and deception are conjunction with consumer compliance examinations, related supervisory activities, and consumer independent of each other, depending on the facts, an act or practice may be unfair, deceptive, or both. The complaint investigations..Consistent with the Board's legal standards are briefly described here. risk-focused consumer compliance supervision program, the need to assess compliance with section Unfair Acts or Practices 5 should be considered when developing' risk assessments, scoping an examination, or investigating An act or practice is unfair where it a consumer complaint. Causes or is likely to cause substantial injury to consumers, A determination about whether a particular act or Cannot be reasonably avoided by consumers, practice is unfair or deceptive will depend on an and analysis of the facts and circumstances, Although Is not outweighed by countervailing benefits to individual violations or complaints may appear consumers or to competition. isolated, they may, when considered in the context of additional information, including other violations or Public policy, as established by statute, regulation, or complaints, raise concerns about unfair or deceptive judicial decisions, may be considered with all other acts or practices. evidence in determining whether an act or practice is umfair. Furthermore, the prohibition against unfair or deceptive acts or practices' applies not only to all Deceptive Acts or Practices products and services offered by a bank, but to every An act or practice is deceptive where stage and activity, from product development to the A representation, omission, or practice misleads creation and rollout of marketing campaigns, and to or is likely to mislead the consumer; servicing and collections. Therefore, particular A consumer's interpretation of the representation, attention should be paid to new or modified systems omission, or practice is considered reasonable or products and to third-party arrangements. under the circumstances; and The misleading representation, omission, or practice is material