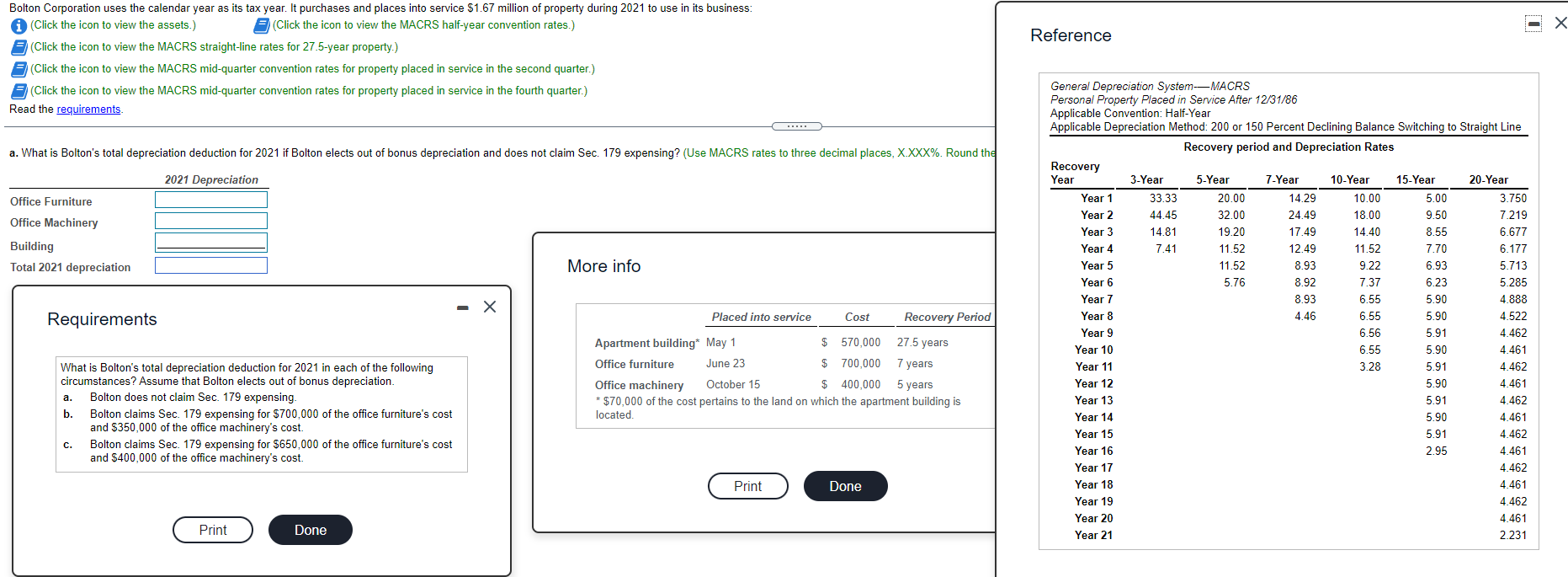

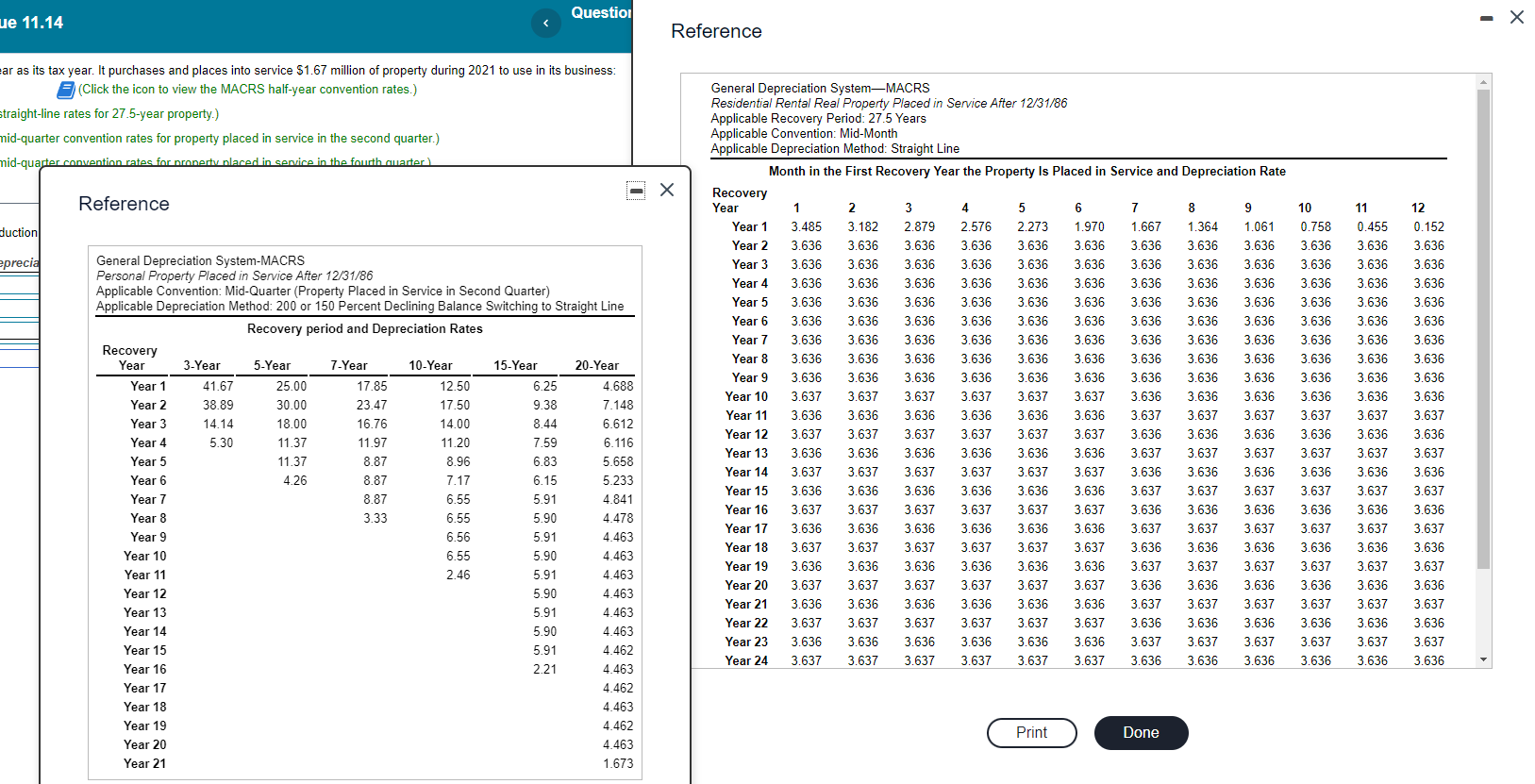

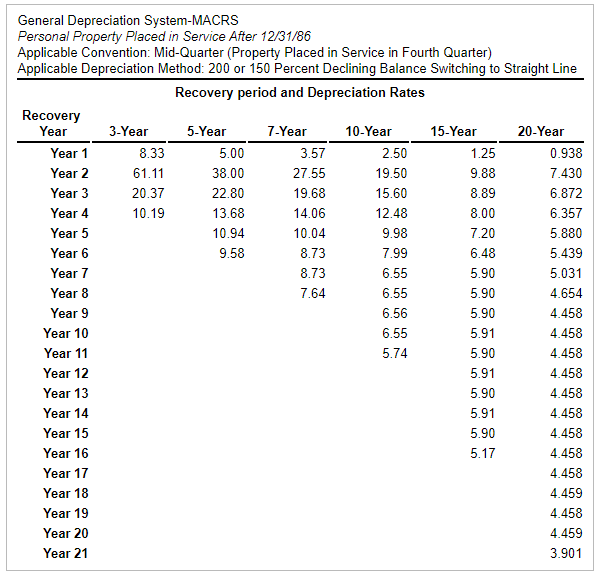

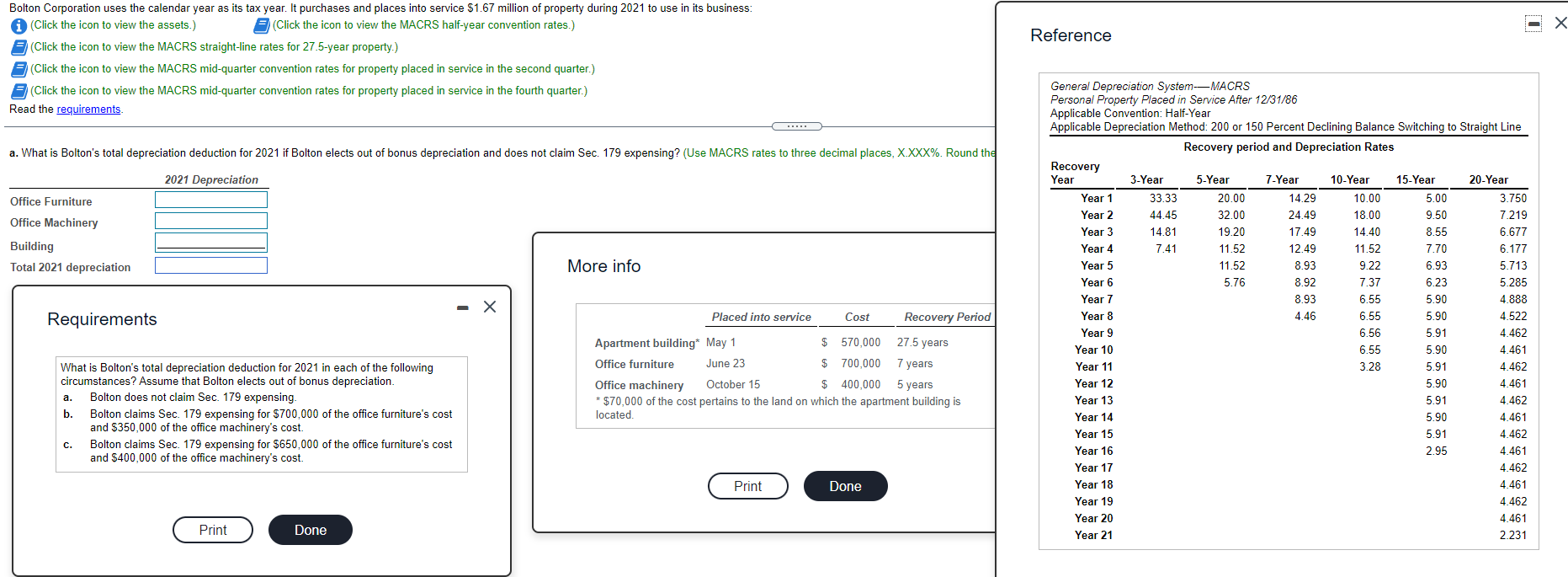

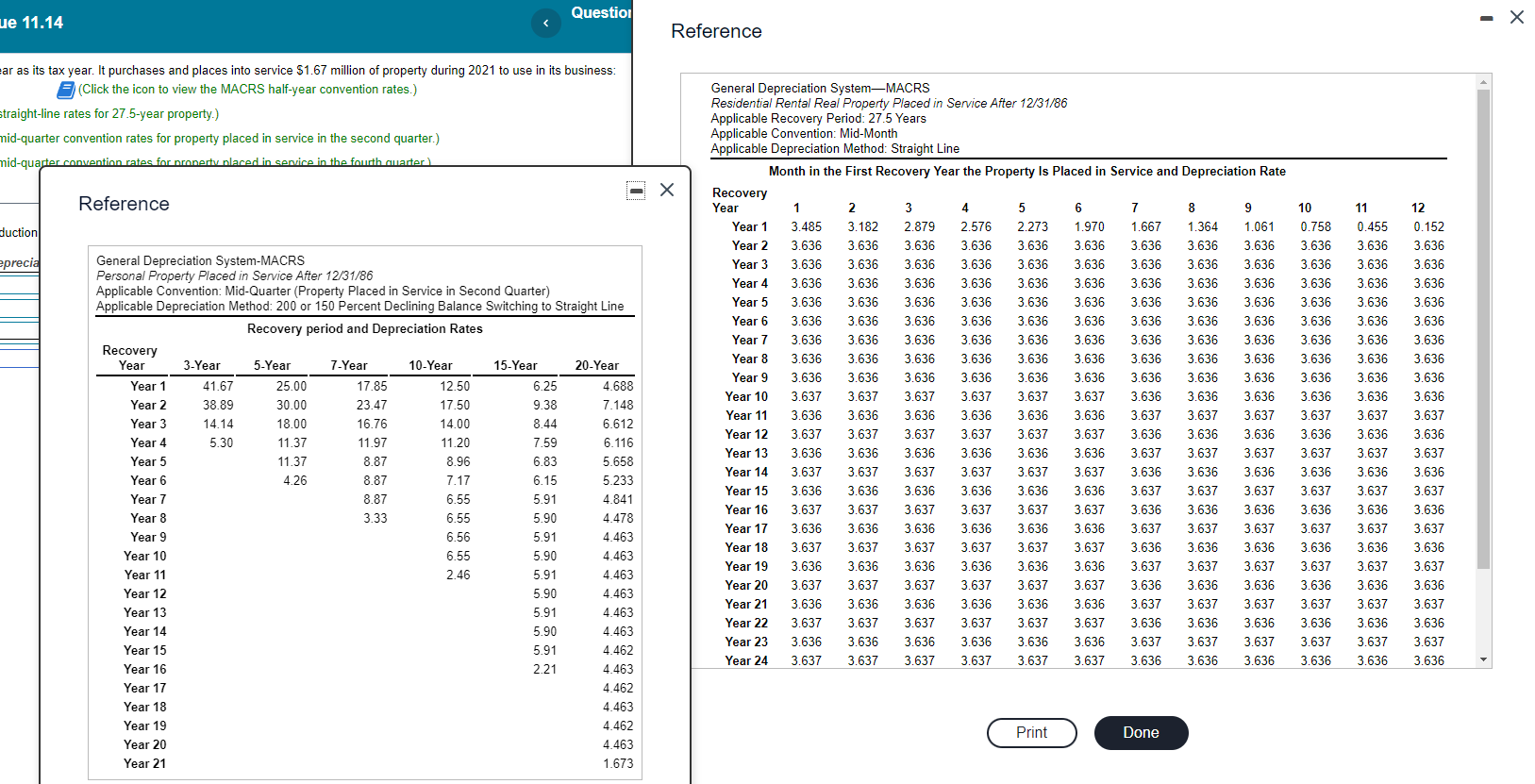

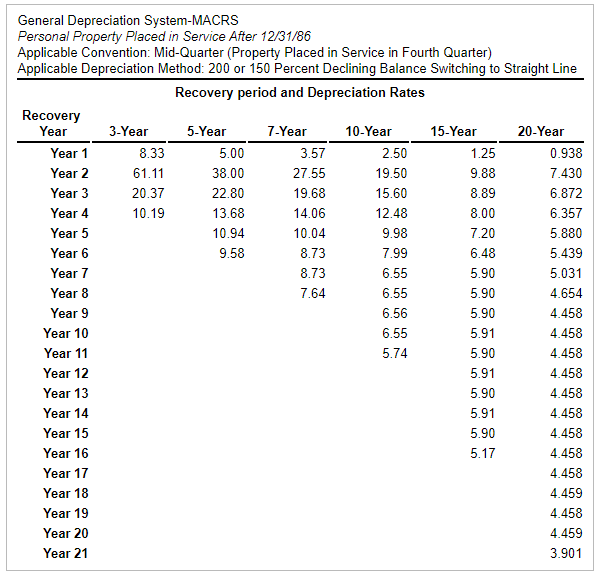

Reference Bolton Corporation uses the calendar year as its tax year. It purchases and places into service $1.67 million of property during 2021 to use in its business: i (Click the icon to view the assets.) (Click the icon to view the MACRS half-year convention rates.) (Click the icon to view the MACRS straight-line rates for 27.5-year property.) (Click the icon to view the MACRS mid-quarter convention rates for property placed in service in the second quarter.) (Click the icon to view the MACRS mid-quarter convention rates for property placed in service in the fourth quarter.) Read the requirements a. What is Bolton's total depreciation deduction for 2021 if Bolton elects out of bonus depreciation and does not claim Sec. 179 expensing? (Use MACRS rates to three decimal places, X.XXX%. Round the 2021 Depreciation Office Furniture Office Machinery Building Total 2021 depreciation More info - X Requirements General Depreciation System-MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Half-Year Applicable Depreciation Method: 200 or 150 Percent Declining Balance Switching to Straight Line Recovery period and Depreciation Rates Recovery Year 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Year 1 33.33 20.00 14.29 10.00 5.00 3.750 Year 2 44.45 32.00 24.49 18.00 9.50 7.219 Year 3 14.81 19.20 17.49 14.40 8.55 6.677 Year 4 7.41 11.52 12.49 11.52 7.70 6.177 Year 5 11.52 8.93 9.22 6.93 5.713 Year 6 5.76 8.92 7.37 6.23 5.285 Year 7 8.93 6.55 5.90 4.888 Year 8 4.46 6.55 5.90 4.522 Year 9 6.56 5.91 4.462 Year 10 6.55 5.90 4.461 Year 11 3.28 5.91 4.462 Year 12 5.90 4.461 Year 13 5.91 4.462 Year 14 5.90 4.461 Year 15 5.91 4.462 Year 16 2.95 4.461 Year 17 4.462 Year 18 4.461 Year 19 4.462 Year 20 4.461 Year 21 2.231 Placed into service Cost Recovery Period Apartment building* May 1 $ 570,000 27.5 years Office furniture June 23 $ 700,000 7 years Office machinery October 15 $ 400,000 * $70,000 of the cost pertains to the land on which the apartment building is located What is Bolton's total depreciation deduction for 2021 in each of the following circumstances? Assume that Bolton elects out of bonus depreciation. a. Bolton does not claim Sec. 179 expensing. b. Bolton claims Sec. 179 expensing for $700,000 of the office furniture's cost and $350,000 of the office machinery's cost. c. Bolton claims Sec. 179 expensing for $650,000 of the office furniture's cost and $400,000 of the office machinery's cost. 5 years Print Done Print Done Question ue 11.14 Reference ar as its tax year. It purchases and places into service 51.67 million of property during 2021 to use in its business: (Click the icon to view the MACRS half-year convention rates.) straight-line rates for 27.5-year property.) mid-quarter convention rates for property placed in service in the second quarter.) mid-quarter convention rates for pronertu nlaced in service in the fourth quarter) Reference duction eprecia 3-Year General Depreciation System-MACRS Residential Rental Real Property Placed in Service After 12/31/86 Applicable Recovery Period: 27.5 Years Applicable Convention: Mid-Month Applicable Depreciation Method: Straight Line Month in the First Recovery Year the Property Is Placed in Service and Depreciation Rate Recovery Year 1 2 3 4 5 6 7 7 8 9 Year 1 3.485 3.182 2.879 2.576 2.273 1.970 1.667 1.364 1.061 Year 2 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 Year 3 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 Year 4 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 Year 5 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 Year 6 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 Year 7 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 Year 8 8 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 Year 9 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 Year 10 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 Year 11 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.637 3.637 Year 12 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 Year 13 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.637 3.637 Year 14 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 Year 15 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.637 3.637 Year 16 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 Year 17 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.637 3.637 Year 18 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 Year 19 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.637 3.637 Year 20 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 Year 21 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.637 3.637 Year 22 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 Year 23 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.637 3.637 Year 24 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 General Depreciation System-MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Mid-Quarter (Property Placed in Service in Second Quarter) Applicable Depreciation Method: 200 or 150 Percent Declining Balance Switching to Straight Line Recovery period and Depreciation Rates Recovery Year 5-Year 7-Year 10-Year 15-Year 20-Year Year 1 41.67 25.00 17.85 12.50 6.25 4.688 Year 2 38.89 30.00 23.47 17.50 9.38 7.148 Year 3 18.00 16.76 14.00 8.44 6.612 Year 4 5.30 11.37 11.97 11.20 7.59 6.116 Year 5 11.37 8.87 8.96 6.83 5.658 Year 6 4.26 8.87 7.17 6.15 5.233 Year 7 8.87 6.55 5.91 4.841 Year 8 3.33 6.55 5.90 4.478 Year 9 6.56 5.91 4.463 Year 10 6.55 5.90 4.463 Year 11 2.46 5.91 4.463 Year 12 5.90 4.463 Year 13 5.91 4.463 Year 14 5.90 4.463 Year 15 5.91 4.462 Year 16 2.21 4.463 Year 17 4.462 Year 18 4.463 Year 19 4.462 Year 20 4.463 Year 21 1.673 14.14 10 0.758 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 11 0.455 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 12 0.152 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 Print Done General Depreciation System-MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Mid-Quarter (Property Placed in Service in Fourth Quarter) Applicable Depreciation Method: 200 or 150 Percent Declining Balance Switching to Straight Line Recovery period and Depreciation Rates Recovery Year 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Year 1 8.33 5.00 3.57 2.50 1.25 0.938 Year 2 61.11 38.00 27.55 19.50 9.88 7.430 Year 3 20.37 22.80 19.68 15.60 8.89 6.872 Year 4 10.19 13.68 14.06 12.48 8.00 6.357 Year 5 10.94 10.04 9.98 7.20 5.880 Year 6 9.58 8.73 7.99 6.48 5.439 Year 7 8.73 6.55 5.90 5.031 Year 8 7.64 6.55 5.90 4.654 Year 9 6.56 5.90 4.458 Year 10 6.55 5.91 4.458 Year 11 5.74 5.90 4.458 Year 12 5.91 4.458 Year 13 5.90 4.458 Year 14 5.91 4.458 Year 15 5.90 4.458 Year 16 5.17 4.458 Year 17 4.458 Year 18 4.459 Year 19 4.458 Year 20 4.459 Year 21 3.901 Reference Bolton Corporation uses the calendar year as its tax year. It purchases and places into service $1.67 million of property during 2021 to use in its business: i (Click the icon to view the assets.) (Click the icon to view the MACRS half-year convention rates.) (Click the icon to view the MACRS straight-line rates for 27.5-year property.) (Click the icon to view the MACRS mid-quarter convention rates for property placed in service in the second quarter.) (Click the icon to view the MACRS mid-quarter convention rates for property placed in service in the fourth quarter.) Read the requirements a. What is Bolton's total depreciation deduction for 2021 if Bolton elects out of bonus depreciation and does not claim Sec. 179 expensing? (Use MACRS rates to three decimal places, X.XXX%. Round the 2021 Depreciation Office Furniture Office Machinery Building Total 2021 depreciation More info - X Requirements General Depreciation System-MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Half-Year Applicable Depreciation Method: 200 or 150 Percent Declining Balance Switching to Straight Line Recovery period and Depreciation Rates Recovery Year 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Year 1 33.33 20.00 14.29 10.00 5.00 3.750 Year 2 44.45 32.00 24.49 18.00 9.50 7.219 Year 3 14.81 19.20 17.49 14.40 8.55 6.677 Year 4 7.41 11.52 12.49 11.52 7.70 6.177 Year 5 11.52 8.93 9.22 6.93 5.713 Year 6 5.76 8.92 7.37 6.23 5.285 Year 7 8.93 6.55 5.90 4.888 Year 8 4.46 6.55 5.90 4.522 Year 9 6.56 5.91 4.462 Year 10 6.55 5.90 4.461 Year 11 3.28 5.91 4.462 Year 12 5.90 4.461 Year 13 5.91 4.462 Year 14 5.90 4.461 Year 15 5.91 4.462 Year 16 2.95 4.461 Year 17 4.462 Year 18 4.461 Year 19 4.462 Year 20 4.461 Year 21 2.231 Placed into service Cost Recovery Period Apartment building* May 1 $ 570,000 27.5 years Office furniture June 23 $ 700,000 7 years Office machinery October 15 $ 400,000 * $70,000 of the cost pertains to the land on which the apartment building is located What is Bolton's total depreciation deduction for 2021 in each of the following circumstances? Assume that Bolton elects out of bonus depreciation. a. Bolton does not claim Sec. 179 expensing. b. Bolton claims Sec. 179 expensing for $700,000 of the office furniture's cost and $350,000 of the office machinery's cost. c. Bolton claims Sec. 179 expensing for $650,000 of the office furniture's cost and $400,000 of the office machinery's cost. 5 years Print Done Print Done Question ue 11.14 Reference ar as its tax year. It purchases and places into service 51.67 million of property during 2021 to use in its business: (Click the icon to view the MACRS half-year convention rates.) straight-line rates for 27.5-year property.) mid-quarter convention rates for property placed in service in the second quarter.) mid-quarter convention rates for pronertu nlaced in service in the fourth quarter) Reference duction eprecia 3-Year General Depreciation System-MACRS Residential Rental Real Property Placed in Service After 12/31/86 Applicable Recovery Period: 27.5 Years Applicable Convention: Mid-Month Applicable Depreciation Method: Straight Line Month in the First Recovery Year the Property Is Placed in Service and Depreciation Rate Recovery Year 1 2 3 4 5 6 7 7 8 9 Year 1 3.485 3.182 2.879 2.576 2.273 1.970 1.667 1.364 1.061 Year 2 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 Year 3 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 Year 4 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 Year 5 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 Year 6 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 Year 7 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 Year 8 8 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 Year 9 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 Year 10 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 Year 11 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.637 3.637 Year 12 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 Year 13 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.637 3.637 Year 14 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 Year 15 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.637 3.637 Year 16 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 Year 17 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.637 3.637 Year 18 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 Year 19 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.637 3.637 Year 20 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 Year 21 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.637 3.637 Year 22 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 Year 23 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.637 3.637 Year 24 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 General Depreciation System-MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Mid-Quarter (Property Placed in Service in Second Quarter) Applicable Depreciation Method: 200 or 150 Percent Declining Balance Switching to Straight Line Recovery period and Depreciation Rates Recovery Year 5-Year 7-Year 10-Year 15-Year 20-Year Year 1 41.67 25.00 17.85 12.50 6.25 4.688 Year 2 38.89 30.00 23.47 17.50 9.38 7.148 Year 3 18.00 16.76 14.00 8.44 6.612 Year 4 5.30 11.37 11.97 11.20 7.59 6.116 Year 5 11.37 8.87 8.96 6.83 5.658 Year 6 4.26 8.87 7.17 6.15 5.233 Year 7 8.87 6.55 5.91 4.841 Year 8 3.33 6.55 5.90 4.478 Year 9 6.56 5.91 4.463 Year 10 6.55 5.90 4.463 Year 11 2.46 5.91 4.463 Year 12 5.90 4.463 Year 13 5.91 4.463 Year 14 5.90 4.463 Year 15 5.91 4.462 Year 16 2.21 4.463 Year 17 4.462 Year 18 4.463 Year 19 4.462 Year 20 4.463 Year 21 1.673 14.14 10 0.758 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 11 0.455 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 12 0.152 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 Print Done General Depreciation System-MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Mid-Quarter (Property Placed in Service in Fourth Quarter) Applicable Depreciation Method: 200 or 150 Percent Declining Balance Switching to Straight Line Recovery period and Depreciation Rates Recovery Year 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Year 1 8.33 5.00 3.57 2.50 1.25 0.938 Year 2 61.11 38.00 27.55 19.50 9.88 7.430 Year 3 20.37 22.80 19.68 15.60 8.89 6.872 Year 4 10.19 13.68 14.06 12.48 8.00 6.357 Year 5 10.94 10.04 9.98 7.20 5.880 Year 6 9.58 8.73 7.99 6.48 5.439 Year 7 8.73 6.55 5.90 5.031 Year 8 7.64 6.55 5.90 4.654 Year 9 6.56 5.90 4.458 Year 10 6.55 5.91 4.458 Year 11 5.74 5.90 4.458 Year 12 5.91 4.458 Year 13 5.90 4.458 Year 14 5.91 4.458 Year 15 5.90 4.458 Year 16 5.17 4.458 Year 17 4.458 Year 18 4.459 Year 19 4.458 Year 20 4.459 Year 21 3.901