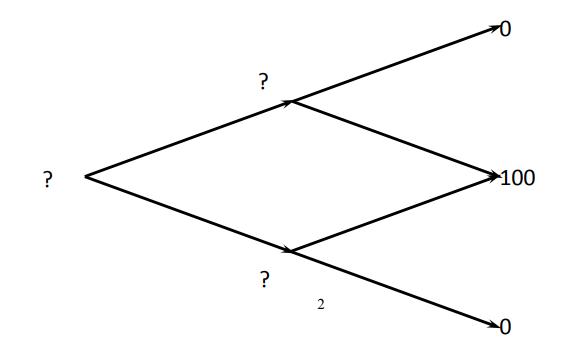

Question: Derivative security (European binary/digital option paying 100 when the stock price is between 50 and 100 and paying zero otherwise). Each step is 12 months

Derivative security (European binary/digital option paying 100 when the stock price is between 50 and 100 and paying zero otherwise). Each step is 12 months

The actual probabilities are 1/3 for up and 2/3 for down at each node.

a. (3 points) What are the risk-neutral probabilities of up and down?

b. (3 points) What is the value of the binary option at each node?

c. (3 points) In the portfolio strategy that replicates the binary option, what are the holdings in the stock and the bond at each node?

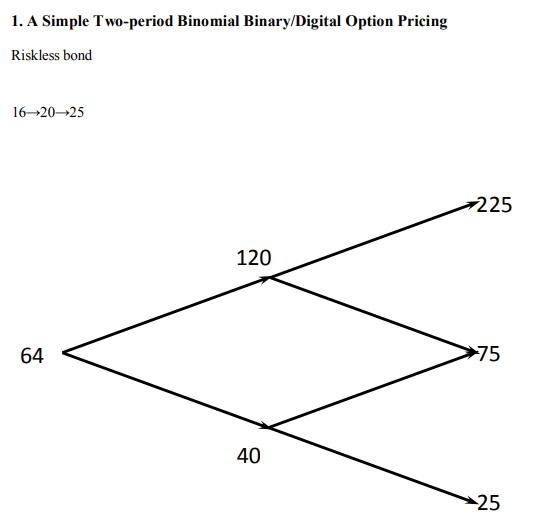

1. A Simple Two-period Binomial Binary/Digital Option Pricing Riskless bond 16-20 25 64 120 40 225 75 25

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts