Question

Real and Brigitte are retired and looking for ways to save on income tax. Given the difference in their respective incomes, their financial advisor

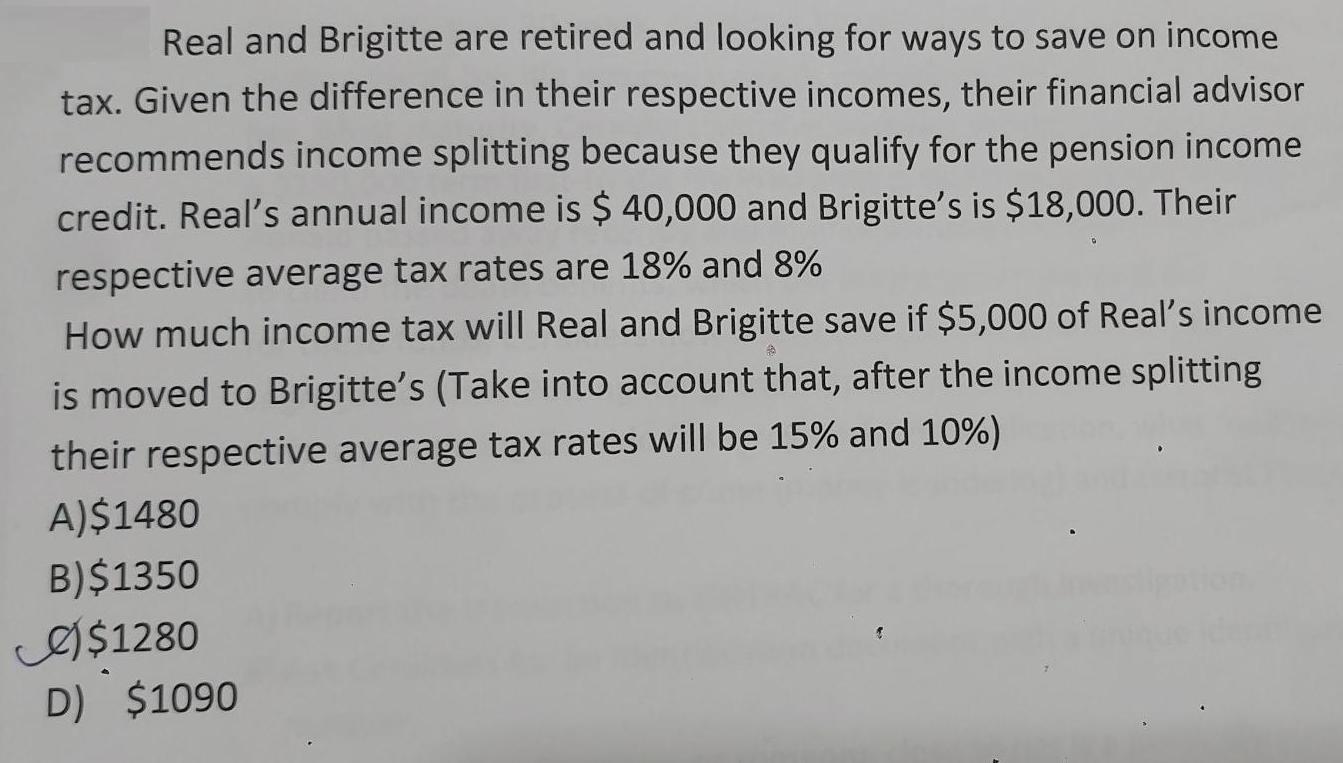

Real and Brigitte are retired and looking for ways to save on income tax. Given the difference in their respective incomes, their financial advisor recommends income splitting because they qualify for the pension income credit. Real's annual income is $ 40,000 and Brigitte's is $18,000. Their respective average tax rates are 18% and 8% How much income tax will Real and Brigitte save if $5,000 of Real's income is moved to Brigitte's (Take into account that, after the income splitting their respective average tax rates will be 15% and 10%) A)$1480 B) $1350 $1280 D) $1090

Step by Step Solution

3.30 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Tax Taxable income X tax rate Step 2 A Particulars 1 2 Annual income 3 Tax before moving i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Accounting A Contemporary Approach

Authors: David Haddock, John Price, Michael Farina

4th edition

978-1259995057, 1259995054, 978-0077503987, 77503988, 978-0077639730

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App