Question

Refer to the Metropolis Health System (MHS) Case Study located in Chapter 33 of the text and use the financial statements found on pp. 462-463

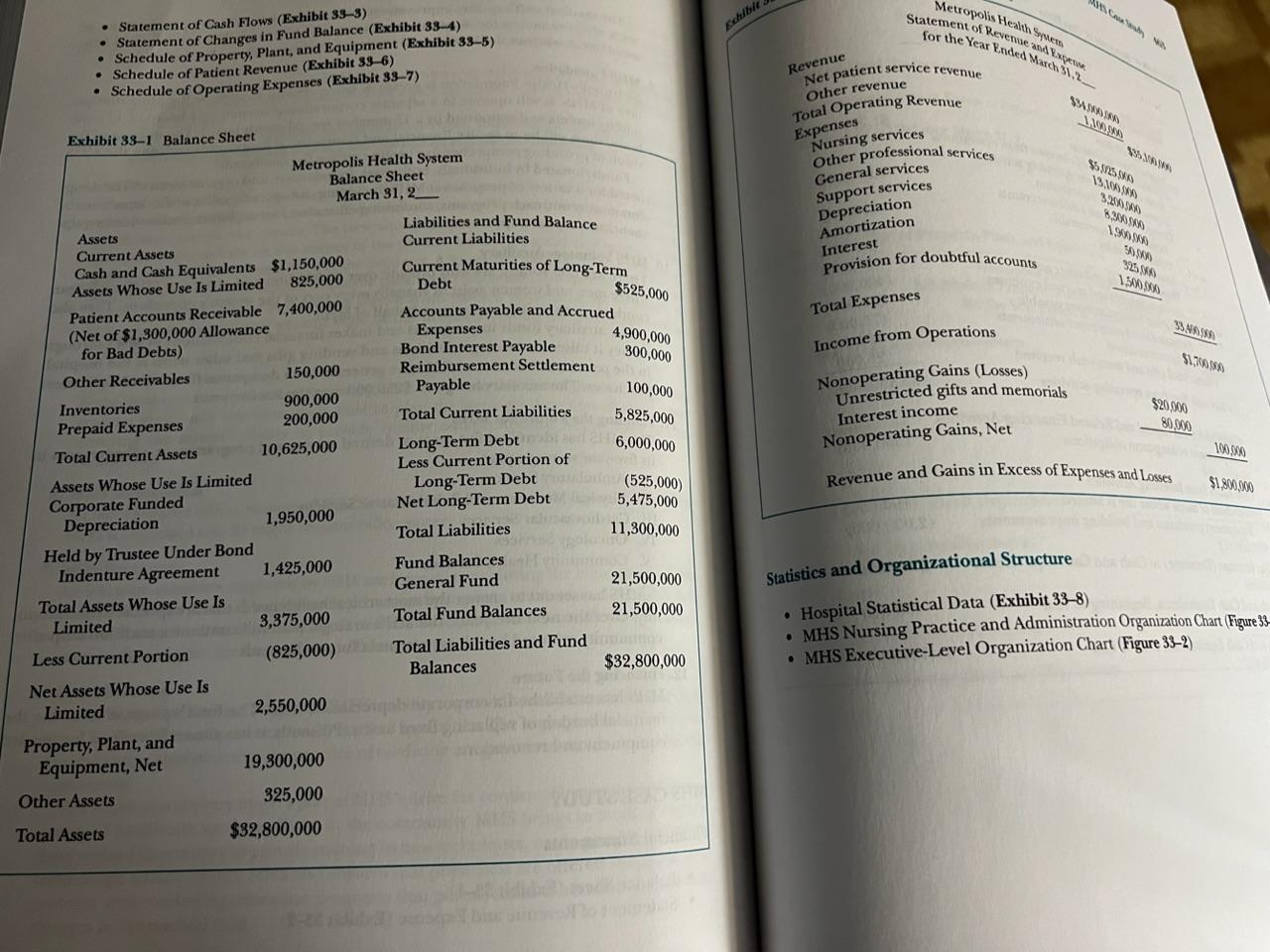

Refer to the Metropolis Health System (MHS) Case Study located in Chapter 33 of the text and use the financial statements found on pp. 462-463 to compute the following four liquidity ratios: Current Ratio Quick Ratio Days Cash on Hand Days Receivables After completing the four required liquidity ratio computations, compare them to the ratio benchmarks provided below and tell how MHS compares to those benchmarks: Current Ratio Benchmark = 1.80 or better Quick Ratio Benchmark = 1.60 or better Days Cash on Hand Benchmark = 90 days or better Days Receivables Benchmark = 52 days or less Metropolis Health System Balance Sheet March 31, 2, Liabilities and Fund Balance Assets Current Liabilities Current Assets Cash and Cash Equivalents $1,150,000 Assets Whose Use Is Limited 825,000 Current Maturities of Long-Term Debt Patient Accounts Receivable 7,400,000 Accounts Payable and Accrued (Net of $1,300,000 Allowance Expenses for Bad Debts) Bond Interest Payable Other Receivables 150,000 Reimbursement Settlement Refer to the Metropolis Health System (MHS) Case Study located in Chapter 33 of the text and use the financial statements found on pp. 462-463 to compute the following four liquidity ratios: Current Ratio Quick Ratio Days Cash on Hand Days Receivables After completing the four required liquidity ratio computations, compare them to the ratio benchmarks provided below and tell how MHS compares to those benchmarks: Current Ratio Benchmark = 1.80 or better - Quick Ratio Benchmark = 1.60 or better Days Cash on Hand Benchmark = 90 days or better Days Receivables Benchmark = 52 days or less Inventories 900,000 Prepaid Expenses 200,000 Total Current Liabilities Total Current Assets 10,625,000 Long-Term Debt Less Current Portion of Assets Whose Use Is Limited Long-Term Debt Corporate Funded Net Long-Term Debt Depreciation 1,950,000 Total Liabilities Held by Trustee Under Bond Indenture Agreement 1,425,000 Fund Balances General Fund Total Assets Whose Use Is Limited 3,375,000 Total Fund Balances Less Current Portion (825,000) Total Liabilities and Fund Balances Net Assets Whose Use Is Limited 2,550,000 Property, Plant, and Equipment, Net 19,300,000 325,000 Other Assets Total Assets $32,800,00

Refer to the Metropolis Health System (MHS) Case Study located in Chapter 33 of the text and use the financial statements found on pp. 462-463 to compute the following four liquidity ratios: Current Ratio Quick Ratio Days Cash on Hand Days Receivables After completing the four required liquidity ratio computations, compare them to the ratio benchmarks provided below and tell how MHS compares to those benchmarks: Current Ratio Benchmark = 1.80 or better Quick Ratio Benchmark = 1.60 or better Days Cash on Hand Benchmark = 90 days or better Days Receivables Benchmark = 52 days or less Metropolis Health System Balance Sheet March 31, 2, Liabilities and Fund Balance Assets Current Liabilities Current Assets Cash and Cash Equivalents $1,150,000 Assets Whose Use Is Limited 825,000 Current Maturities of Long-Term Debt Patient Accounts Receivable 7,400,000 Accounts Payable and Accrued (Net of $1,300,000 Allowance Expenses for Bad Debts) Bond Interest Payable Other Receivables 150,000 Reimbursement Settlement Refer to the Metropolis Health System (MHS) Case Study located in Chapter 33 of the text and use the financial statements found on pp. 462-463 to compute the following four liquidity ratios: Current Ratio Quick Ratio Days Cash on Hand Days Receivables After completing the four required liquidity ratio computations, compare them to the ratio benchmarks provided below and tell how MHS compares to those benchmarks: Current Ratio Benchmark = 1.80 or better - Quick Ratio Benchmark = 1.60 or better Days Cash on Hand Benchmark = 90 days or better Days Receivables Benchmark = 52 days or less Inventories 900,000 Prepaid Expenses 200,000 Total Current Liabilities Total Current Assets 10,625,000 Long-Term Debt Less Current Portion of Assets Whose Use Is Limited Long-Term Debt Corporate Funded Net Long-Term Debt Depreciation 1,950,000 Total Liabilities Held by Trustee Under Bond Indenture Agreement 1,425,000 Fund Balances General Fund Total Assets Whose Use Is Limited 3,375,000 Total Fund Balances Less Current Portion (825,000) Total Liabilities and Fund Balances Net Assets Whose Use Is Limited 2,550,000 Property, Plant, and Equipment, Net 19,300,000 325,000 Other Assets Total Assets $32,800,00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started