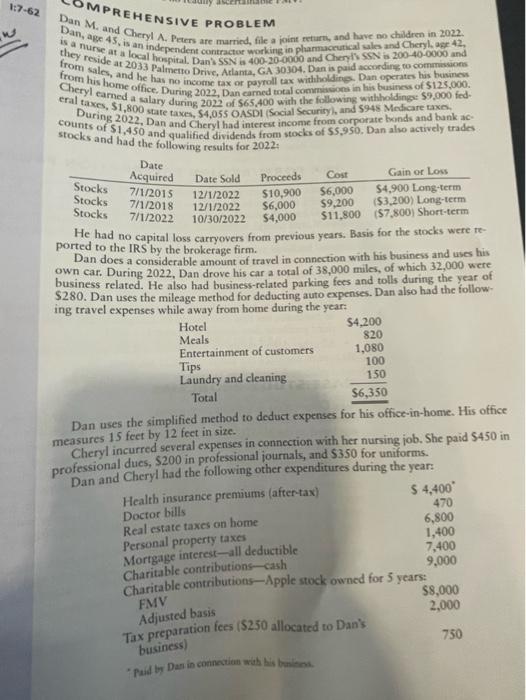

REHENSIVE PROBLEM Dan, age and Cheryl A. Peters are married, file a joint returts, and huve no children in 2022. is a nurse 45 , is an independent contractor working in pharmaceutical sales and Cherylage 42 , During 2022, Dan and Cheryl had interest income from corporate boinds and bank accounts of $1,450. Dan and Cheryl had interes income from corporate bonds and bunk ace stocks and had the following results for 2022 a He had no capital loss carryovers from previous years. Basis for the stocks were reported to the IRS by the brokerage firm. Dan does a considerable amount of travel in connection with his business and uses his own car. During 2022 . Dan drove his car a total of 38,000 miles, of which 32,000 were business related. He also had business-related parking fees and tolls during the year of $280. Dan uses the mileage method for deducting auto expenses. Dan also had the following travel expenses while away from bome during the year: Dan uses the simplified method to deduct expenses for his office-in-home. His office measures 15 feet by 12 fect in size. Cheryl incurred several expenses in connection with her nursing job. She paid $450 in professional dues, $200 in professional journals, and $350 for uniforms. Daring 2022, Dan and Cheryl paid federal and state estimated tax payments on a quarterly basis. Federal estimated tax payments for the year amounted to $20,000. State cstimated payments for the year amounted to 52,200 . Compute Dan and Cheryl's income tax liability for 2022 . Disregard the alternative minimum tax but include the self-employment tax. REHENSIVE PROBLEM Dan, age and Cheryl A. Peters are married, file a joint returts, and huve no children in 2022. is a nurse 45 , is an independent contractor working in pharmaceutical sales and Cherylage 42 , During 2022, Dan and Cheryl had interest income from corporate boinds and bank accounts of $1,450. Dan and Cheryl had interes income from corporate bonds and bunk ace stocks and had the following results for 2022 a He had no capital loss carryovers from previous years. Basis for the stocks were reported to the IRS by the brokerage firm. Dan does a considerable amount of travel in connection with his business and uses his own car. During 2022 . Dan drove his car a total of 38,000 miles, of which 32,000 were business related. He also had business-related parking fees and tolls during the year of $280. Dan uses the mileage method for deducting auto expenses. Dan also had the following travel expenses while away from bome during the year: Dan uses the simplified method to deduct expenses for his office-in-home. His office measures 15 feet by 12 fect in size. Cheryl incurred several expenses in connection with her nursing job. She paid $450 in professional dues, $200 in professional journals, and $350 for uniforms. Daring 2022, Dan and Cheryl paid federal and state estimated tax payments on a quarterly basis. Federal estimated tax payments for the year amounted to $20,000. State cstimated payments for the year amounted to 52,200 . Compute Dan and Cheryl's income tax liability for 2022 . Disregard the alternative minimum tax but include the self-employment tax