Answered step by step

Verified Expert Solution

Question

1 Approved Answer

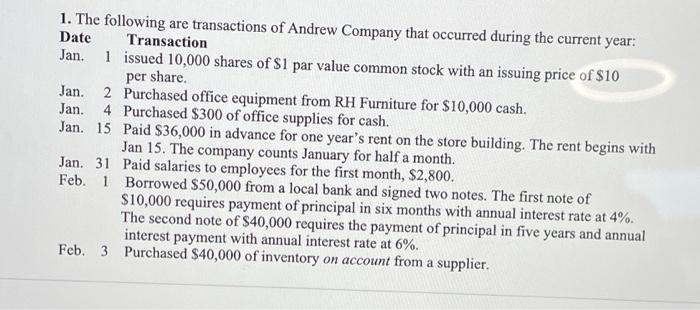

really need help asap please. 1. The following are transactions of Andrew Company that occurred during the current year: DateJan.Transaction1issued10,000sharesof$1parvaluecommonstockwithanissuingpriceof$10 per share. Jan. 2 Purchased

really need help asap please.

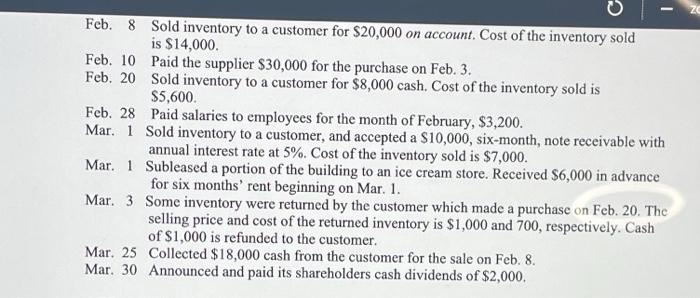

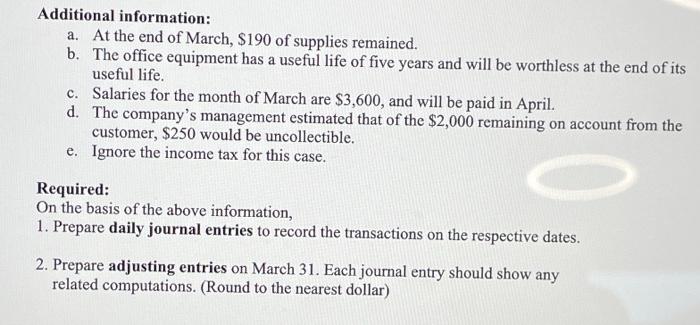

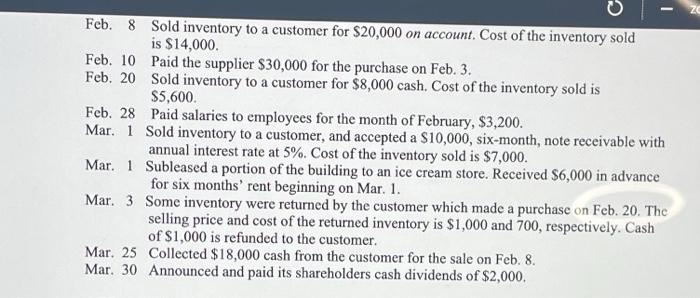

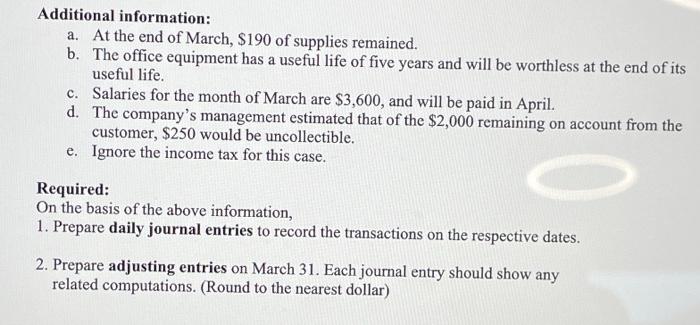

1. The following are transactions of Andrew Company that occurred during the current year: DateJan.Transaction1issued10,000sharesof$1parvaluecommonstockwithanissuingpriceof$10 per share. Jan. 2 Purchased office equipment from RH Furniture for $10,000 cash. Jan. 4 Purchased $300 of office supplies for cash. Jan. 15 Paid $36,000 in advance for one year's rent on the store building. The rent begins with Jan 15 . The company counts January for half a month. Jan. 31 Paid salaries to employees for the first month, $2,800. Feb. 1 Borrowed $50,000 from a local bank and signed two notes. The first note of $10,000 requires payment of principal in six months with annual interest rate at 4%. The second note of $40,000 requires the payment of principal in five years and annual interest payment with annual interest rate at 6%. Feb. 3 Purchased $40,000 of inventory on account from a supplier. Additional information: a. At the end of March, $190 of supplies remained. b. The office equipment has a useful life of five years and will be worthless at the end of its useful life. c. Salaries for the month of March are $3,600, and will be paid in April. d. The company's management estimated that of the $2,000 remaining on account from the customer, $250 would be uncollectible. e. Ignore the income tax for this case. Required: On the basis of the above information, 1. Prepare daily journal entries to record the transactions on the respective dates. 2. Prepare adjusting entries on March 31 . Each journal entry should show any related computations. (Round to the nearest dollar) Feb. 8 Sold inventory to a customer for $20,000 on account. Cost of the inventory sold is $14,000. Feb. 10 Paid the supplier $30,000 for the purchase on Feb. 3. Feb. 20 Sold inventory to a customer for $8,000 cash. Cost of the inventory sold is $5,600. Feb. 28 Paid salaries to employees for the month of February, $3,200. Mar. 1 Sold inventory to a customer, and accepted a $10,000, six-month, note receivable with annual interest rate at 5%. Cost of the inventory sold is $7,000. Mar. 1 Subleased a portion of the building to an ice cream store. Received $6,000 in advance for six months' rent beginning on Mar. 1. Mar. 3 Some inventory were returned by the customer which made a purchase on Feb. 20. The selling price and cost of the returned inventory is $1,000 and 700 , respectively. Cash of $1,000 is refunded to the customer. Mar. 25 Collected $18,000 cash from the customer for the sale on Feb. 8. Mar. 30 Announced and paid its shareholders cash dividends of $2,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started