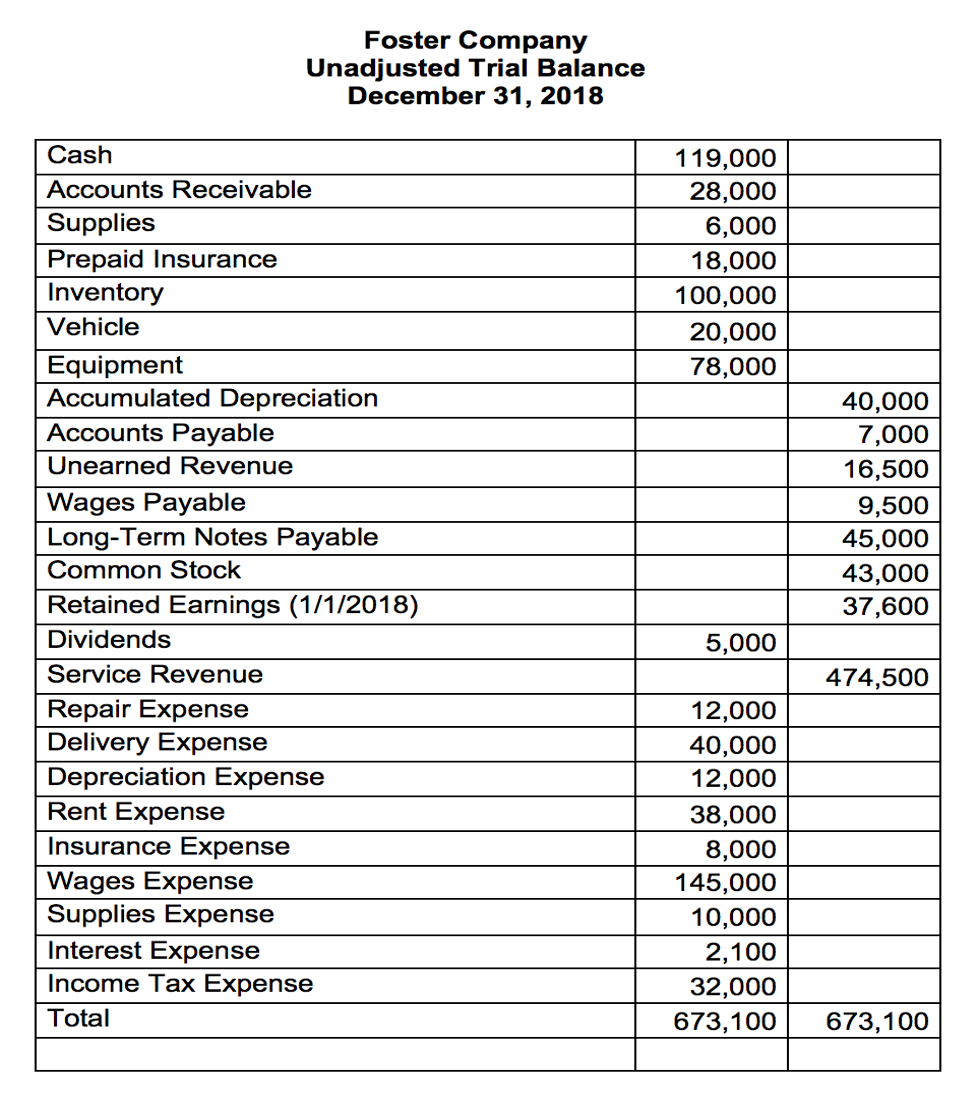

Question

The prepaid insurance balance reflects a 12-month insurance policy which started on Sept. 1, 2018, and no adjustments were made from Sept. 1 Dec. 31,

- The prepaid insurance balance reflects a 12-month insurance policy which started on Sept. 1, 2018, and no adjustments were made from Sept. 1 Dec. 31, 2018. Write the adjusting journal entry for Dec. 31, 2018.

| Insurance Expense | 6,000 |

|

| Prepaid Insurance |

| 6,000 |

- Additional depreciation expense of $15,000 needs to be recorded for the year ended 2018.

| Depreciation Expense | 15,000 |

|

| Accumulated Depreciation |

| 15,000 |

- Wages due to employees of $8,000 need to be recorded at year end. These wages will be paid to employees on January 9, 2019. (next month)

| Wages Expense | 8,000 |

|

| Wage payable |

| 8,000 |

- The company has completed $12,900 of the amount in unearned revenue as of Dec. 31st.

| Unearned Revenue | 129,000 |

|

| Service Revenue |

| 129,00 |

- In Dec. the company provided services worth $8,000 to clients that were not yet billed or recorded by Dec. 31. Record the additional revenue.

| Accounts Receivable | 8,000 |

|

| Service Revenue |

| 8,000 |

- On Dec 31st the company completed a physical count of their supplies and determined that only $4,000 of supplies are still on hand.

| Supplies Expense | 2,000 |

|

| Supplies |

| 2,000 |

Part 2: Post the adjusting journal entries to t-accounts:

(Hints on getting started: Above each T-account, write the account name of each account affected by an adjusting journal entry (you may not need to use all of the T-accounts). Write in the unadjusted balance for each of these accounts from the Unadjusted Trial Balance provided in question 1 of your D2L quiz (the unadjusted balance might be a debit, a credit, or zero balance). Now you are ready to post your adjusting journal entries from Part 1 to the corresponding T-accounts and calculate adjusted balances.

Part 3: Prepare the Adjusted Trial Balance (i.e., after the previous 6 journal entries are posted)

______________ (Company Name)

______________ (Date)

Adjusted Trial Balance

| Cash |

|

|

| Accounts Receivable |

|

|

| Supplies |

|

|

| Prepaid Insurance |

|

|

| Inventory |

|

|

| Vehicle |

|

|

| Equipment |

|

|

| Accumulated Depreciation |

|

|

| Accounts Payable |

|

|

| Unearned Revenue |

|

|

| Wages Payable |

|

|

| Long-Term Notes Payable |

|

|

| Common Stock |

|

|

| Retained Earnings (1/1/2018) |

|

|

| Dividends |

|

|

| Service Revenue |

|

|

| Repair Expense |

|

|

| Delivery Expense |

|

|

| Depreciation Expense |

|

|

| Rent Expense |

|

|

| Insurance Expense |

|

|

| Wages Expense |

|

|

| Supplies Expense |

|

|

| Interest Expense |

|

|

| Income Tax Expense |

|

|

| Total |

|

|

|

|

|

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started