Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Read the Groupon case (PDF posted on Bb, from the 3rd edition textbook, pages 109-110). Does Groupon have resources and capabilities? What are they,

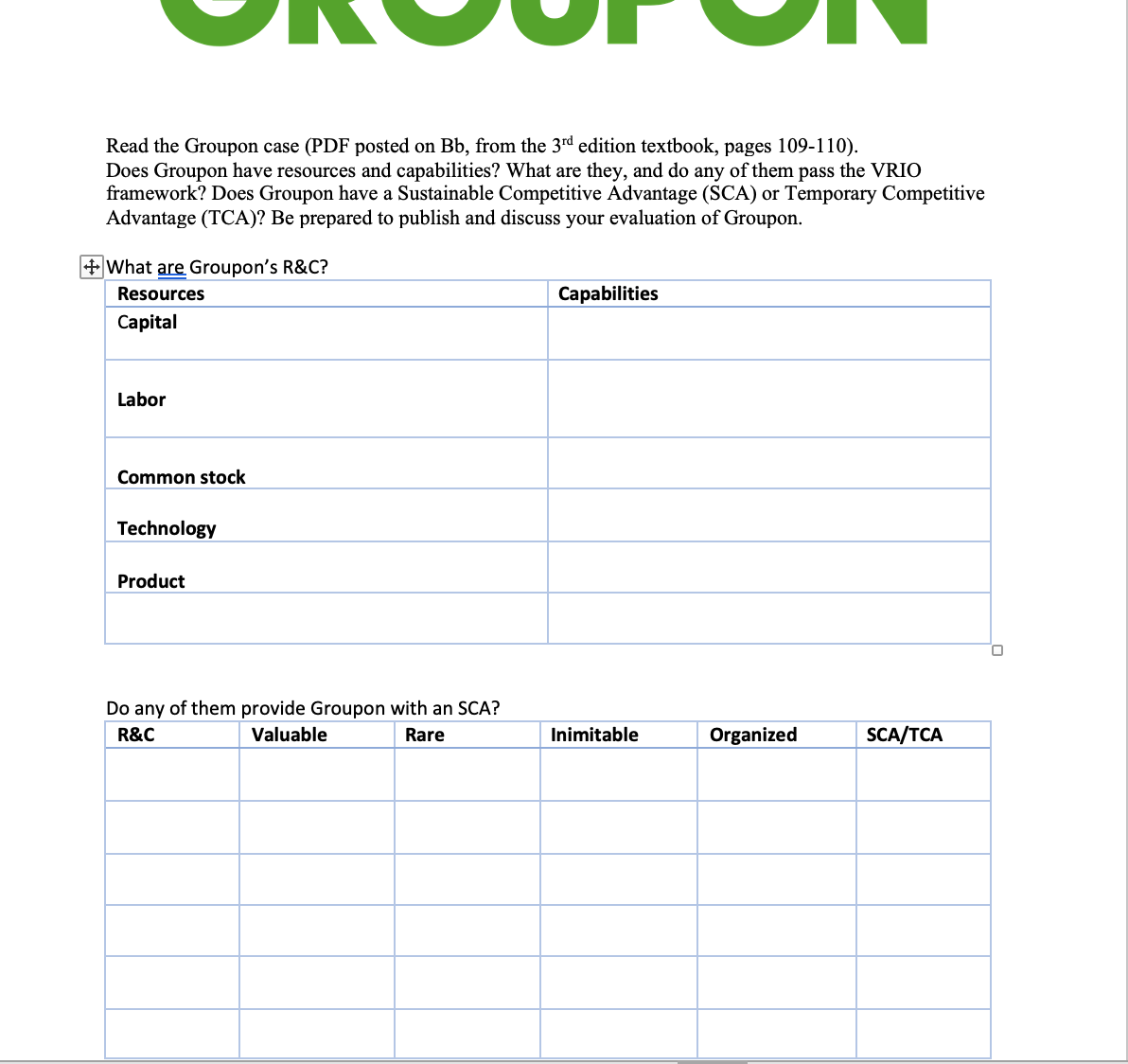

Read the Groupon case (PDF posted on Bb, from the 3rd edition textbook, pages 109-110). Does Groupon have resources and capabilities? What are they, and do any of them pass the VRIO framework? Does Groupon have a Sustainable Competitive Advantage (SCA) or Temporary Competitive Advantage (TCA)? Be prepared to publish and discuss your evaluation of Groupon. + What are Groupon's R&C? Resources Capital Capabilities Labor Common stock Technology Product Do any of them provide Groupon with an SCA? R&C Valuable Rare Inimitable Organized SCA/TCA Applying VRIO: The Rise and Fall of Groupon After graduating with a degree in music from Northwestern University, Andrew Mason spent a couple of years as a web designer. In 2008, the then 27-year-old founded Groupon, a daily-deal website that connects local retailers and other merchants to consumers by offering goods and services at a discount. Groupon creates marketplaces by bringing the brick-and-mortar world of local commerce onto the internet. The company basically offers a "group-coupon." If more than a predetermined number of Groupon users sign up for the offer, the deal is extended to all Groupon users. For exam- ple, a local spa may offer a massage for $40 instead of the regular $80. If more than say 10 people sign up, the deal becomes reality. The users prepay $40 for the coupon, which Groupon splits 50-50 with the local merchant. Inspired by how Amazon.com has become the global leader in ecom- merce, Mason's strategic vision for Groupon was to be the global leader in local commerce. Measured by its explosive growth, Groupon became one of the most successful recent internet startups, with over 260 million subscribers and serving more than 500,000 merchants in the United States and some 50 countries. Indeed, Groupon's success attracted a $6 billion buyout offer by Google in early 2011, which Mason declined. In November 2011, Groupon held a successful initial public offering (IPO), valued at more than $16 billion with a share price of over $26. But a year later, Groupon's share price had fallen 90 percent to just $2.63, resulting in a market cap of less than $1.8 billion. In early 2013, Mason posted a letter for Grou- pon employees on the web, arguing that it would leak anyway, stating, "After four and a half intense and wonderful years as CEO of Groupon, I've decided that I'd like to spend more time with my family. Just kiddingI was fired today." Although Groupon is still in business, it is just one compet- itor among many, and not a market leader. What went wrong? The implosion of Groupon's market value can be explained using the VRIO framework. Its competency to drum up more business for local retailers by offering lower prices for its users was certainly valuable. Before Groupon, local merchants used online and classified ads, direct mail, yellow pages, and other venues to reach customers. Rather than using one-way communication, Groupon facilitates the meeting of supply and demand in local markets. When Groupon launched, such local market-making competency was also rare. Groupon, with its first-mover advantage, seemed able to use technology in a way so valuable and rare it prompted Google's buyout offer. But was it costly to imitate? Not so much. The multibillion-dollar Google offer spurred potential competitors to reproduce Groupon's business model. They discovered that Groupon was more of a sales company than a tech venture, despite perceptions to the contrary. To target and fine-tune its local deals, Groupon relies heavily on human labor to do the selling. Barriers to entry in this type of busi- ness are nonexistent because Groupon's competency is built more on a tangible resource (labor) than on an intangible one (proprietary technology). Given that Groupon's valuable and rare competency was not hard to imitate, hundreds of new ventures (so-called Groupon clones) rushed in to take advantage of this opportunity. Existing online giants such as Google, Amazon (via Living Social), and Facebook also moved in. The spurned Google almost immediately created its own daily-deal version with Google Offers. Also, note that the ability to imitate a rare and valuable resource is directly linked to barriers of entry, which is one of the key elements in Porter's five forces model (threat of new entrants). This relationship allows linking internal analy- sis using the resource-based view to external analysis with the five forces model, which also would have predicted low industry profit potential given low or no barriers to entry. To make matters worse, these Groupon clones are often able to better serve the needs of local markets and specific population groups. Some daily-deal sites focus only on a spe- cific geographic area. As an example, Conejo Deals meets the needs of customers and retailers in Southern California's Conejo Valley, a cluster of suburban communities. These hyper-local sites tend to have much deeper relationships and expertise with merchants in their specific areas. Since they are mostly matching local customers with local businesses, moreover, they tend to foster more repeat business than the one-off bargain hunters that use Groupon (based in Chi- cago). In addition, some daily-deal sites often target specific groups. They have greater expertise in matching their users with local retailers (e.g., Daily Pride serving LGBT commu- nities; Black Biz Hookup serving African-American business owners and operators; Jdeal, a Jewish group-buying site in New York City; and so on). "Finding your specific group" or "going hyper local" allows these startups to increase the perceived value added for their users over and above what Groupon can offer. Although Groupon aspires to be the global leader, there is really no advantage to global scale in serving local markets. This is because daily-deal sites are best suited to market experi- ence goods, such as haircuts at a local barber shop or a meal in a specific Thai restaurant. The quality of these goods and services cannot be judged unless they are consumed. Creation of experience goods and their consumption happens in the same geographic space. Once imitated, Groupon's competency to facilitate local commerce using an internet platform was neither valuable nor rare. As an application of the VRIO model would have predicted, Groupon's competitive advantage as a first mover would only be temporary at best (see Exhibit 4.5). LO 4-5 Evaluate different conditions that allow a firm to sustain a competitive advantage. isolating mechanisms Barriers to imitation that prevent rivals from competing away the advantage a firm may enjoy. ISOLATING MECHANISMS: HOW TO SUSTAIN A COMPETITIVE ADVANTAGE Although VRIO resources can lay the foundation of a competitive advantage, no competi- tive advantage can be sustained indefinitely. 23 Several conditions, however, can offer some protection to a successful firm by making it more difficult for competitors to imitate the resources, capabilities, or competencies that underlie its competitive advantage. Barriers to imitation are important examples of isolating mechanisms because they prevent rivals from competing away the advantage a firm may enjoy; they include: 24 Better expectations of future resource value. Path dependence. Causal ambiguity. Social complexity. Intellectual property (IP) protection. This link ties isolating mechanisms directly to one of the criteria in the resource-based view to assess the basis of competitive advantage: costly (or difficult) to imitate. If one, or any combination, of these isolating mechanisms is present, a firm may strengthen its basis for competitive advantage, increasing its chance to be sustainable over a longer period of time. BETTER EXPECTATIONS OF FUTURE RESOURCE VALUE. Sometimes firms can acquire resources at a low cost, which can lay the foundation for a competitive advantage later when expectations about the future of the resource turn out to be more accurate than those held by competitors. Better expectations of the future value of a resource allows a firm to gain a competitive advantage. If such better expectations can be systematically repeated over time, it may help in sustaining a competitive advantage. A real estate developer illustrates the role that the future value of a resource can play. She must decide when and where to buy land for future development. Her firm may gain a competitive advantage if she buys a parcel of land for a low cost in an undeveloped rural area 40 miles north of San Antonio, Texas-in anticipation that it will increase in value with shifting demographics. Let's assume, several years later, that an interstate highway is built near her firm's land. With the highway, suburban growth explodes as many new

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started