- Regarding the significant increase in dividends payment, what would you expect the stock price of PharmaTech to do? Why? [20 marks; maximum word limit 200]

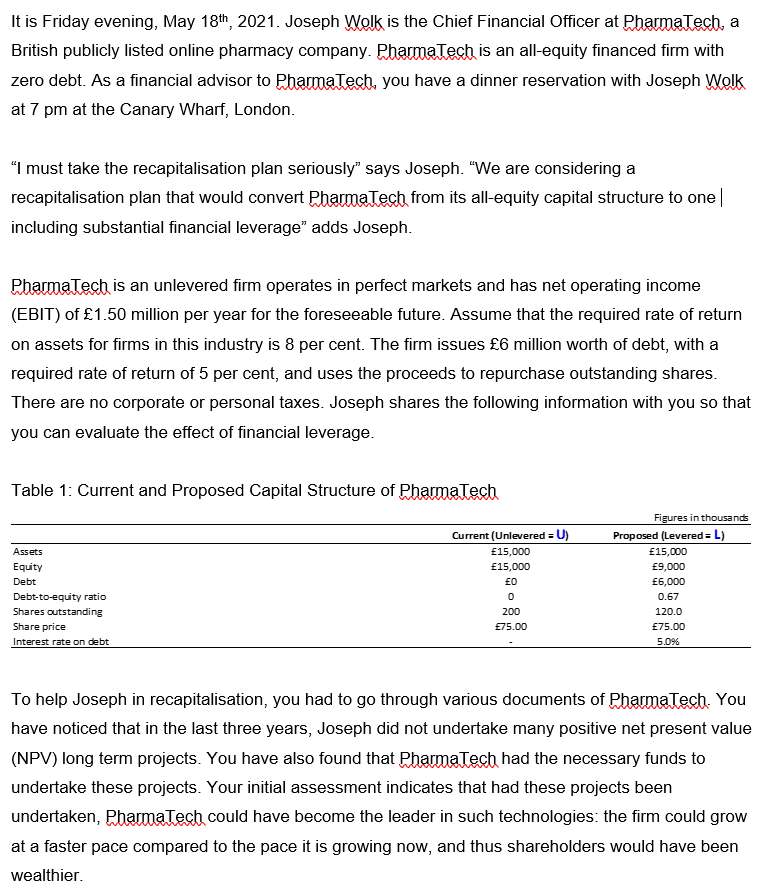

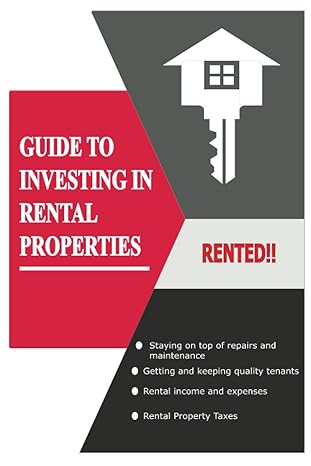

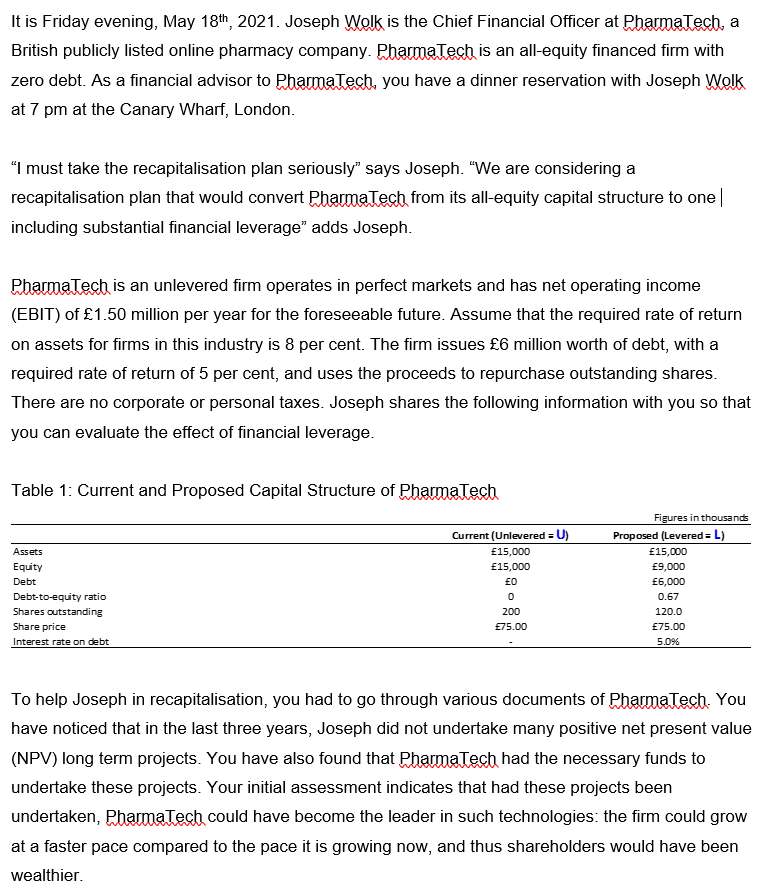

It is Friday evening, May 18th, 2021. Joseph Wolk is the Chief Financial Officer at PharmaTech, a British publicly listed online pharmacy company. PharmaTech is an all-equity financed firm with zero debt. As a financial advisor to PharmaTech, you have a dinner reservation with Joseph Wolk at 7 pm at the Canary Wharf, London. I must take the recapitalisation plan seriously" says Joseph. "We are considering a recapitalisation plan that would convert PharmaTech from its all-equity capital structure to one| including substantial financial leverage adds Joseph. PharmaTech is an unlevered firm operates in perfect markets and has net operating income (EBIT) of 1.50 million per year for the foreseeable future. Assume that the required rate of return on assets for firms in this industry is 8 per cent. The firm issues 6 million worth of debt, with a required rate of return of 5 per cent, and uses the proceeds to repurchase outstanding shares. There are no corporate or personal taxes. Joseph shares the following information with you so that you can evaluate the effect of financial leverage. Table 1: Current and Proposed Capital Structure of PharmaTech Current (Unlevered = U) 15,000 15,000 EO Assets Equity Debt Debt-to-equity ratio Shares outstanding Share price Interest rate on debt Figures in thousands Proposed (Levered=L) 15,000 9,000 6,000 0.67 120.0 75.00 5.096 200 75.00 To help Joseph in recapitalisation, you had to go through various documents of PharmaTech. You have noticed that in the last three years, Joseph did not undertake many positive net present value (NPV) long term projects. You have also found that PharmaTech had the necessary funds to undertake these projects. Your initial assessment indicates that had these projects been undertaken, PharmaTech could have become the leader in such technologies: the firm could grow at a faster pace compared to the pace it is growing now, and thus shareholders would have been wealthier. By exploring various other recent documents, you have found that Joseph is considering to take a project to develop COVID-19 rapid test. It requires 400,000 initial investment to start the project. It is expected that this project will bring 115,000 annual revenue for the next 4 years. Since the outbreak of the Covid-19 pandemic, PharmaTech has closed some of its high street outlets and has moved most of its operation online. PharmaTech has never missed paying dividends to its shareholders in the last few years. Now, Joseph is considering a significant increase in dividends payment to shareholders financed by the sale of some of its assets used in the high street outlets