Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Recent geo-political events and post-pandemic inflation concerns have seen large swings in commodity prices in recent years. Unsurprisingly, many of your clients are trying

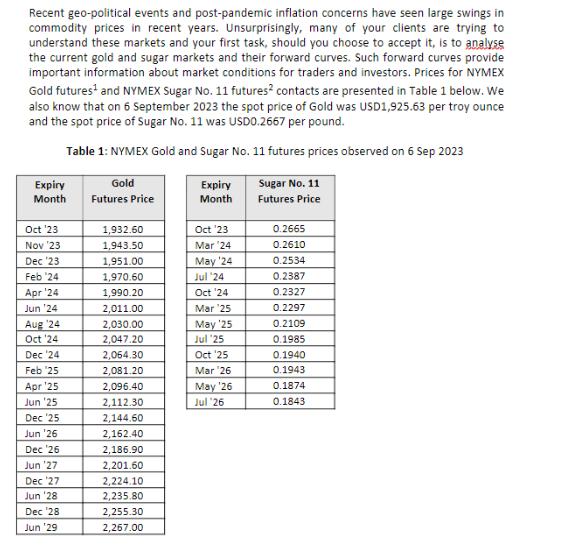

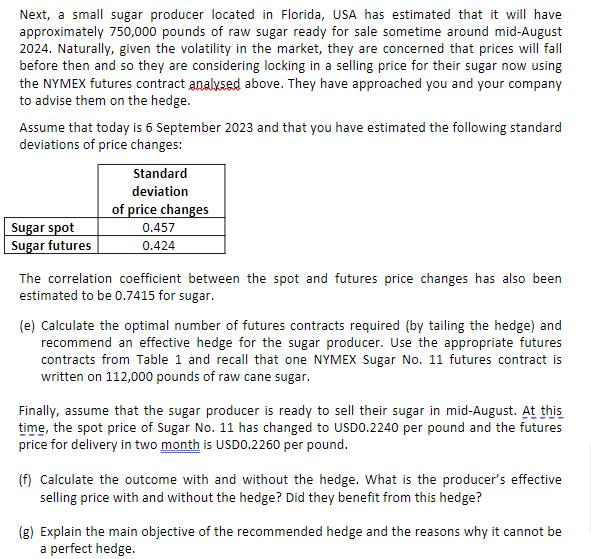

Recent geo-political events and post-pandemic inflation concerns have seen large swings in commodity prices in recent years. Unsurprisingly, many of your clients are trying to understand these markets and your first task, should you choose to accept it, is to analyse the current gold and sugar markets and their forward curves. Such forward curves provide important information about market conditions for traders and investors. Prices for NYMEX Gold futures and NYMEX Sugar No. 11 futures contacts are presented in Table 1 below. We also know that on 6 September 2023 the spot price of Gold was USD1,925.63 per troy ounce and the spot price of Sugar No. 11 was USD0.2667 per pound. Table 1: NYMEX Gold and Sugar No. 11 futures prices observed on 6 Sep 2023 Sugar No. 11 Futures Price Expiry Month Oct 23 Nov 23 Dec 23 Feb 24 Apr 24 Jun '24 Aug 24 Oct 24 Dec 24 Feb 25 Apr 25 Jun 25 Dec 25 Jun 26 Dec '26 Jun '27 Dec '27 Jun 28 Dec 28 Jun '29 Gold Futures Price 1,932.60 1,943.50 1,951.00 1,970.60 1,990.20 2,011.00 2,030.00 2,047.20 2,064.30 2,081.20 2,096.40 2,112.30 2,144.60 2,162.40 2,186.90 2,201.60 2,224.10 2,235.80 2,255.30 2,267.00 Expiry Month Oct 23 Mar 24 May 24 Jul 24 Oct 24 Mar 25 May '25 Jul '25 Oct 25 Mar 26 May 26 Jul 26 0.2665 0.2610 0.2534 0.2387 0.2327 0.2297 0.2109 0.1985 0.1940 0.1943 0.1874 0.1843 Next, a small sugar producer located in Florida, USA has estimated that it will have approximately 750,000 pounds of raw sugar ready for sale sometime around mid-August 2024. Naturally, given the volatility in the market, they are concerned that prices will fall before then and so they are considering locking in a selling price for their sugar now using the NYMEX futures contract analysed above. They have approached you and your company to advise them on the hedge. Assume that today is 6 September 2023 and that you have estimated the following standard deviations of price changes: Sugar spot Sugar futures Standard deviation of price changes 0.457 0.424 The correlation coefficient between the spot and futures price changes has also been estimated to be 0.7415 for sugar. (e) Calculate the optimal number of futures contracts required (by tailing the hedge) and recommend an effective hedge for the sugar producer. Use the appropriate futures contracts from Table 1 and recall that one NYMEX Sugar No. 11 futures contract is written on 112,000 pounds of raw cane sugar. Finally, assume that the sugar producer is ready to sell their sugar in mid-August. At this time, the spot price of Sugar No. 11 has changed to USD0.2240 per pound and the futures price for delivery in two month is USDO.2260 per pound. (f) Calculate the outcome with and without the hedge. What is the producer's effective selling price with and without the hedge? Did they benefit from this hedge? (g) Explain the main objective of the recommended hedge and the reasons why it cannot be a perfect hedge.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the optimal number of futures contracts required by tailing the hedge you can use the f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started