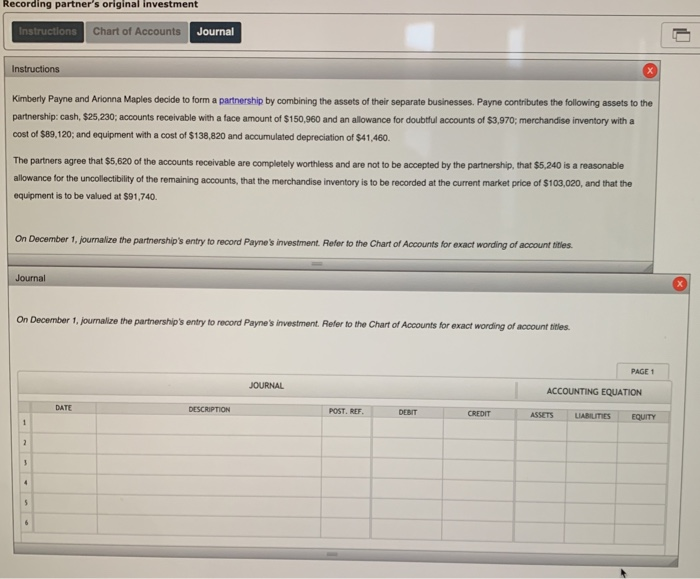

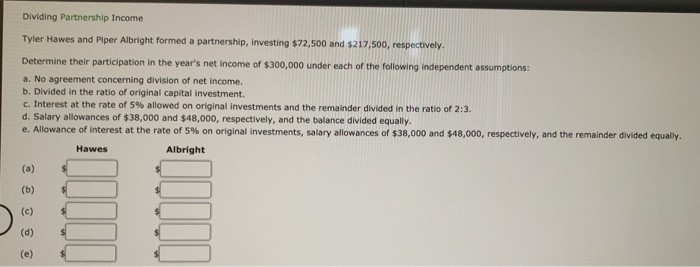

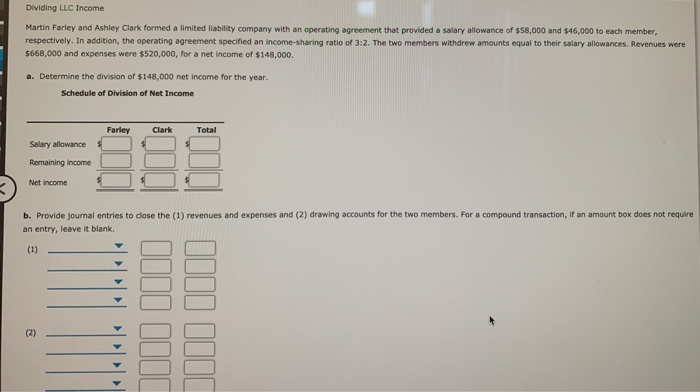

Recording partner's original investment Instructions Chart of Accounts Journal Instructions Kimberly Payne and Arionna Maples decide to form a partnership by combining the assets of their separate businesses. Payne contributes the following assets to the partnership: cash, $25 230; accounts receivable with a face amount of $150,960 and an allowance for doubtful accounts of $3,970, merchandise inventory with a cost of $89,120; and equipment with a cost of $138,820 and accumulated depreciation of $41.460. The partners agree that $5,620 of the accounts receivable are completely worthless and are not to be accepted by the partnership, that $5,240 is a reasonable allowance for the uncollectibility of the remaining accounts, that the merchandise inventory is to be recorded at the current market price of $103.020, and that the equipment is to be valued at $91,740 On December 1, joumalize the partnerships entry to record Payne's investment. Refer to the Chart of Accounts for exact wording of account titles. Journal On December 1, journalize the partnership's entry to record Payne's investment. Refer to the Chart of Accounts for exact wording of account titles. PAGE 1 JOURNAL ACCOUNTING EQUATION DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY Dividing Partnership Income Tyler Hawes and Piper Albright formed a partnership, Investing $72,500 and $217,500, respectively. Determine their participation in the year's net income of $300,000 under each of the following independent assumptions: a. No agreement concerning division of net income. b. Divided in the ratio of original capital investment. C. Interest at the rate of 5% allowed on original investments and the remainder divided in the ratio of 2:3. d. Salary allowances of $38,000 and $48,000, respectively, and the balance divided equally. e. Allowance of interest at the rate of 5% on original investments, salary allowances of $38,000 and $48,000, respectively, and the remainder divided equally. Hawes Albright Dividing LLC Income Martin Farley and Ashley Clark formed a limited liability company with an operating agreement that provided a salary allowance of $58,000 and $46,000 to each member, respectively. In addition, the operating agreement specified an income-sharing ratio of 3:2. The two members withdrew amounts equal to their salary allowances. Revenues were $668,000 and expenses were $520,000, for a net income of $148,000 a. Determine the division of $148,000 net income for the year. Schedule of Division of Net Income Farley Salary allowance Remaining income Net Income b. Provide journal entries to close the (1) revenues and expenses and (2) drawing accounts for the two members. For a compound transaction, if an amount box does not require an entry, leave it blank. (1) Q10 l 1 0