Question

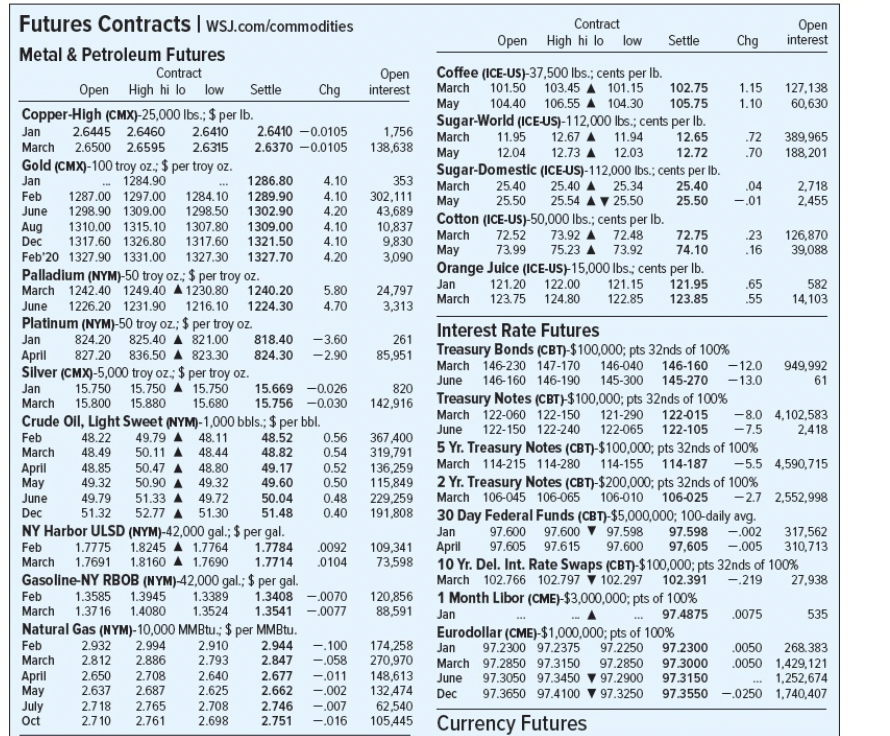

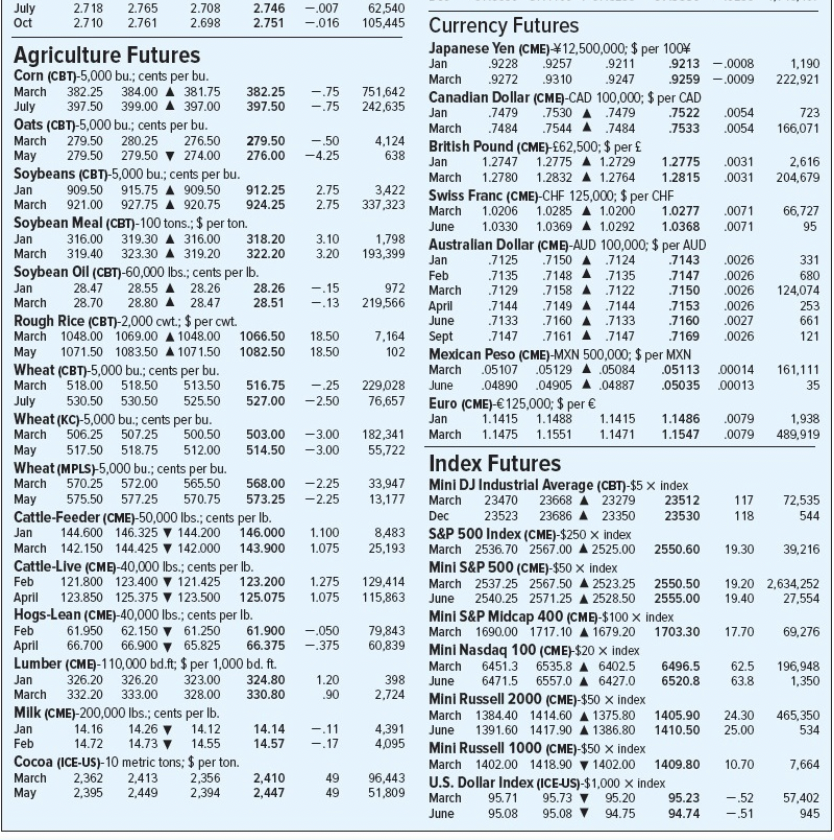

Refer to the Mini-S&P contract in Figure 22.1. Assume the closing price for this day. a. If the margin requirement is 28% of the futures

Refer to the Mini-S&P contract in Figure 22.1. Assume the closing price for this day. a. If the margin requirement is 28% of the futures price times the contract multiplier of $50, how much must you deposit with your broker to trade the June maturity contract? (Round your answer to the nearest whole dollar.)

b. If the June futures price increases to 2601.20, what percentage return will you earn on your investment if you entered the long side of the contract at the price shown in the figure? (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. If the June futures price falls by 1%, what is your percentage return? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.)

1.15 .70 23 Dec .16 Futures Contracts | WSJ.com/commodities Contract Open Open High hilo low Settle Chg interest Metal & Petroleum Futures Contract Open Coffee (ICE-US)-37,500 lbs., cents per lb. Open High hilo low Settle Chg interest March 101.50 103.45 A 101.15 102.75 127,138 May 104.40 106.55 A 104.30 105.75 1.10 60,630 Copper-High (CMX)-25,000 lbs.; $ per lb. Sugar-World (ICE-US)-112,000 lbs., cents per lb. Jan 2.6445 2.6460 2.6410 2.6410 -0.0105 1,756 March 11.95 12.67 A 11.94 12.65 .72 389,965 March 2.6500 2.6595 2.6315 2.6370 -0.0105138,638 May 12.04 12.73 A 12.03 12.72 188,201 Gold (CMX)-100 troy oz. $ per troy oz. Sugar-Domestic (ICE-US)-112,000 lbs., cents per lb. Jan .. 1284.90 1286.80 4.10 353 March 25.40 25.40 A 25.34 25.40 .04 2,718 Feb 1287.00 1297.00 1284.10 1289.90 4.10 302,111 May 25.50 25.54 A 25.50 25.50 -.01 2,455 June 1298.90 1309.00 1298.50 1302.90 4.20 43,689 Cotton (ICE-US)-50,000 lbs., cents per lb. Aug 1310.00 1315.10 1307.80 1309.00 4.10 10,837 1317.60 1326.801317.60 1321.50 4.10 9,830 March 72.52 73.92 A 72.48 72.75 126,870 Feb'20 1327.90 1331.00 1327.30 1327.70 4.20 3,090 May 73.99 75.23 A 73.92 74.10 39,088 Palladium (NYM)-50 troy oz. $ per troy oz. Orange Juice (ICE-US)15,000 lbs.; cents per lb. March 1242.40 1249.40 A 1230.80 1240.20 24,797 Jan 5.80 121.20 122.00 121.15 121.95 .65 582 June 1226.20 1231.90 1216.10 1224.30 4.70 3,313 123.85 March 123.75 124.80 122.85 .55 14.103 Platinum (NYM)-50 troy oz.; $ per troy oz. Jan Interest Rate Futures 824.20 825.40 A 821.00 818.40 -3.60 261 April 827.20 836.50 A 823.30 824.30 -2.90 85,951 Treasury Bonds (CBT)-$100,000; pts 32nds of 100% Silver (CMX)-5,000 troy oz.; $ per troy oz. March 146-230 147-170 146-040 146-160 -12.0 949,992 June Jan 61 15.750 15.750 15.750 15.669 -0.026 146-160 146-190 145-300 145-270 -13.0 820 March 15.800 15.880 15.680 15.756 -0.030 142,916 Treasury Notes (CBT)-$100,000; pts 32nds of 100% March 122-060 122-150 Crude Oil, Light Sweet (NYM)-1,000 bbls.; $ per bbl. 121-290 122-015 -8.0 4.102,583 June 122-150 122-240 Feb -7.5 49.79 A 48.11 48.22 48.52 0.56 122-065 122-105 367.400 2,418 March 48.49 50.11 A 48.44 48.82 0.54 319,791 5 Yr. Treasury Notes (CBT)-$100,000; pts 32nds of 100% 48.85 50.47 A 48.80 49.17 0.52 136,259 March 114-215 114-280 114-155 114-187 -5.5 4,590,715 May 49.32 50.90 A 49.32 49.60 0.50 115,849 2 Yr. Treasury Notes (CBT)-$200,000; pts 32nds of 100% June 49.79 51.33 A 49.72 50.04 0.48 229,259 March 106-045 106-065 106-010 106-025 -2.7 2,552,998 Dec 51.32 52.77 A 51.30 51.48 0.40 191,808 30 Day Federal Funds (CBT)-$5,000,000; 100-daily avg. NY Harbor ULSD (NYM)-42,000 gal.; $ per gal. Jan 97.600 97.600 97.598 97.598 -.002 317,562 Feb 1.7775 1.8245 A 1.7764 1.7784 .0092 109,341 April 97.605 97.615 97.600 97,605 -.005 310,713 March 1.7691 1.8160 A 1.7690 1.7714 .0104 73,598 10 Yr. Del. Int. Rate Swaps (CBT)-$100,000; pts 32nds of 100% Gasoline-NY RBOB (NYM)-42,000 gal.; $ per gal. March 102.766 102.797 102.297 102.391 -219 27,938 Feb 1.3585 1.3945 1.3389 1.3408 -.0070 120,856 1 Month Libor (CME)-$3,000,000; pts of 100% March 1.3716 1.4080 1.3524 1.3541 -.0077 88,591 Jan 97.4875 .0075 535 Natural Gas (NYM)-10,000 MMBtu.; $ per MMBtu. Eurodollar (CME)-$1,000,000; pts of 100% Feb 2.932 2.994 2.910 2.944 -.100 174,258 Jan 97.2300 97.2375 97.2250 97.2300 .0050 268.383 March 2.812 2.886 2.793 2.847 -.058 270,970 March 97.2850 97.3150 97.2850 97.3000 .0050 1,429,121 April 2.650 2.708 2.640 2.677 -.011 148,613 June 97.3050 97.3450 97.2900 97.3150 1,252,674 May 2.637 2.687 2.625 2.662 -.002 132.474 Dec 97.3650 97.4100 97.3250 97.3550 -.0250 1,740,407 July 2.718 2.765 2.708 2.746 -.007 62,540 Oct 2.710 2.761 2.698 2.751 - .016 105,445 Currency Futures April Jan Jan 638 253 July 2.718 2.765 2.708 2.746 -.007 Oct 2.710 2.761 2.698 2.751 -.016 Agriculture Futures Corn (CBT)-5,000 bu; cents per bu. March 382.25 384.00 381.75 382.25 -.75 July 397.50 399.00 A 397.00 397.50 -.75 Oats (CBT)-5,000 bu.; cents per bu. March 279.50 280.25 276.50 279.50 -.50 May 279.50 279.50 274.00 276.00 -4.25 Soybeans (CBT)-5,000 bu., cents per bu. Jan 909.50 915.75 A 909.50 912.25 2.75 March 921.00 927.75 A 920.75 924.25 2.75 Soybean Meal (CBT)-100 tons.: $ per ton. Jan 316.00 319.30 A 316.00 318.20 3.10 March 319.40 323.30 A 319.20 322.20 3.20 Soybean Oil (CBT)-60,000 lbs., cents per lb. Jan 28.47 28.55 A 28.26 28.26 -15 March 28.70 28.80 A 28.47 28.51 -.13 Rough Rice (CBT)-2,000 cwt.; $ per cwt. March 1048.00 1069.00 A 1048.00 1066.50 18.50 May 1071.50 1083.50 A 107 1.50 1082.50 18.50 Wheat (CBT)-5,000 bu., cents per bu. March 518.00 518.50 513.50 516.75 -.25 530.50 530.50 525.50 527.00 -2.50 Wheat (KC)-5,000 bu.; cents per bu. March 506.25 507.25 500.50 503.00 -3.00 May 517.50 518.75 512.00 514.50 -3.00 Wheat (MPLS) 5,000 bu.; cents per bu. March 570.25 572.00 565.50 568.00 -2.25 May 575.50 577.25 570.75 573.25 -2.25 Cattle-Feeder (CME)-50,000 lbs., cents per lb. Jan 144.600 146.325 144.200 146.000 1.100 March 142.150 144.425 142.000 143.900 1.075 Cattle-Live (CME)-40,000 lbs., cents per lb. Feb 121.800 123.400 V 121.425 123.200 1.275 April 123.850 125.375 123.500 125.075 1.075 Hogs-Lean (CME)-40,000 lbs., cents per lb. Feb 61.950 62.150 61.250 61.900 -.050 April 66.700 66.900 65.825 66.375 -.375 Lumber (CME)-110,000 bd.ft; $ per 1,000 bd. ft. Jan 326.20 326.20 323.00 324.80 1.20 March 332.20 333.00 328.00 330.80 .90 Milk (CME)-200,000 lbs., cents per lb. Jan 14.16 14.26 14.12 14.14 -.11 Feb 14.72 14.73 14.55 14.57 -.17 Cocoa (ICE-US)-10 metric tons: $ per ton. March 2,362 2,413 2,356 2,410 49 May 2,395 2.449 2,394 2,447 49 July 62,540 105,445 Currency Futures Japanese Yen (CME) #12,500,000; $ per 1004 .9228 9257 .9211 .9213-0008 1,190 March .9272 .9310 .9247 9259 -.0009 222,921 751,642 Canadian Dollar (CME-CAD 100,000; $ per CAD 242,635 .7479 7530 A 7479 .7522 .0054 723 March .7484 .7544 A 7484 .7533 .0054 166,071 4.124 British Pound (CME)62,500; $ per Jan 1.2747 1.2775 A 1.2729 1.2775 .0031 2,616 March 1.2780 1.2832 A 1.2764 1.2815 .0031 204,679 3,422 337,323 Swiss Franc (CME)-CHF 125,000; $ per CHF March 1.0206 1.0285 A 1.0200 1.0277 .0071 66,727 June 1.0330 1.0369 A 1.0292 1.0368 .0071 95 1,798 Australian Dollar (CME-AUD 100,000; $ per AUD 193,399 Jan .7125 .7150 A 7124 .7143 .0026 331 Feb .7135 .7148 A 7135 .7147 .0026 680 972 March .7129 .7158 A 7122 .7150 .0026 124,074 219,566 April .7144 .7149 A 7144 .7153 .0026 June .7133 .7160 A 7133 .7160 .0027 661 7,164 Sept .7147 .7161 A 7147 .7169 .0026 121 102 Mexican Peso (CME)-MXN 500,000; $ per MXN March .05107 .05129 A .05084 .05113 .00014 161,111 229,028 June .04890 .04905 A .04887 .05035 .00013 35 76,657 Euro (CME)-125,000; $ per Jan 1.1415 1.1488 1.1415 1.1486 .0079 1,938 182,341 March 1.1475 1.1551 1.1471 1.1547 .0079 489,919 55,722 Index Futures 33,947 Mini DJ Industrial Average (CBT)-$5 X index 13,177 March 23470 23668 A 23279 23512 117 72,535 Dec 23523 23686 A 23350 23530 118 544 8,483 S&P 500 Index (CME)-$250 x index 25,193 March 2536.70 2567.00 A 2525.00 2550.60 19.30 39,216 Mini S&P 500 (CME)-$50 x index 129,414 March 2537.25 2567.50 A 2523.25 2550.50 19.20 2,634,252 115,863 June 2540.25 2571.25 A2528.50 2555.00 19.40 27,554 Mini S&P Midcap 400 (CME)-$100 X index 79,843 March 1690.00 1717.10 A 1679.20 1703.30 17.70 69,276 60,839 Mini Nasdaq 100 (CME)-$20 x index March 6451.3 6535.8 A 6402.5 6496.5 62.5 196,948 398 June 6471.5 6557.0 A 6427.0 6520.8 63.8 1,350 2,724 Mini Russell 2000 (CME)-$50 X index March 1384.40 1414.60 A 1375.80 1405.90 24.30 465,350 4,391 June 1391.60 1417.90 A 1386.80 1410.50 25.00 534 4,095 Mini Russell 1000 (CME)-$50 X index March 1402.00 1418.90 1402.00 1409.80 10.70 7,664 96,443 U.S. Dollar Index (ICE-US)-$1,000 x index 51,809 March 95.71 95.73 95.20 95.23 -.52 57,402 June 95.08 95.0894.75 94.74 -.51 945

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started