Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Read the case study and answer the questions that follow: DREAMIT ELECTRONICS LTD: PROJECTIONS FOR 2 0 2 4 AND 2 0 2 5 After

Read the case study and answer the questions that follow:

DREAMIT ELECTRONICS LTD: PROJECTIONS FOR AND

After posting excellent sales and net profit in the previous year Dreamit Electronics Ltd set its sights on growth and innovation as it celebrated its th anniversary in It has continually strived to become the leader in the electronics industry in South Africa. The company is also committed to being a good corporate citizen, as it strives to fulfil both its economic and social responsibilities.

The following reflects the financial position of the company on December :

The carrying value of the fixed assets was R whilst the current assets comprised inventory of R accounts receivable of R and cash of R The equity consisted of ordinary share capital, R and retained earnings of R An amount of R was owed to Mesa Bank for a longterm loan. Trade creditors were owed R

The following projections and proposals were made by Dreamit Electronics Ltd for :

The sales are expected to increase from R in to R in All the sales are on credit. Accounts receivable is based on a collection period of days. Accounts payable must be calculated using the percentageofsales method. The gross margin and net profit margin ratios are expected to be and respectively for All purchases of inventory are on credit. Purchases for are projected at R The company expects to show a net increase in cash of R during R will be spent on additional land and buildings during the fourth quarter of The total depreciation for is forecasted at R During January ordinary shares are expected to be sold at R each. Dividends of R are expected to be recommended by the directors at the end of These dividends will be paid during R will be paid to Mesa Bank during This amount includes R for interest on loan. The amount of external funding noncurrent debt required must be calculated.

Dreamit Electronics Ltd has identified a new machine that it is considering for purchase at the start of The cost the machine is R The machine is expected to have a useful life of five years. No scrap value is anticipated. The annual profits that are expected to be generated from the machine are as follows: Year R; Year R; Year R; Year R; Year R The cost of capital is Depreciation is estimated at R per year.

QUESTIONS

Prepare the Pro Forma Statement of Financial Position as at December

Ignore the investment opportunity for

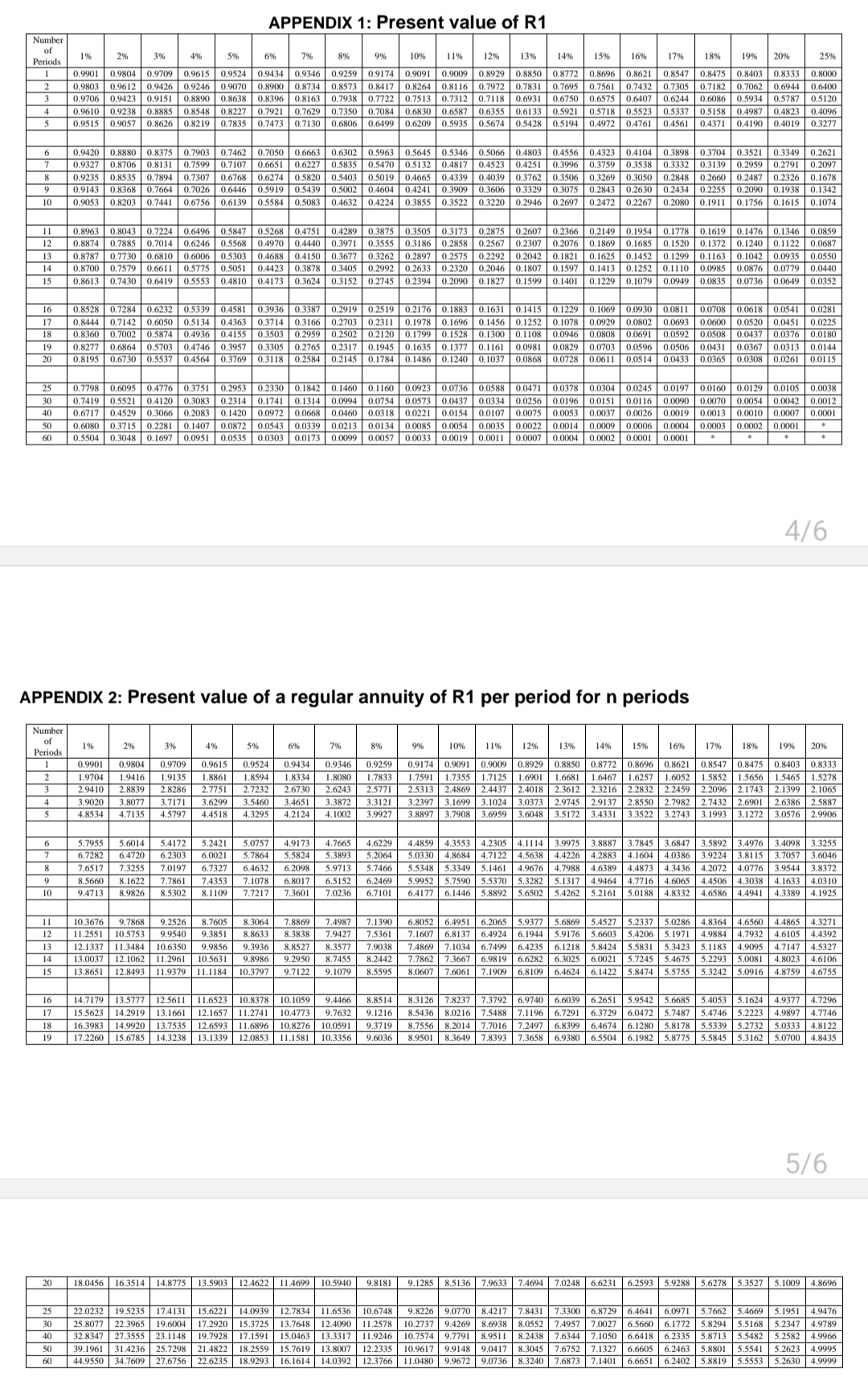

Refer to the investment opportunity for the purchase of a new machine and calculate the following. Ignore taxes. Use only the fourdecimals present value tables that appear in the attached image.

Accounting Rate of Return on average investment expressed to two decimal places

Net Present Value. Your answer must reflect the calculations of the present values and NPV

Internal Rate of Return expressed to two decimal places if the net cash flows are R per year for five years. Your answer must include two net present value calculations using consecutive ratespercentages and interpolation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started