Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Really need help with these questions please and thank you! Can you at least answer the first question please that was the most difficult for

Really need help with these questions please and thank you!

Can you at least answer the first question please that was the most difficult for me, thank you

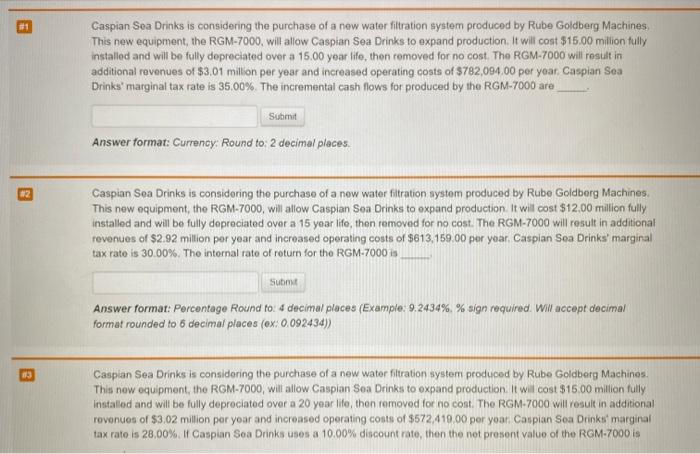

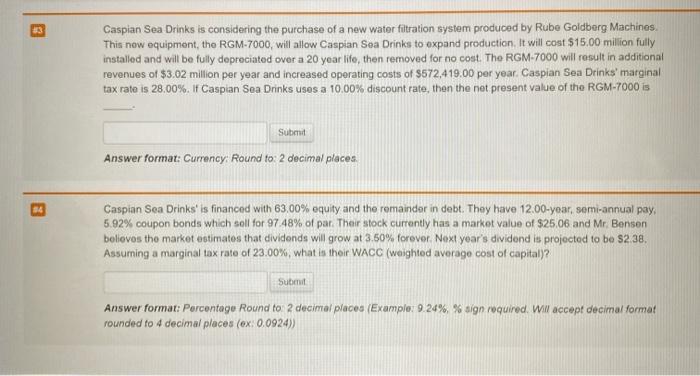

Caspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube Goldberg Machines This new equipment, the RGM-7000, will allow Caspian Sea Drinks to expand production. It will cost $15.00 million tully installed and will be fully depreciated over a 15.00 year life, then removed for no cost. The RGM-7000 will result in additional revenues of $3.01 million per year and increased operating costs of $782,094.00 per year. Caspian Sea Drinks' marginal tax rate is 35.00%. The incremental cash flows for produced by the RGM-7000 are Submit Answer format: Currency: Round to: 2 decimal places 2 Caspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube Goldberg Machines This new equipment, the RGM-7000, will allow Caspian Sea Drinks to oxpand production. It will cost $12.00 million fully installed and will be fully depreciated over a 15 year life, then removed for no cost. The RGM-7000 will result in additional revenues of $2.92 million per year and increased operating costs of $613,159,00 per year. Caspian Sea Drinks' marginal tax rate is 30.00%. The internal tato of return for the RGM-7000 is Submit Answer format: Percentage Round to: 4 decimal places (Example: 9.2434%. % sign required. Will accept decimal format rounded to 6 decimal places (ex: 0.092434)) Caspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube Goldberg Machines This now equipment, the RGM-7000, will allow Caspian Sea Drinks to expand production. It will cost $15.00 million fully installed and will be fully depreciated over a 20 year life, then removed for no cost. The RGM-7000 will result in additional rovonuos of $3.02 million por yoar and increased operating costs of $572,419.00 por yoar Caspian Sea Drinks' marginal tax rate is 28,00%. Caspian Sea Drinks uses a 10.00% discount rate, then the not present value of the RGM-7000 is Caspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube Goldberg Machines. This now equipment, the RGM-7000, will allow Caspian Sea Drinks to expand production. It will cost $15.00 million fully installed and will be fully depreciated over a 20 year life, then removed for no cost. The RGM-7000 will result in additional revenues of $3.02 million per year and increased operating costs of $572,419.00 per year. Caspian Sea Drinks' marginal tax rate is 28,00%. If Caspian Sea Drinks uses a 10.00% discount rate, then the net present value of the RGM-7000 is Submit Answer formar: Currency Round to 2 decimal places. 34 Caspian Sea Drinks' is financed with 63,00% equity and the remainder in debt. They have 12.00-year, semi-annual pay, 5.92% coupon bonds which soll for 97.48% of par. Their stock currently has a market value of $25.06 and Mr. Benson believes tho market estimates that dividonds will grow at 3.60% forever. Next year's dividend is projected to be $2.38. Assuming a marginal tax rate of 23.00%, what is their WACC (weighted average cost of capital? Submit Answer format: Porcentage Round to 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started