Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Read the Professional Judgment Allowance for Doubtful Accounts scenario. Review the professional judgment framework application template and slides. Application Template & Excel spreadsheet : For

- Read the Professional Judgment Allowance for Doubtful Accounts scenario.

- Review the professional judgment framework application templateand slides.

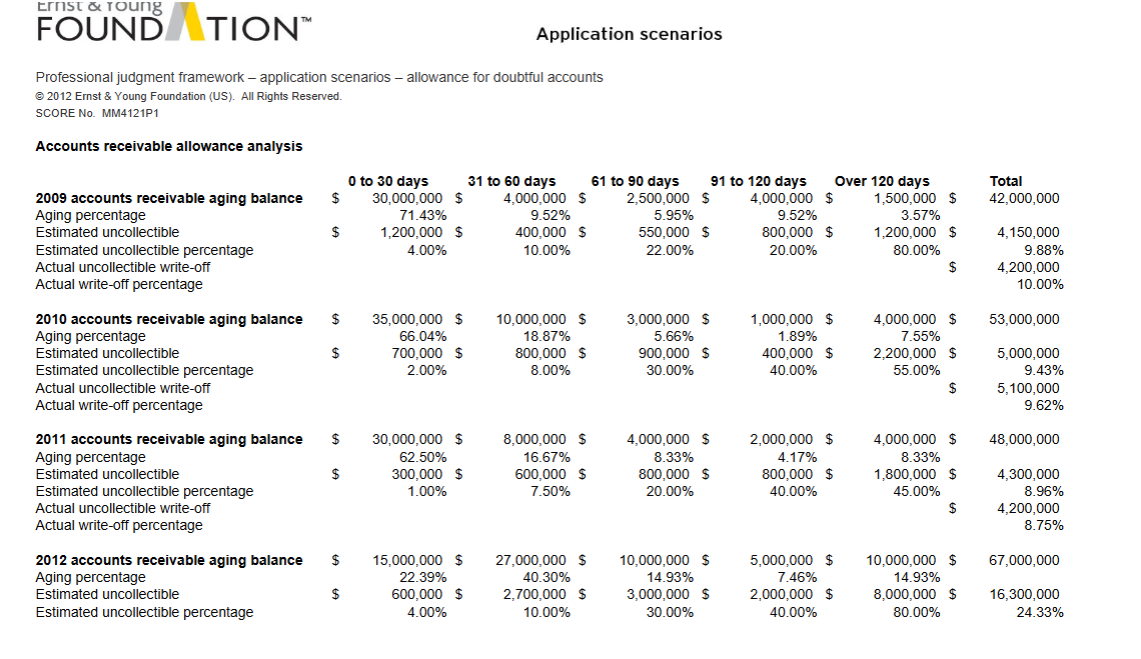

- Application Template & Excel spreadsheet: For December 31, 2012 in the scenario given, perform an assessment of the allowance for doubtful accounts receivable. Using the professional judgment framework, complete the application template for all process steps and provide the appropriate information in the documentation column. In performing your analysis, you should use an Excel spreadsheet to support any calculations. (Note: It may be best to use the allowance analysis provided by the credit manager as a starting point for your analysis.)

- Memo: Using the information you documented regarding the specific and overarching considerations for each process step in the framework, prepare a memo (use the format provided in the template) that you will provide to the CFO (not to exceed three pages). Upon completing your documentation, make certain that you are able to answer the following questions:

- Is the documentation sufficient to support your judgment?

- Can another professional understand how you reached your conclusion (including why reasonable outcomes and possible alternatives identified were not selected)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started