Question

Recall that Medicaid is a joint federal and state entitlement health insurance program. The ACA of 2010 required all states to eliminate the use of

Recall that Medicaid is a joint federal and state entitlement health insurance program. The ACA of 2010 required all states to eliminate the use of categories to determine eligibility and expand the Medicaid program to all persons younger than age 65 with incomes at or below 138% of the federal poverty level. However, in June 2012, the U.S. Supreme Court ruled that requiring states to expand their Medicaid programs was unconstitutional: Each state could make its own decision on whether to expand the program. By 2016, 32 states and Washington, D.C., had opted to expand their Medicaid programs. Declining expansion means that Medicaid continues as it was prior to the ACA's implementation, with category-based eligibility.

Determine whether your state has expanded its Medicaid program.

Explain why a very poor person (income below FPL) living in one of the states that declined Medicaid expansion may be ineligible to participate in the health insurance exchanges.

What is the economic effect on the state (and on the hospital or site where you work or are being trained) of having a large population of uninsured people?

Why would a state choose not to participate in Medicaid expansion despite the federal promise of paying for the additional beneficiaries?

There is no "right" to health care in the U.S. Constitution. Debate the pros and cons of a universal Medicare-for-all healthcare finance program for the United States. Refer to the ANA Code of Ethics to inform your debate.

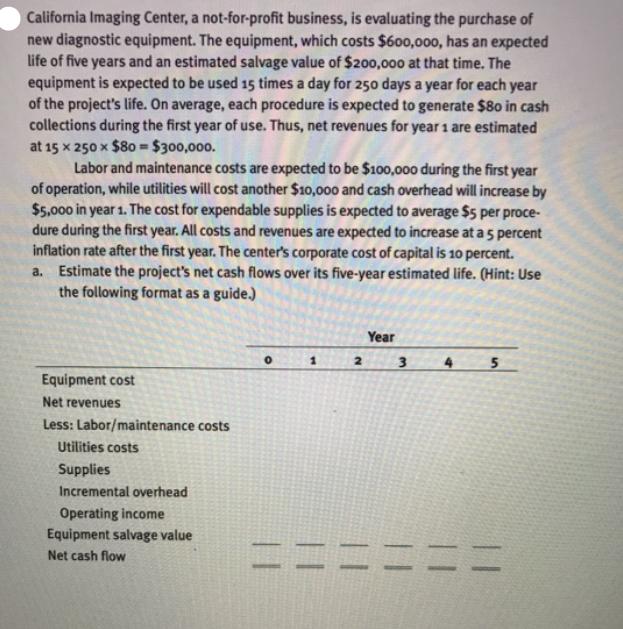

O California Imaging Center, a not-for-profit business, is evaluating the purchase of new diagnostic equipment. The equipment, which costs $600,000, has an expected life of five years and an estimated salvage value of $200,000 at that time. The equipment is expected to be used 15 times a day for 250 days a year for each year of the project's life. On average, each procedure is expected to generate $80 in cash collections during the first year of use. Thus, net revenues for year 1 are estimated at 15 x 250 x $80 = $300,000. Labor and maintenance costs are expected to be $100,000 during the first year of operation, while utilities will cost another $10,000 and cash overhead will increase by $5,000 in year 1. The cost for expendable supplies is expected to average $5 per proce- dure during the first year. All costs and revenues are expected to increase at a 5 percent inflation rate after the first year. The center's corporate cost of capital is 10 percent. a. Estimate the project's net cash flows over its five-year estimated life. (Hint: Use the following format as a guide.) Equipment cost Net revenues Less: Labor/maintenance costs Utilities costs Supplies Incremental overhead Operating income Equipment salvage value Net cash flow 0 1 2 Year 3 5 === ==

Step by Step Solution

3.51 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

1 Ineligibility for Health Insurance Exchanges A very poor person living in a state that declined Medicaid expansion may be ineligible to participate in the health insurance exchanges established unde...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started