Answered step by step

Verified Expert Solution

Question

1 Approved Answer

recreate financial statements based on the ratio results Since financial and accounting ratios are the product of the relationship of various financial statement line items,

recreate financial statements based on the ratio results

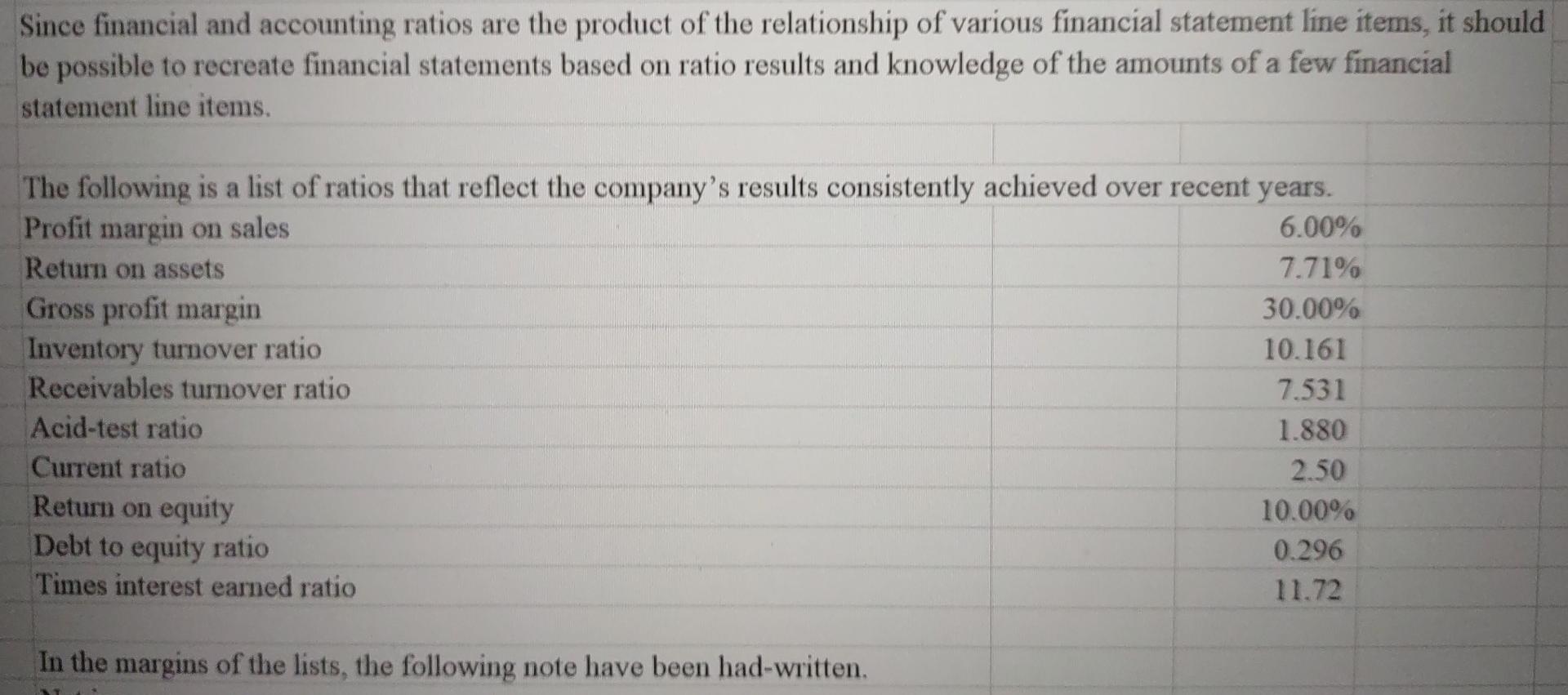

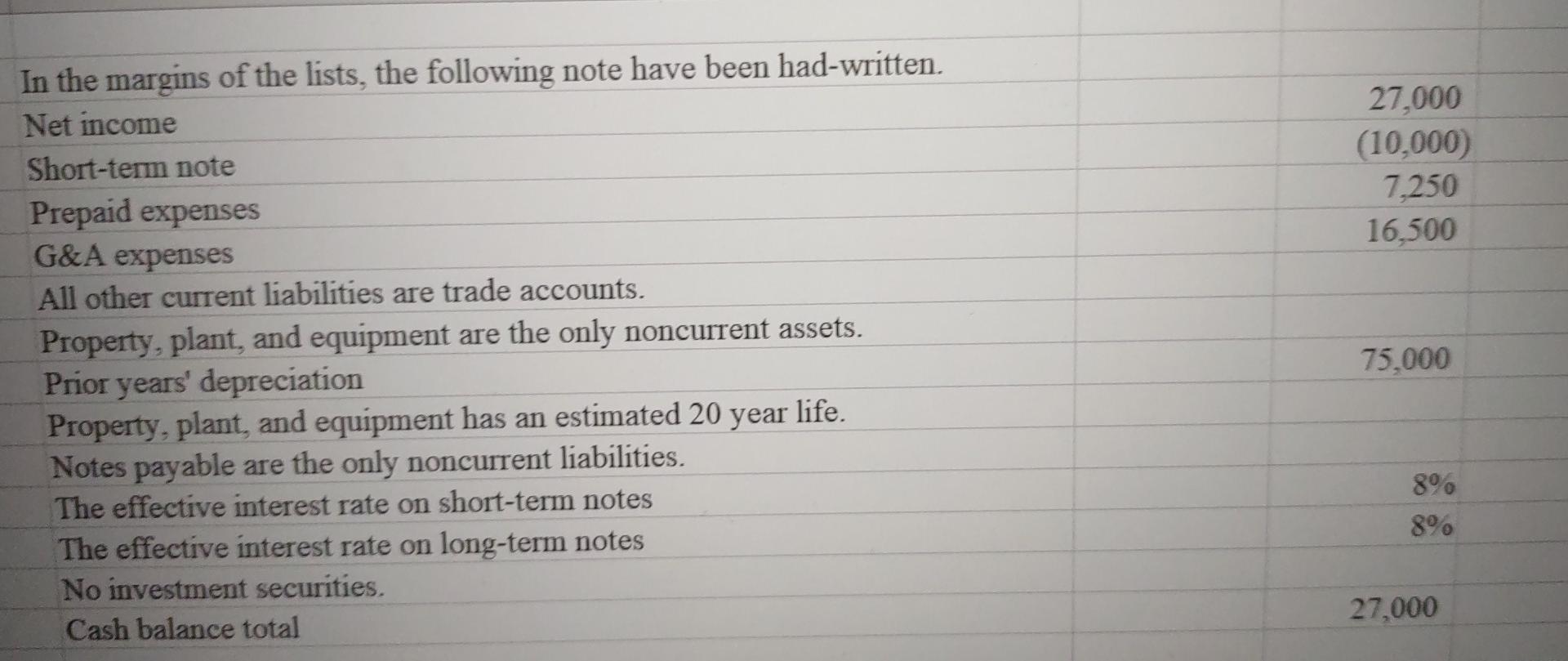

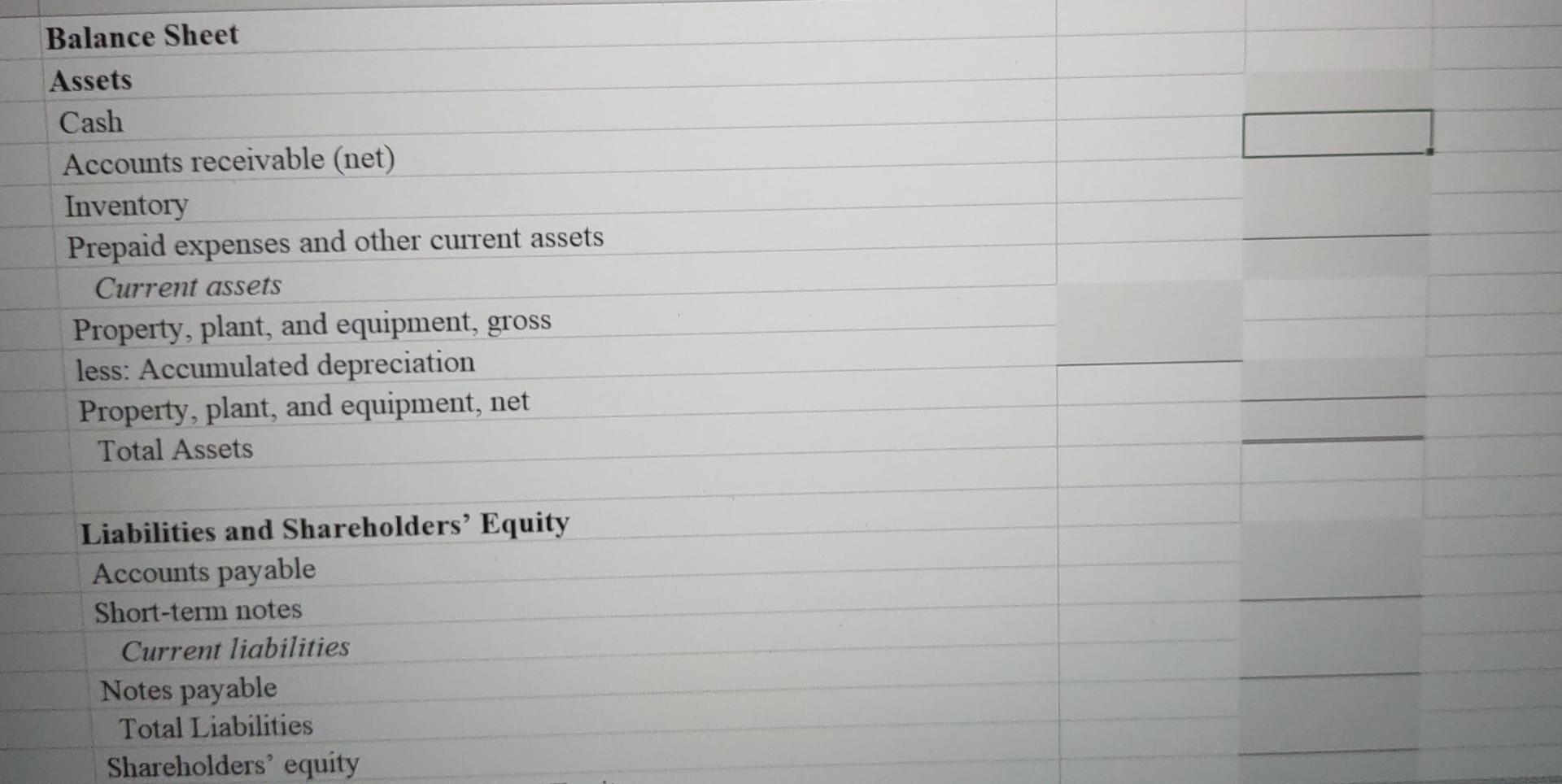

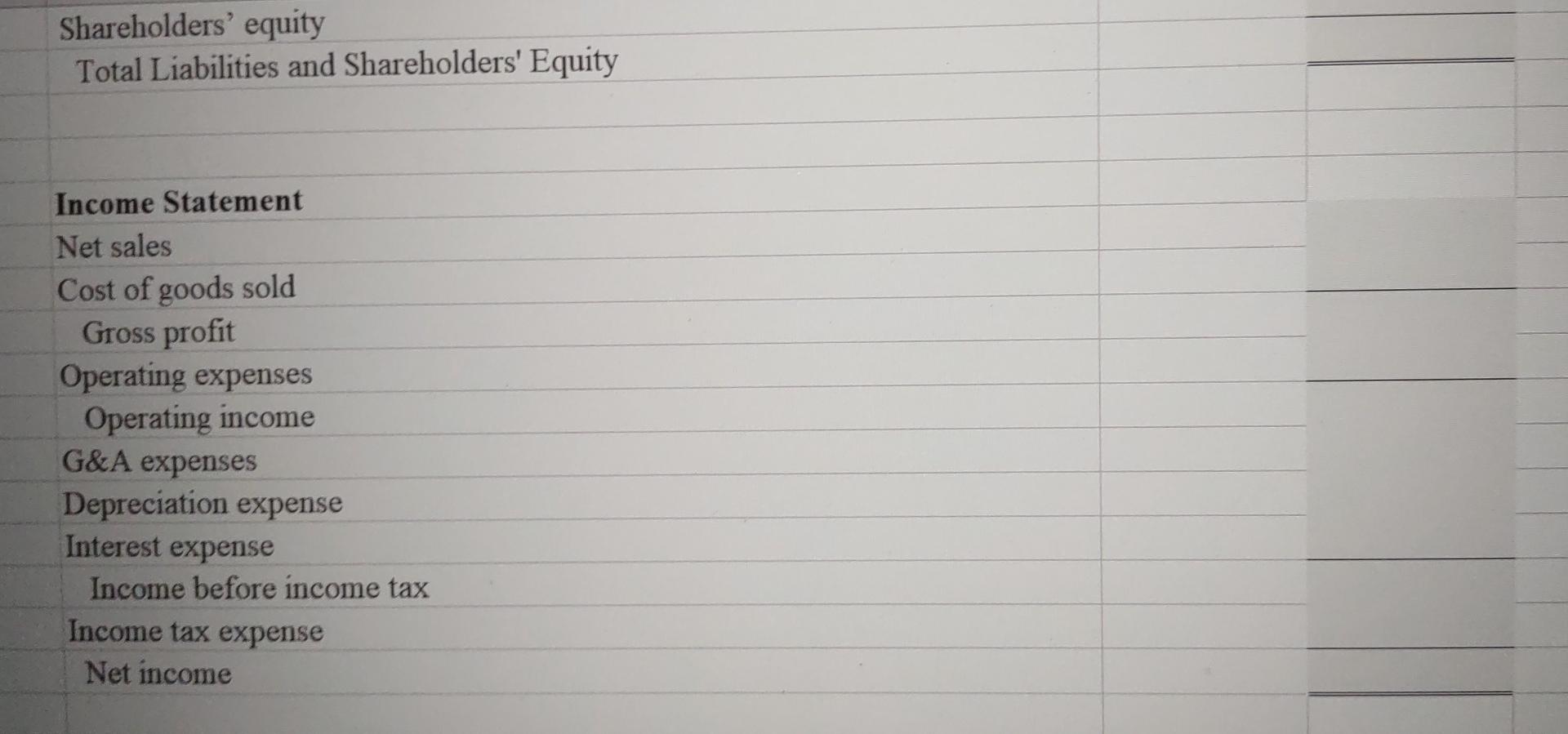

Since financial and accounting ratios are the product of the relationship of various financial statement line items, it should be possible to recreate financial statements based on ratio results and knowledge of the amounts of a few financial statement line items. The following is a list of ratios that reflect the company's results consistently achieved over recent years. Profit margin on sales 6.00% Return on assets 7.71% Gross profit margin 30.00% Inventory turnover ratio 10.161 Receivables turnover ratio 7.531 Acid-test ratio 1.880 Current ratio 2.50 Return on equity 10.00% Debt to equity ratio 0.296 Times interest earned ratio 11.72 In the margins of the lists, the following note have been had-written, 27,000 (10,000) 7.250 16.500 In the margins of the lists, the following note have been had-written Net income Short-term note Prepaid expenses G&A expenses All other current liabilities are trade accounts. Property, plant, and equipment are the only noncurrent assets. Prior years' depreciation Property, plant, and equipment has an estimated 20 year life. Notes payable are the only noncurrent liabilities. The effective interest rate on short-term notes The effective interest rate on long-term notes No investment securities. Cash balance total 75.000 89 8% 27,000 Balance Sheet Assets Cash Accounts receivable (net) Inventory Prepaid expenses and other current assets Current assets Property, plant, and equipment, gross less: Accumulated depreciation Property, plant, and equipment, net Total Assets Liabilities and Shareholders' Equity Accounts payable Short-term notes Current liabilities Notes payable Total Liabilities Shareholders' equity Shareholders' equity Total Liabilities and Shareholders' Equity Income Statement Net sales Cost of goods sold Gross profit Operating expenses Operating income G&A expenses Depreciation expense Interest expense Income before income tax Income tax expense Net incomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started