? General Journal 2. Record the journal entry for the payroll, crediting Cash for the net pay. When required, enter amounts in dollars and cents.

?

?

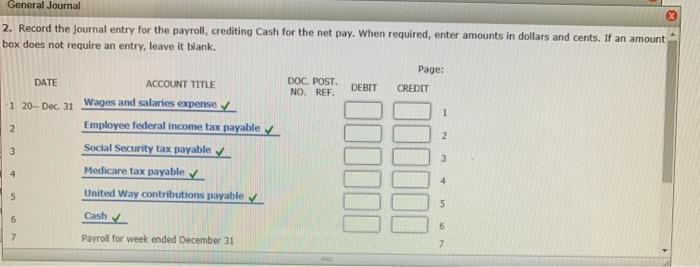

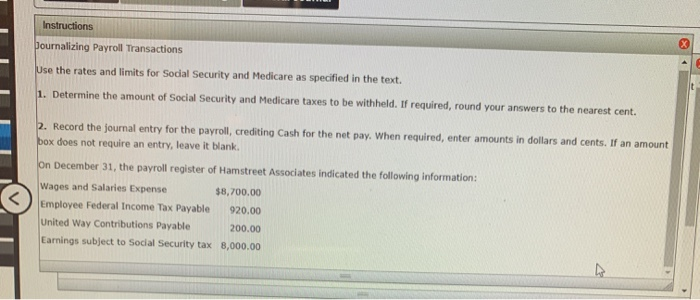

General Journal 2. Record the journal entry for the payroll, crediting Cash for the net pay. When required, enter amounts in dollars and cents. If an amount box does not require an entry, leave it blank. Page: DOC. POST. NO. REF. DATE ACCOUNT TITLE DEBIT CREDIT 1 20- Dec. 31 Wages and salaries expense 2 Employee federal income tax payable Social Security tax payable y Medicare tax payable v United Way contributions payable v Cash 3 4 5. 16. Payroll for week ended December 31 7. 0D00

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 As per the year 2020 Social Security tax rate ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started