Answered step by step

Verified Expert Solution

Question

1 Approved Answer

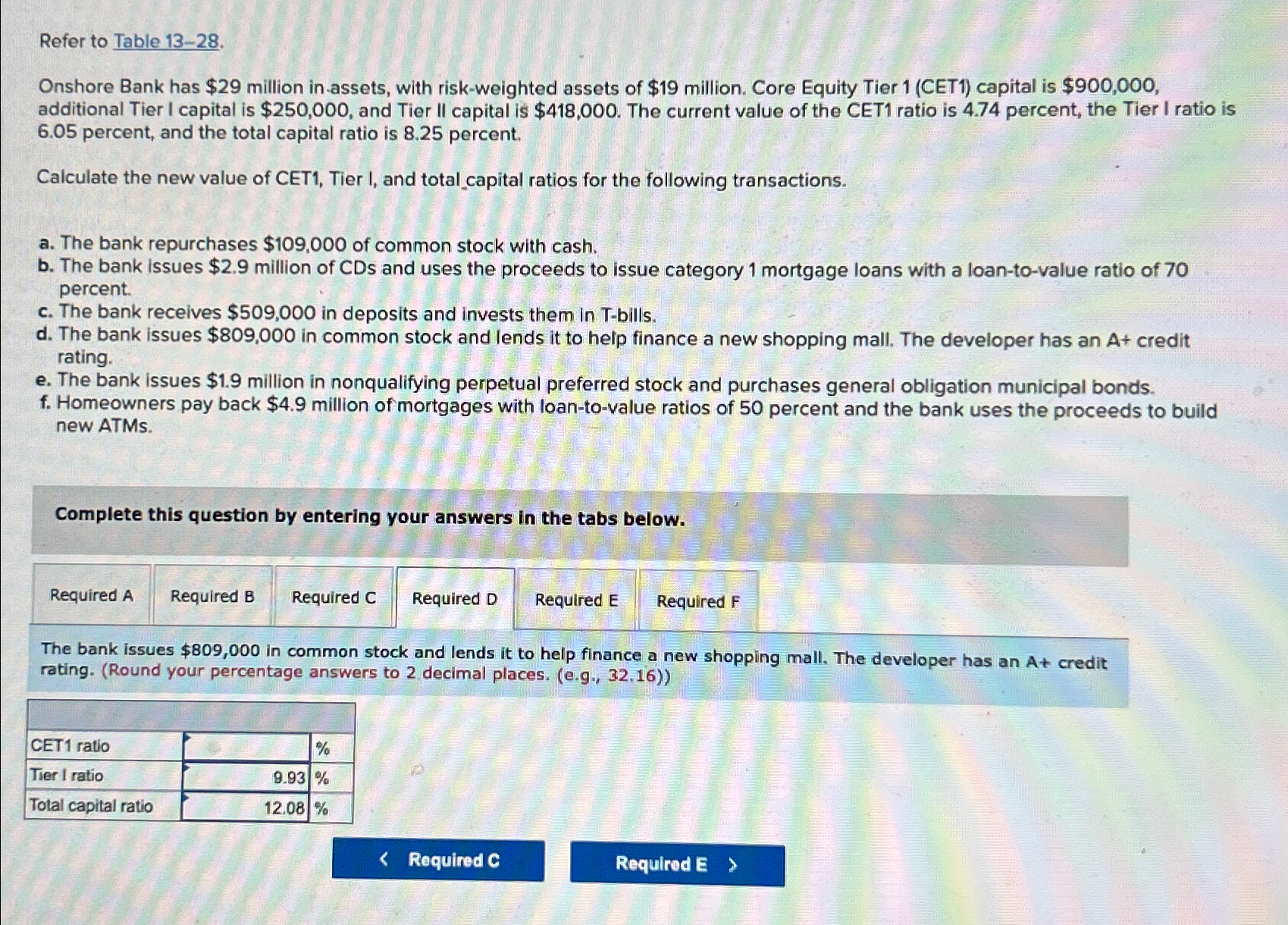

Refer to Table 1 3 - 2 8 . Onshore Bank has $ 2 9 million in assets, with risk - weighted assets of $

Refer to Table

Onshore Bank has $ million in assets, with riskweighted assets of $ million. Core Equity Tier CET capital is $ additional Tier I capital is $ and Tier II capital is $ The current value of the CET ratio is percent, the Tier I ratio is percent, and the total capital ratio is percent.

Calculate the new value of CET Tier I, and totalcapital ratios for the following transactions.

a The bank repurchases $ of common stock with cash.

b The bank issues $ million of CDs and uses the proceeds to issue category mortgage loans with a loantovalue ratio of percent.

c The bank receives $ in deposits and invests them in Tbills.

d The bank issues $ in common stock and lends it to help finance a new shopping mall. The developer has an credit rating.

e The bank issues $ million in nonqualifying perpetual preferred stock and purchases general obligation municipal bonds.

f Homeowners pay back $ million of mortgages with loantovalue ratios of percent and the bank uses the proceeds to build new ATMs.

Complete this question by entering your answers in the tabs below.

Required

Required B

Required C

Required D

Required

The bank issues $ in common stock and lends it to help finance a new shopping mall. The developer has an credit rating. Round your percentage answers to decimal places.

tableCET ratio,,

Please answer Part D E F please

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started